| | Introduction | How consumers define sustainability? | Understanding sustainable consumer | Barriers to sustainable purchasing | Deep dive into sustainable products: food and beverage | What industry can do to bridge the ‘gap’? | Do you know?..

.

Introduction

The concept of sustainability and its movement is now decades old. Manufacturers and other organizations have adopted sustainable sourcing and production practices to meet the expectations of consumers. Marketers have launched sustainable consumer products. Various coalitions have worked together to help vendors offer more sustainable products and to help educate their customers and end-users on what that means. Media coverage has helped in educating consumers about the need for sustainability and the “green” actions possible at the household level.

However, despite extensive efforts made to support and promote sustainable household consumption, there is a ‘gap’ between the sustainable products consumers say they want and what they actually buy. Therefore, in this issue an

attempt was made to understand the “sustainable consumer” based on the research study Sustainability (2013) by Hartman Group Inc.

How Consumers Define Sustainability?

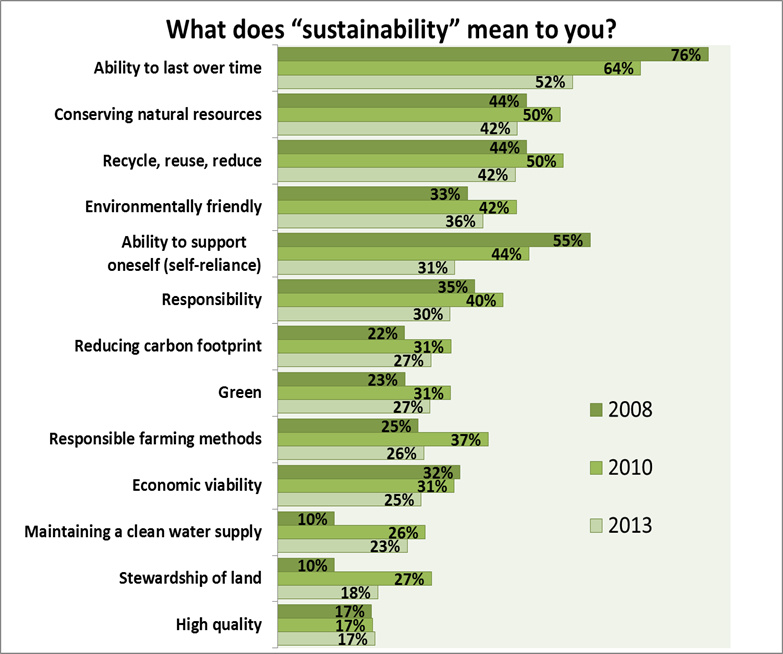

Sustainability is most strongly associated with the definition of long lasting for American consumers. Consumers define sustainability in number of ways. The following figure illustrates the survey results and shows how consumers’ definition of sustainability has broadened in the last five years.

Figure 1: What does Sustainability Mean to Consumers?

Source: Sustainability , Hartman Group Inc. 2013.

Q13. The word “sustainability” may mean different things to different people. What does it mean to you? (Select all that apply). Base: Consumers familiar with the term “sustainability”; 2008 (n=1,151), 2010 (n=1,352), 2013 (n=1,356).

Understanding Sustainable Consumer

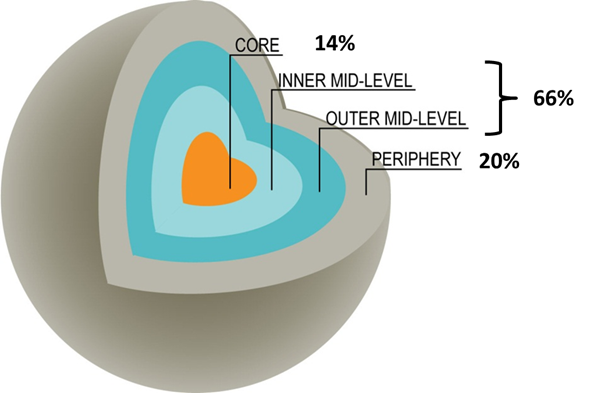

According to the Hartman study, consumers in the world of sustainability can be

categorized into three groups:

- Periphery (least involved),

- Mid-level and

- Core (most involved).

The Core (14%) is the smallest segment and the most intensely involved in sustainability. The Periphery group (20%) is the least involved. Sustainability is rarely top-of-mind in their day-to-day decision-making. Mid- level (66%) is the largest segment and shares some attitudes and behaviors with both the Core and the Periphery groups.

Figure 2: Consumer Segmentation Based on the Intensity of Engagement with Sustainability

| Source: Sustainability, Hartman Group, Inc. 2013 |

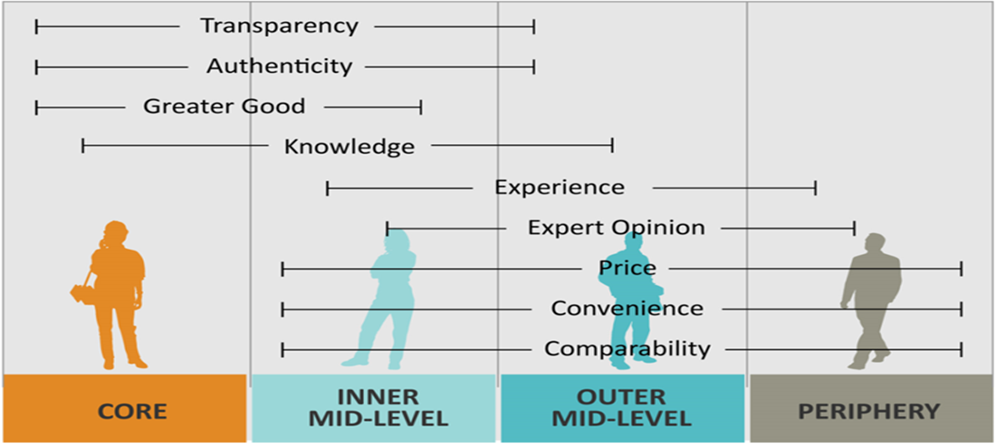

In the context of agriculture and agri-food, it is important to understand the different measures that consumers use in their purchase decisions. The Hartman Group research has identified a number of criteria that are important for different consumer segments in their purchasing decisions.

Figure 3: Different Segments have Different Criteria When Making Purchases

Source: Sustainability, Hartman Group Inc. 2013

. |

Another way to understand consumers is to identify their ‘Zones of Responsibility’. This research suggests that this categorization is an easy way to identify how consumers think about companies and their products in terms of sustainability. For sustainability there are four zones of responsibility and they are presented below with their key dimensions.

| Figure 4: Zone of Responsibility and Key Dimensions |

Personal zone

Personal benefits to the consumer | Social zone

Human and animal welfare; improving physical and emotional well-being | Environmental zone

The equilibrium of the planet; stewardship of water, earth, and air | Economic zone

Distribution of monetary resources, jobs, and profits |

Key dimensions:

quality, household finances, personal safety/health, feeling good about purchase | Key dimensions:

employment practices, community involvement, treatment of animals, fair trade | Key dimensions:

energy consumption, waste disposal, resource preservation | Key dimensions:

money circulation, ownership, scale |

| Source: Sustainability , Hartman Group Inc. 2013 |

Another way to understand consumers is to identify their ‘Zones of Responsibility’. This research suggests that this categorization is an easy way to identify how consumers think about companies and their products in terms of sustainability. For sustainability there are four zones of responsibility and they are presented below with their key dimensions.

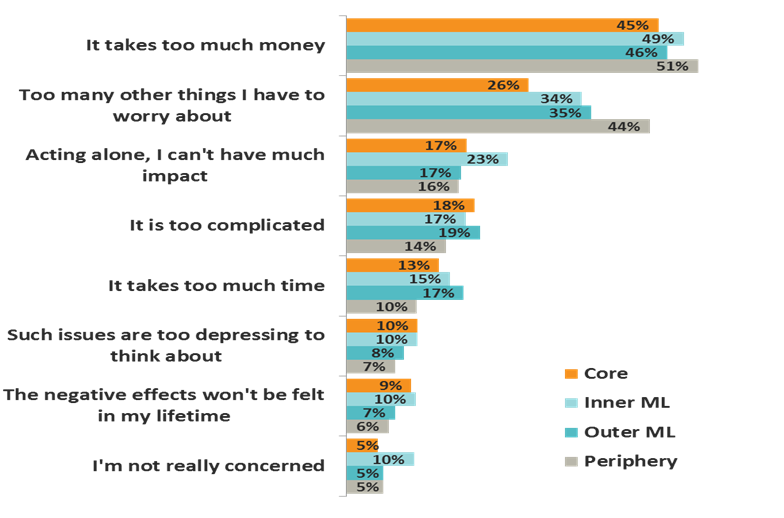

Barriers to Sustainable Purchasing

While consumers want to make sustainable purchases, they also want it to be easy. Most consumers want to engage in the world’s sustainability in a relatively passive way. They want the right choices to be obvious and accessible and the benefit to the world made clear. At the same time, they do not want to compromise on the quality of the product.

| Figure 5: Barriers to Sustainable Purchasing by Different Segments |

Respondents were asked -- At times when purchasing decisions are not based on concerns such as the environment and social well-being, what are the main reasons why these issues do not influence your decision?

Base: Significant shoppers inside the World of Sustainability (n=1,481), Core (n=208), Inner Mid-level (n=490), Outer Mid-level (n=478), Periphery (n=305).

Source: Sustainability, Hartman Group Research.

Deep Dive into Sustainable Products: Food and Beverage

The Hartman research on ‘Sustainability’ has discovered that understanding consumer priorities at the product category level gives us greater insight into why consumers often fail to “walk the talk”. At the category level, consumers speak to sustainability values that actually guide their purchase decisions.

The values that guide purchase decisions vary by food type and venues. Some examples are:

Fish and seafood

Consumers see a strong connection between the aquatic ecosystem and the safety and quality of sea food/fish

Meat

Animal welfare (grass fed, pasture raised, free range, cage free, kosher) and natural agricultural practices are important for consumers. Consumers believe that animals that have lived a good life are better quality and better for you.

Produce

Natural agriculture and supporting the local economy are the most significant for consumers. They believe that produce grown ‘naturally’ without scientific intervention is a less risky option.

Snacks

Minimal/ecofriendly packaging is most important in the snacking category.

Restaurant/ foodservice purchases

Employment practices and local community are the most important features to consumers at these venues. Employment practices include worker payment and belief that well treated staff results in better quality food. In terms of the local community, consumers want to contribute to their community by spending locally and are influenced by the convenience of having food service places near to where they live and work.

Retail

Consumers in or near the Core segment, shop more retail channels and more specialty stores to purchase their goods. In addition to good value, convenience and quality, many consumers want their grocery store to contribute to the local economy and community.

What Industry Can do to Bridge the ‘Gap’?

The Hartman report outlines how to present the sustainability of your products to consumers:

- Address consumers’ barriers to knowledge, practicality and faith/trust

Knowledge - start with what consumers already know. Explain your actions, position, priorities so that consumers understand why sustainability matters to you, be careful not to appear to preach, teach or reprimand.

Practicality – Make it easy for consumers to prioritize. Consumers are pragmatists and need a reason to believe; do not make sustainability a tradeoff problem for consumers.

Faith/ Trust - Provide evidence that choosing your product will have an impact; do not put the responsibility on the consumer for making a difference.

- Communicate sustainability in a way that is relevant and moving

Focus on the dimensions of responsibility that are most important for your category as noted in the chart.

Communicate authenticity and transparency. This is the route to building credibility and

believability for your products.

Do you know?........

.

Major restaurant chains (e.g. McDonald’s) are working with producers to ensure a sustainable beef supply. McDonald’s has chosen Alberta, Canada as the site of its first pilot project in their effort to provide ‘sustainable beef’ in its large global restaurant network.

Industry and primary agriculture and processors are already taking actions to be sustainable, for example:

- Alberta Barley, Wheat, Pulse and Canola are undertaking a pilot study on Crops Sustainability Certification.

- Alberta Pulse Growers are undertaking research to lower the carbon footprint.

- Alberta Potato Growers are meeting the sustainability requirement of processor, Frito Lay.

- Alberta Egg Farmers are implementing a sustainability strategy.

|

|