| | Introduction | What’s the pulse on pulse consumption in Canada? | Why was this important study? | What are some of the highlights the study revealed? | What’s next? | In summary

,

Introduction

The study was conducted by Ipsos Reid, through an online survey with 1100 Canadian households, followed by four focus groups, to find out what consumers were saying about pulses.

Ipsos Reid is a survey-based marketing research firm that interprets market trends and assesses market potential among other services.

Pictures in this issue are courtesy of Pulse Canada

What’s the pulse on Pulse Consumption in Canada?

What are pulses anyway? Do Canadians eat them?

The word pulse comes from the Latin puls or pultis, meaning thick soup. Pulses are the edible seeds of pod-bearing legume crops, such as peas, bean, lentils and chickpeas, among others.

Saskatchewan Pulse Growers

Why was this an important study?

The study was designed to find out more on Canadian’s attitudes, perceptions and behaviours regarding pulses, and the factors that influence them the most, “to eat” or “not eat” pulses (i.e., the who, what, where and why behind pulse consumption).

To learn more about the consumption patterns of pulses, based on Canadian demographics (culture, age, regions, immigration, ethnic background, etc.).

Canadian consumption is fairly low (much like the US, at approximately ½cup per week), and yet Canada is a leader in global exports of pulse crops. If we know the barriers to consumption, this can direct us to potential opportunities and increase our own domestic demand for pulses.

The study was funded by Growing Forward a federal-provincial-territorial program, with direction from Alberta Agriculture and Rural Development, along with industry partners, Pulse Canada and the Alberta Pulse Growers Commission. This study complements industry's research in pulse awareness, product use and marketing.

What are some of the highlights the study revealed?

A greater understanding of pulses is needed

Many people do not know what pulses are.

Consumption levels

- In general, about 60% of Canadians are considered “light” pulse consumers – meaning they are consuming at least one type of pulse “less than once a month” to as much as “three times per month”.

- Another 20% of Canadians are considered “moderate to heavy” consumers - eating at least “one type of pulse every week”.

- Finally, about 20% are considered “non-consumers” of pulses - meaning that “during the past six months they have not consumed any type of pulse at home or at a restaurant”.

Types or forms of pulses

The types of pulse purchased most frequently and eaten at home &/or at a restaurant:

- Beans are the highest (66%), or 2 out of 3 people consumed them in the last 6 months.

- Chickpeas and peas are next (around 53%).

- Lentils are the lowest (41%) or four in 10 people.

For consumption of pulses at home, frequency varied slightly from above:

- Beans are followed by chickpeas and lentils, then followed by peas.

- Beans and chickpeas have the broadest variety of food types (or forms) available, which can influence on how much they are consumed (canned, dips, salads, ethnic dishes, stews, flour, hummus). Peas are often used in soups or stews, and less in other types of dishes, although they can be used in various food preparations.

Motivators and barriers

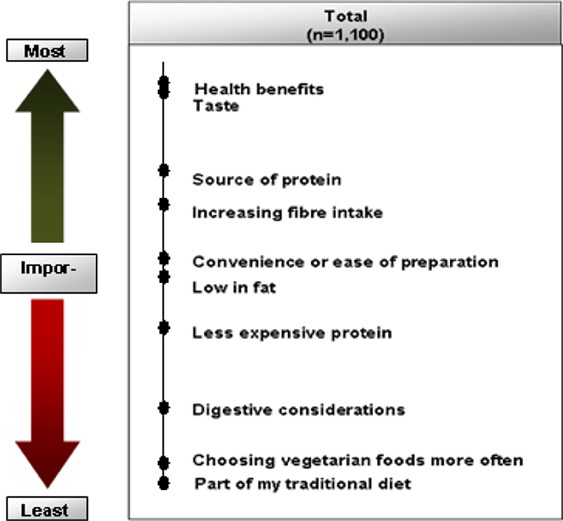

- When participants were asked to choose the relative importance among a number of factors, regarding why they "eat" or "don’t eat" pulses theses two reasons emerged with all consumers:

- "Taste", and

- "Health benefits" of pulses (includes protein, and fibre, but not exclusive to those components).

- Incidence of Disease—over 30%of households were influenced by concerns of weight or certain key chronic diseases.

Do you or anyone in your household currently have... ?

Heart disease or high blood pressure |

23% |

Diabetes |

16% |

Celiac disease |

1% |

None of the above |

68% |

Declined to answer |

1% |

Advised about weight

Have you (or members of your household) been advised by a health professional that your (their) weight may cause health problems now or in the future?

- Yes (32%)

- No (66%)

- No response (2%)

- “Convenience” or ”ease of preparation” came in at third to sixth place on the list of influencing factors, depending if it was a non-consumer, light-, or moderate-to-heavy consumer group.

- The message “pulses grown in Canada or locally grown” also resonated with Canadians.

| Which of the following factors is most important to you and least important to you when deciding whether or not to eat pulses? |

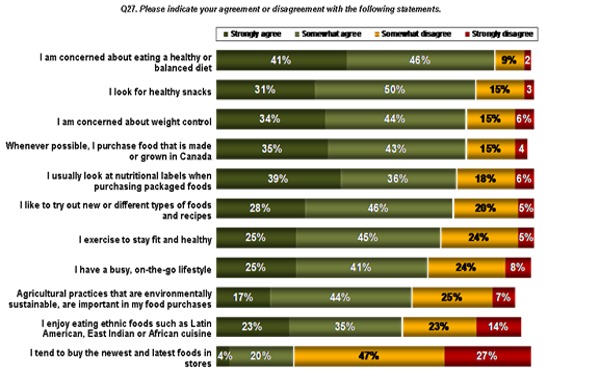

The chart below indicates Canadian’s attitudes towards food, health and the environment.

- The majority of Canadians are concerned about maintaining their health and take actions towards this.

- About half of Canadians said that knowing environmental facts, such as pulses are good for soil health and sustainable agriculture, and that they reduce overall greenhouse gases in the atmosphere, would make them more likely to eat pulses. However, overall environmental benefits would have a lesser impact on consumers’ choices than facts relating to personal health.

What’s next?

The study identified 5 groups of consumers, based on their attitude towards pulses, as well as food and health.

Pulse growers and processors may want to focus their marketing efforts on the 3 groups of “light” eaters of pulses.

Those that have not been exposed to pulse dishes, but are interested in the health benefits. Taste is their key motivator followed by a distant health benefit. Highlight factors such as great tasting, weight management and convenience.

- Unexposed Reachables (23%) – Haven’t had a great deal of exposure to pulses, but the health benefits resonate strongly. (Should be the primary target of communication). Communicate information on the health benefits, as well as how to cook a variety of “great tasting” basic recipes (not ethnic or vegetarian options). In the health messaging, include weight management as a benefit.

Those who eat them, but just need reminders, or a wider range of food options (recipes, ethnic foods). Taste and health benefits are equally as important. Remind them of fibre and protein. They are the 2nd highest group to use cookbooks for information/preparing pulses, as well as having personal knowledge of pulses.

- Forgetful Proponents (23%) – (2nd highest pulse consumption segment). Already enjoy pulses, but need to be reminded to include them in their diet more often. They eat them on a monthly basis (about 70% of them). Teach them the wide variety of ways that pulses can be used, and provide new and different recipes. They like to try out different foods, as well as enjoy ethnic food. There are no limits to the types of recipes that might appeal to this group. Weekly emails of pulse recipes could appeal to this segment. Reminding them about the fibre and protein content of pulses as well as other health benefits, could serve as motivators.

Those driven by health (personal, environment), followed by a distant taste. Their main barrier is not knowing how to prepare them or not thinking of them.

- Health Driven Persuadables (22%) – Health, taste and environmental benefits appeal to this group. Main barrier is not knowing how to prepare them and not thinking about them in meal planning. Like ethic foods and many are trying to choose vegetarian meal more often. They are second (after Informed Champions) on environmental concerns.

The two groups, less likely to respond to marketing or change in consumption habits, are those at the opposite ends of the spectrum.

- Informed Champions (20%) – not a key target, since they are the highest consuming segment. They already eat pulses frequently and have positive attitudes towards pulses, food and health. However, messages that resonate with other groups would also interest this group.

- Disinterested Unreachables (12%) - not interested in food and health. Very little would convince them to incorporate more pulses into their diet in a big way; highest incidence of underweight, youngest segment (under 43 yrs), 3 in 10 live alone, majority male (56%), least educated (15% university degree), low incidence of heart disease or high blood cholesterol levels in household (16%).

In Summary

- Since consumers are not familiar with the word pulses; advertising or promotional efforts will need to explain that it includes beans, peas, chickpeas and lentils.

- Consumers need a greater awareness of recipes and variety of dishes that can be made, types of pulse products available, and ways to cook with pulses, in order to increase their consumption (e.g., some like convenience/easy to make dishes, while others like to experiment with ethnic dishes, or use various types of pulse flour).

- Promotional efforts must emphasize “taste”. People that have not been greatly exposed to pulse dishes, may have the perception that they don’t taste very good. For other people, who know how to prepare pulses, they know that they are tasty.

- Reminders – weekly emails on recipes or other information are helpful to consumers.

- Reminders of the health benefits of pulses – including protein, fibre are also helpful.tion?

Where can we get more information?

The study and report highlights "Factors Influencing Pulse Consumption in Canada" are available at

http://www1.agric.gov.ab.ca/$department/deptdocs.nsf/all/sis13117

or contact Sharon Faye, Market Analyst at (780) 422-5326 for more information. |

|