| | Introduction | Venue distribution of lunches | The skipped lunch and the afternoon snack | Top lunch vs. top snack foods | Lunch at restaurants

.

Introduction

The Consumer and Market Analysis Group purchases Market Research Reports in order to understand the possible changes in consumer behaviour and the potential for our industry to capitalize on these changes. One such report purchased is “Eating Patterns in Canada, 12th Edition”. The report was published by the NDP Group.

This report provides a unique look at in-home and away from home eating behaviour. What foods do Canadians eat at different meal occasions? Where do we eat these foods? Who eats what and how often? Also, covered is eating behaviour in the home during the recession. In the last consumer corner we explored the breakfast eating habits of Canadians. With this report we will explore the eating habits of Canadians at lunch, and snacking instances.

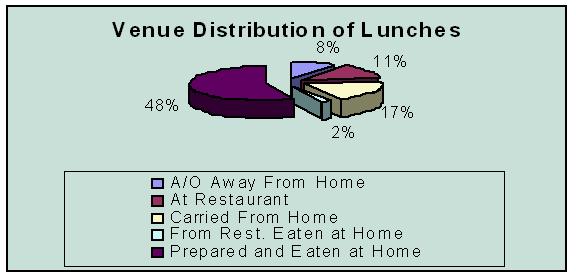

Venue Distribution of Lunches

In 2009, the average Canadian ate 300 lunches, which has virtually not changed over the last ten years. Lunch, of all meal occasions, is the meal eaten out of the home most often.

Compared to ten years ago all age groups are eating fewer lunches at home and younger age groups are carrying more lunches from home, as are more boomers and seniors.

Sandwiches and fruits are the top foods to be carried from home but both are declining along with cookies, salads and soup. Foods that have found growth are vegetables, yogurt, snack bars and cheese. While sandwich eatings are declining at lunch and dinner, its popularity is increasing during breakfast. Ham and lunch meat, two of the most common sandwiches are being eaten less. Turkey sandwiches, perceived as being leaner and better for you, are gaining ground.

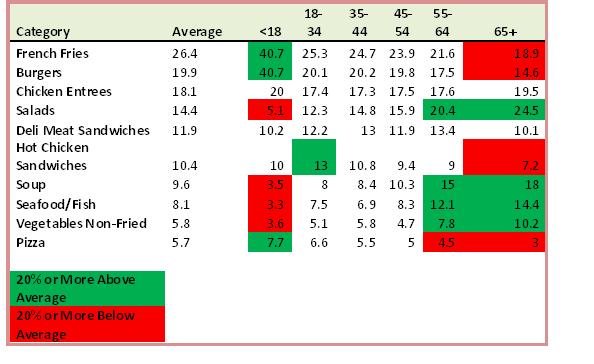

Young adults are less inclined to eat many of the top lunch foods, while those over 65 are more inclined. Following is a chart that shows the top lunch foods by age group. Highlighted in red are foods that are at least 20 percent below average in that age group and highlighted in green are the foods that are at least 20 percent above average for that age group.

Category | Average | <18 | 18-34 | 35-44 | 45-54 | 55-64 | 65+ |

| Sandwiches | 96.1 | 100.5 | 90.4 | 84.2 | 95.2 | 107.1 | 105.4 |

| Fruit | 51.9 | 56.9 | 35.2 | 42.7 | 50.9 | 55.1 | 82.8 |

| Vegetables | 45.1 | 47.8 | 27.3 | 47.9 | 50.8 | 43.7 | 70.6 |

| Soup | 43.3 | 32.9 | 30.2 | 44.4 | 39.1 | 50.4 | 81.1 |

| Salads | 14.9 | 18.3 | 20.9 | 34.1 | 35.6 | 35 | 41.8 |

| French Fries | 14.3 | 16.9 | 19.2 | 16.3 | 14 | 11 | 7 |

| Bread Non-Toasted | 14 | 11.5 | 8.8 | 11.3 | 14.9 | 15.1 | 30.9 |

| Yogurt | 13.9 | 14.2 | 8.4 | 17.9 | 14.4 | 15.5 | 17.2 |

| Cookies | 13.9 | 13.6 | 10.8 | 10.1 | 9.4 | 15.5 | 28.8 |

| All Other Pasta | 13.4 | 18.8 | 13.2 | 17 | 15.3 | 7.4 | 6.9 |

|  |  |  |  |  |  |  |

| 20% Below Average |  |  |  |  |  |  |  |

| 20% Above Average |  |  |  |  |  |  |  |

.

More Canadians are turning to frozen food as an option for the carried from home lunch. In 2009, 6.7 percent of Canadians had a frozen food for lunch in an average week. Frozen food has risen steadily from 2000 when frozen food was only carried 3.6 percent of the time. Frozen pizza is the clear favourite in this category. In 2000 pizza had a penetration rate of only 2.5 percent while in 2009 pizza has doubled its penetration rate to 5.0 percent.

Following a decline in the middle of the decade leftovers are gradually making a comeback and they are being carried from home at an even faster rate. Soup remains the most common leftover eaten at home or carried away from home. In 2009, the average Canadian had soup as a leftover for lunch 8.2 times. Increased usage of the microwave at lunch coincides with the resurgence of leftovers. Monday, at 27.4 percent, was the day most likely to contain leftovers for lunch.

Beverage consumption at lunch, as with other meal occasions, is on the decline across all age groups.

The Skipped Lunch and the Afternoon Snack

In 2009, the average Canadian skipped lunch 45 times. The most likely age groups to skip lunch are the 18 to 34 year olds (55.7 times) and the 45 to 54 year olds (54.6 times). As consumers age, a lesser proportion of their meals are comprised of snacks. Fruit is the number one choice for afternoon snacks. As shown in the chart below the difference in top foods between lunch and afternoon snacks further indicates that Canadians view them as being truly separate occasions.

Top Lunch vs. Top Snack Foods

Lunch at Restaurants

All venue segments experienced growth in 2009 compared to 2008. The largest increases were in Quick Service Restaurants, and Family/Midscale Restaurants which showed an increase of 4 percent over 2008. This translates into 781 million visits to Quick Service Restaurants for lunch and 235 million visits to Family/Midscale Restaurants for lunch.

Following is a chart showing Top Restaurant Lunch Foods by Demographics.

Carbonated soft drinks are the number one beverage during lunch across all age groups except for those 65+. The 65+ crowd were more likely to enjoy a coffee with their lunch. While the breakfast sandwich dominated the breakfast scene, burgers are the fastest growing food at lunch gaining 18.6 million more servings over last year. Other foods growing at a fast rate for lunch are chicken entrees, potatoes, dinner rolls and coffee. The fastest declining foods at lunch are salads, sandwiches, side dishes, rice and alcoholic beverages.

In the next consumer corner we will look at the dinner and evening snacking trends of Canadians. |

|