| | Introduction | Fastest growing main dish dinner food Items | Side dishes | Role of restaurants at dinner | Top foods eaten at dinner in restaurants | Did you know?| Information source

.

Introduction

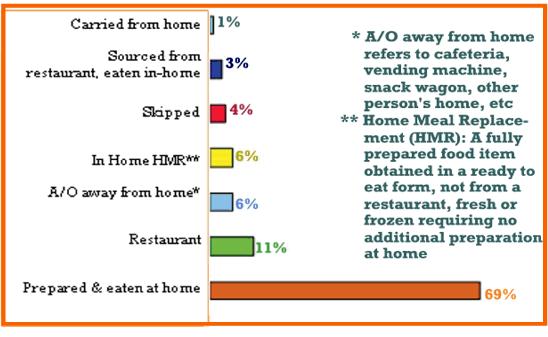

Venue distribution (precent of meal occasions)

Not surprising most dinners are prepared and eaten at home (see chart below)

Surprisingly, the driver of meals prepared at home are not those over 65 years of age but the consumers who are 45-54 years old. There has been an increase in the number of dinner meals prepared and eaten at home by the 45-54 year olds while in most other age categories that number of dinners prepared and eaten at home is decreasing.

In the case of meals sourced from home meal replacement (HMR), it is the consumers over 65 years old who are increasingly taking advantage of this type of convenience. The average 65+ year old will source about 33 dinners from HMR each year compared to about 20 dinners from HMR each year for other consumers.

Top main dish foods prepared and eaten at home

(excluding beverages - % of meal occasions for in-home dinner)

When preparing and eating dinner at home, consumers are generally still eating the same foods they ate in 1999 with the exception of pork, burgers, salads and beef steaks. If fact, over the years fish and pork, which were either very low on the list of top 10 foods in 1999 or not on the list at all, are now among the most common main dishes at dinner.

| Main Dish | 2008 %of meals | 1999

% of meals |

| Pasta Dishes | 12 | 12 |

| Chicken* | 10 | 10 |

| Vegetables | 9 | 12 |

| Casseroles/One Dish Meal | 7 | 10 |

| Fish | 6 | 4 |

| Soup | 5 | 7 |

| Sandwiches** | 5 | 7 |

| Boiled/Mashed Potatoes | 5 | 6 |

| Rice | 5 | 4 |

| Burgers | 5 | |

| Pork*** | 5 | |

| Salads | | 5 |

| Beef Steak | | 4 |

How to read this chart: 12 % of all prepared and eaten at home dinner main dish meal occasions included chicken*

* excludes wings/nuggets

** excludes burgers/hot dogs/Mexican

*** excludes pork chops

Fastest Growing Main Dish Dinner Food Items

Side dishes such as rice, convenient pasta,(convenient pasta includes frozen, dry mix, canned or ready made pasta. It does not include fresh or dry pasta that does not have a sauce already included) and French fries illustrate how simple side dishes are gaining in popularity as a main dish because of their ease of preparation. The fastest growing main dishes are rice, pork (excluding pork chops), convenient pasta, turkey, burgers, pizza (excluding novelties), ham, French fries, pasta dishes, and chicken wings/nuggets.

Side Dishes

Among side dishes, there has been virtually no change in what was eaten in a decade, it is simply the presence or absence of the side dish that has changed the most. Vegetables continue to top the list but are losing share because one-dish meals often include vegetables as an ingredient.

Top 10 side dishes prepared and eaten at home (excluding vegetables)

Percent of meal occasions – in home dinner

| Side Dish | % of meal occasions

in home dinner |

| Vegetables | 50 |

| Salads | 18 |

| Boiled/Mashed Potatoes | 15 |

| Rice | 12 |

| Bread: Non-Toasted | 10 |

| Baked/Roasted Potatoes | 9 |

| French Fries | 5 |

| Bread: Toasted | 3 |

| Soup | 2 |

| Buns/Rolls | 2 |

The most popular side dishes are also those that are on the decline. Unfortunately, vegetables and salads although two of the most popular side dishes are also two of the fastest declining side dishes. In 2008, 3% fewer individuals are eating vegetables or salad as a side dish than in 2006. The other side dishes that are on the decline are convenient pasta, pasta dishes, cheese, fruit and buns/rolls.

Role of Restaurants at Dinner

In 2008, the average person ate about 38 dinners at a restaurant. This represents about a 4%increase compared to 2007.

There are two separate groups using restaurants more often, 55 + and the 35-44 years olds and their children.

For both dinners sourced from a restaurant and eaten at home and dinners eaten in the restaurant, family/midscale restaurants saw the largest increase in traffic (see figure below). There was a 12% increase in dinner traffic (sourced from restaurant and eaten in home) at family/midscale restaurants in 2008 compared to 2007. During the same period, family/midscale restaurants also saw a 9% increase consumers in eating in the restaurant.

Percent change in volume of traffic 2008 compared to 2007

| | Sourced from restaurant eaten at home | |

| Quick Service | 0 | +2 |

| Family/Midscale | +12 | +9 |

| Casual | +6 | 0 |

| Fine | -5 | -8 |

| HMR/Retail | +10 | n/a |

Top Foods Eaten at Dinner in Restaurants

The foods consumers are eating more frequently in restaurants resembles many of the same foods that consumer are eaten more frequently at home (e.g. vegetables, French fries, soup, fish and burgers). As eating in restaurants becomes more of a trade-off between money and time, consumers may gravitate to familiar foods they would want to cook.

The fastest growing foods and beverage at dinner in restaurants are Japanese, French fries, soup, seafood/fish, beef entrees, burgers and tap water.

The fastest declining foods are vegetables non-fried, fruit, pizza, carbonated soft drinks, pies and hot coffee.

Did You Know?

About 37% of Canadians decide what they are going to eat for dinner using either a detailed plan or an overall plan for the week. The number of “planners” has been increasing gradually over the past eight years.

Eating meals together most nights grew steadily and peaked in 2004. Since that time it hovers around 80% (i.e. about 80% of Canadians indicated that about 5-7 days of the week, every member of the household ate together.

In 1986, 32.1% of individuals aged 20-29 lived at home with parents. In 2006, 43.5% of individuals aged 20-29 lived at home with parents.

Forty two percent of all in-home dinner main dishes were prepared in 15 minutes or less and 36% of dinner main dishes were prepared in 16-30 minutes.

Information Source

The information in the NPD Eating Patterns in Canada Report is based on four different NPD Group services.

- National Eating Trends (NET) tracks consumption behaviour relating to retail and restaurants.

- HealthTrack survey adds an attitudinal component and health/diet status to the NET database.

- SnackTrack tracks the consumption and sourcing of snack foods by individuals.

- CREST collects information about purchases of prepared foods and beverages at restaurants.

Dinner Trends in Canada in pdf |

|