| | Eating behaviour in the home during the recession | Beverage consumption | Breakfast | Breakfast beverages in-home | Breakfasts eaten away from home

.

The Consumer and Market Analysis Group purchases Market Research Reports in order to understand the possible changes in consumer behaviour and the potential for our industry to capitalize on these changes. One such report purchased is “Eating Patterns in Canada, 12th Edition”. The report was published by the NDP Group.

This report provides a unique look at in-home and away from home eating behaviour. What foods do Canadians eat at different meal occasions? Where do we eat these foods? Who eats what and how often? Also, covered is eating behaviour in the home during the recession.

Eating Behaviour in the Home during the Recession

When asked, consumers indicated that convenience is more important than price, though the importance of price rose in step with onset of the recession. Despite the recession, consumers mostly ate the same foods in 2009 versus prior years. Challenging economic times did not translate into an increase in more meals cooked in the home. The number of meals eaten in the home, and carried from home in 2009 remained consistent with past years. Total eatings, conversely, showed a substantial decline in 2009 when compared with 2008 levels. In 2008 the average Canadian consumed either a food or beverage 4861 times compared to 4655 times in 2009. The decline in eatings was concentrated in the lunch and dinner meal occasions. 2009 saw the continuation of a trend towards simpler meals in the home with fewer base dishes included across all meal occasions. (A base dish is a food eaten in its original form rather than being used as an ingredient or topping.)

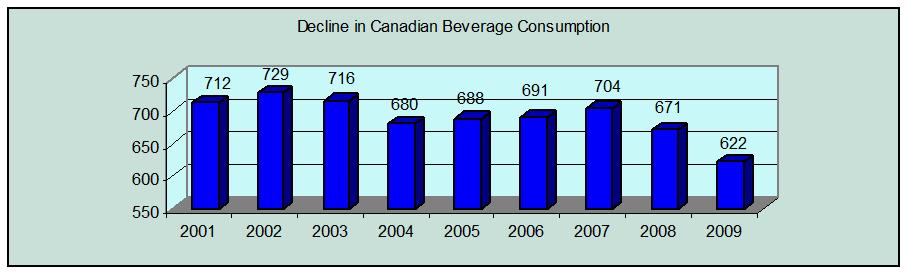

One reason for the drop in eatings is the decline in beverage consumption. Canadians drank fewer beverages last year than the previous nine years, and this may represent an area Canadians are willing to cut back on monetary savings.

Beverage Consumption

In concert with there being fewer base dishes in the average meal, consumers also used fewer ingredients and additives, indicating a trend towards more convenient meal preparation in the home. Although conventional wisdom dictates that as consumers look for savings in a weakened economy, they rely more on homemade meals. In 2009, 380 meals contained homemade foods or beverages compared to 398 in 2008. As the number of homemade meals decline, consumers increasingly turn to the frozen aisle for meals that can often be prepared with less hassle and are less perishable. The top five foods from the freezer in 2009 were vegetables, ice cream, French fries, pizza and chicken in the form of wings or nuggets.

As has been consistent throughout the past decade, convenience remains the key factor, with 75% of meals being prepared in under 15 minutes.

So in general Canadians sat down for the same number of meals in 2009 as they did in previous years, but the meals they did have had fewer separate parts to them. This could have meant that they were willing to forgo some elements traditionally part of a meal, be it an additive or a beverage, but this does not necessarily mean that Canadians ate less. Rather, it indicated that Canadians simplified their meals with fewer components. 2009 also saw a stark decrease in the number of additives and ingredients consumed. This decline was centered around the lunch occasion, and again, reflects a trend towards meal simplification. Aside from this being a reflection on the economy, it may further point to a trend in which Canadians are looking for meals that are easy to prepare and require little cooking ability. The report now looks more closely at our eating habits during specific meals.

Breakfast

First let’s start with breakfast. In 2009 Canadians ate breakfast 313 times. This has remained relatively constant over the past decade. It seems like the older we get the less likely we are to skip breakfast. As an example, Canadians 65+ years old only skipped breakfast seven times while the 18-34 year old group skipped breakfast fifty-nine times. Just because this age group skipped breakfast does not mean they don’t eat. This age group is more prone to be snackers. Even though we, as Canadians, continue to eat breakfast, we are spending less time preparing breakfast. Eighty-two percent of breakfasts took one to five minutes to prepare. Eighty one percent of Canadians eat breakfast at home with the younger adults more likely to eat at home and the over fifty-five group more likely to eat out.

Where do Canadians look to find their breakfast foods in a grocery store? Well they look to grocery store shelves. The fresh section has steadily declined since 2007.

So what are the favourite breakfast foods by age group eaten at home? Listed below are foods in each age category that shows either a 20% above average or 20% below average usage.

<18 more likely to eat RTE cereal or waffles, less likely to eat hot cereal or eggs/omelettes

18 to 34 are more likely to eat bagels and less likely to eat bread, fruit, hot cereals, eggs/omelettes, sandwiches or waffles

35 to 44 are more likely to eat hot cereals and less likely to eat RTE cereal, non toasted bread or waffles

45 to 54 are more likely to eat eggs/omelettes and less likely to eat waffles

55 to 64 are more likely to eat bread, fruit and eggs/omelettes and less likely to eat yogurt, bagels and waffles.

Two things to note that although showing a decline in total bread consumption, there has been and increase usage of bran/fibre bread and fibre/grain bread. Also yogurt consumption has increased across all age groups.

Breakfast Beverages in-Home

Overall beverage drinking at home has declined across all age groups, with the largest decline among the 18 to 34 year olds. Coffee and juice/ades and drinks have been the hardest hit with milk and hot tea remaining relatively stable. While overall juice consumption has gone down the hardest hit was frozen juices, while ready to serve juice has shown an increase. This is most likely because of the taste, quality and convenience offered.

Breakfasts Eaten Away From Home

Consumers in the 35 to 44 and 65+ age groups are increasingly relying on restaurants for breakfast. The breakfast sandwich is the fastest growing food at breakfast/brunch in food service.

| Category | Average | <18 | 18-34 | 35-44 | 45-54 | 55-64 | 65+ |

| Breakfast Sandwiches | 26.7 | 18.8 | 30.2 | 28.7 | 29 | 25 | 19.6 |

| Eggs | 22.1 | 18.1 | 16.4 | 16 | 21.1 | 33.4 | 41.7 |

| Bacon/Sausage | 21.5 | 23.9 | 16.8 | 15.6 | 18.9 | 29.1 | 38.3 |

| Hashbrowns | 20.5 | 18.2 | 18.3 | 18.6 | 19.5 | 25.2 | 29 |

| Toast | 17.7 | 13.9 | 11.4 | 12.5 | 16.8 | 29 | 36.2 |

| Bagels | 14.9 | 13.1 | 18.5 | 17.9 | 11.8 | 12.9 | 9.8 |

| Muffins | 8 | 5.9 | 6.4 | 9.5 | 10.5 | 8.1 | 6.7 |

| Fruit | 6.6 | 7.6 | 6.5 | 5 | 5.5 | 8.3 | 8.8 |

| Donuts | 6.2 | 10.5 | 6.4 | 7 | 5.2 | 3.7 | 4.6 |

| Pancakes | 6.2 | 15.7 | 5.4 | 3.5 | 3.9 | 5.4 | 7.8 |

|  |  |  |  |  |  |  |

| | 20% Less than average |  |  |  |  |

| | 20% greater than average |  |  |  |  |

,

At breakfast, quick service restaurants dominated with 500 million visits. Casual restaurants, on the other hand, are the fastest growing segment with over 15% growth versus last year. Continuing on in the next consumer corner will be the findings from the report on lunch, snacking and dinner habit |

|