| | Introduction | Selected survey findings | So what? | Sources

,

Introduction

According to Statistics Canada, per capita meat consumption has declined since 1990s with the exception of poultry. Meat industry is constantly looking for ways to improve domestic market consumption. A number of research studies have identified consumer preferences for meat and fish proteins, based on factors like socio-demographic, health and nutritional related perceptions, safety, and family preferences. A series of research studies conducted by ALMA (former Alberta Livestock and Meat Agency) provides information on the importance of various meat product attributes like price, freshness, leanness, color, tenderness and flavor etc., impact of technology like smart phones for marketing and recipes on shopper behavior and several other shopper measures in purchasing meat.

However, we do not have information about consumer perceptions of their meat preparation skills. In February 2017, Alberta Agriculture and Forestry and Alberta Cattle Feeders Association contracted Nielsen Canada to do a short survey about meat consumers in Canada. In this issue, some of the key findings are highlighted to provide insights on consumer perceptions of how they prepare meat. By understanding these trends, producers and processors can capitalize on emerging opportunities and position their products successfully.

Selected Survey Findings

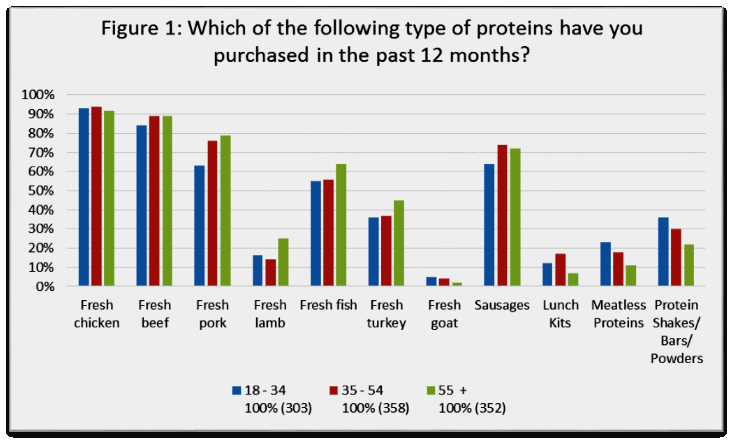

One of the survey questions was “what types of meat products have you purchased in the last 12 months?”

Confirming the findings of the ALMA (2016) study, the majority of survey respondents purchased chicken followed by beef and pork. Only a small percentage of consumers purchased lamb and goat. Looking at the type of protein and the purchase behavior of different age groups (ages 18-34; ages 35-54, and ages 50 plus), chicken was purchased more or less equally by all three age groups.

Consumers in the youngest age group purchased considerably less beef and pork as compared to older consumers. The youngest consumer group purchased comparatively more meatless proteins and protein shakes/bars/powders etc.

Fresh fish and fresh turkey purchases were highest among the 50 plus age group, indicating their demand for healthier protein items.

Even though lamb and goat are purchased by very few consumers, differences among age groups are noteworthy.

While the oldest consumers purchased more lamb as compared to younger age groups, the youngest consumer group purchased more goat as compared to older consumer groups.

The goat meat purchase pattern may indicate the ethnic diversity among the younger consumer groups in Canada.

Source: Canadian Cooking Habits Survey, Nielsen Canada, 2017

There are many reasons why a meat product is selected by a particular consumer or age group.

Various studies have indicated that consumers choose meat mainly due to the perceived health benefits.

Considering top three meat types purchased, consumers often perceive that chicken is healthier than beef and pork. Research has found that, in general, Canadian meat consumers think they will eat less of all types of meat in the next five years, except for chicken where many consumers think they will eat more.

According to this survey, when consumers are cooking their preferred meat item, attributes such as ‘flavorful’, ‘stays tender’ and ‘stays moist’ are very important for all consumers. Short preparation times and fast-cooking proteins are more important for the younger age group (18-34 years). The most common challenge experienced by all consumers in cooking their favorite meat is ‘drying it out’.

According to the ALMA study (2016), many consumers indicate that the majority of the meat they purchased in the past month was pre-cooked, ready to eat, branded, and/or already flavored (e.g. spices, marinade, sauces, etc.).

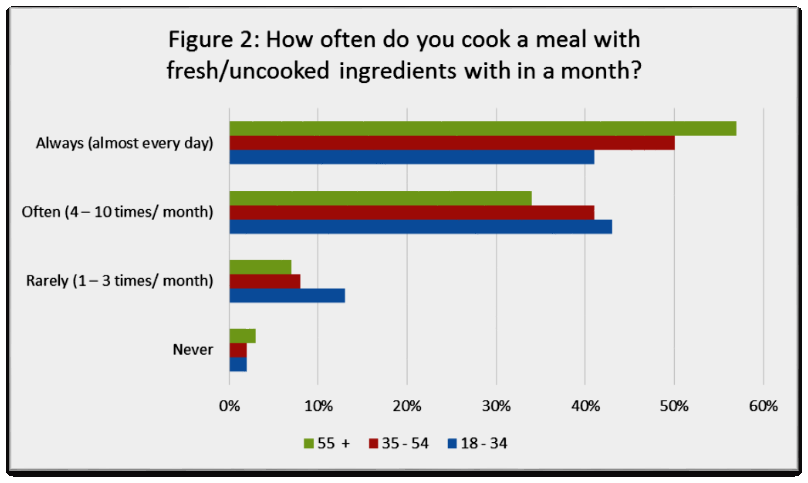

Confirming these findings, this study also provides evidence that the majority of consumers, irrespective of their age, purchase partially-prepared or fully- prepared take out items from a grocery store at least one to three times per month. Younger consumers purchase these types of prepared meat more frequently (4 to 10 times per month) as compared to the 50 plus age group, who seldom purchase these items.

Except for the 50 plus age group, half of respondents indicated that they prepare meat ‘from scratch’ less than 10 times per month. Among the consumers who prepare meat ‘from scratch’ almost every day, the oldest age group is dominant.

Source: Canadian Cooking Habits Survey, Nielsen Canada, 2017

The majority of survey respondents (about 85%) spend less than 30 minutes preparing and cooking meat during

week days. However, they often spend an hour or more preparing and cooking meats on the weekends.

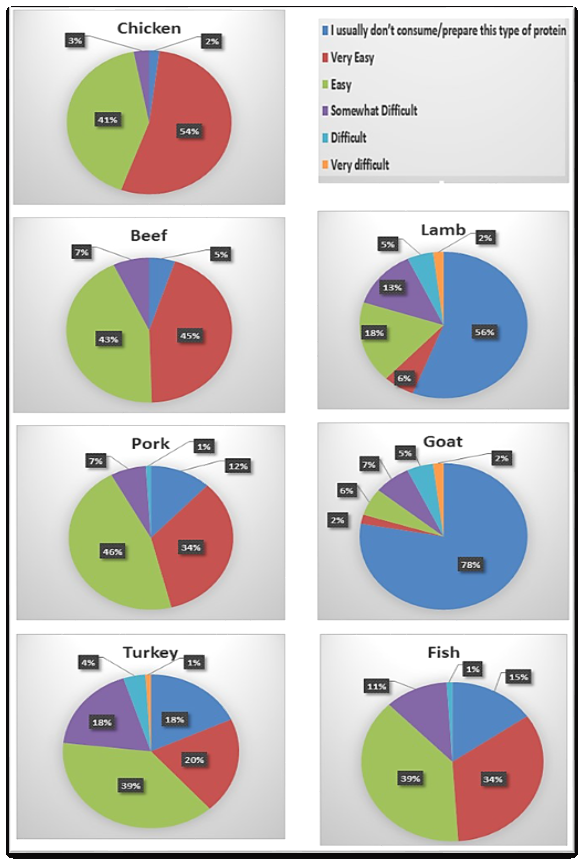

As illustrated in Figure 3, about 95 % of respondents think that chicken is the easiest meat to prepare. Among three main meat proteins, chicken, beef and pork, a higher percentage of consumers (about 12%) say they do not usually prepare pork at home. The majority of consumers do not prepare lamb and goat meat at home.

Figure 3: Please rate the following proteins in terms of easiness to prepare?

Source: Canadian Cooking Habits Survey, Nielsen Canada, 2017

A comparison of perceptions among different age groups show that the younger age group (age 18-34) is less confident about their meat preparation skills. A similar trend is observed among Canadians in a study conducted by the Pan-Canadian Public Health Network (PCPHN). They have identified several technological, food system related and broader shifts within the social, economic, physical and cultural environments have been identified as factors influencing the culture of cooking and food preparation in the domestic environment. A few such

factors include:

- increased availability of food commodities (basic/raw and processed);

- improved and advanced technology for food storage, preparation and cooking; resulting in changes in the level of knowledge and skill

- required to cook;

- time and financial demands/ realities related to labor market participation;

- shifting family priorities and values;

- decreased opportunities for cooking; and

- preparation skill acquisition both within the home and public education environments.

So What?

The survey results suggest that the market shows strong potential for long-term growth in ready-to-eat and heat-and-eat meat. In the process of value- adding, processors should consider, increasing ethnic diversity and generational differences. Other related studies provide evidence that consumers also want convenient meat products that are healthy and ethical.

Many consumers don’t have the time to prepare meat “from scratch” and are looking for more convenient options. In this type of market, including easily-prepared recipes on packaging or marketing materials might be a good strategy to encourage consumers to purchase meat products. The fact that consumers spend more time preparing and cooking meat during weekends could also be used in marketing and promotion activities.

Sources

- Canadian Cooking Habits Survey, Neilsen Canada, 2017

- Canadian Consumer Retail Meat Study, 2012, 2014 & 2016

- Improving Cooking and Food Preparation Skills: A synthesis of evidence to inform program and policy development, Pan-Canadian Public Health Network Government of Canada, 2010

|

|