| | Introduction | Consumer segments | Well beings | Food actives | Magic bullets | Fence sitters | Eat, drink & be merrys | Information source

,

Introduction

NMI’s report “9th Edition Health $ Wellness Trends Report”, April, 2008 is now in its ninth year and includes trended consumer data gathered from over 26,000 consumers across 20 shopping channels and over 100 product categories. The study covers industry trends such as who are shopping and where; their motivations, attitudes and beliefs towards nutrition, diet, and health lifestyles; and the desire for specific ingredients and avoidance issues. With the 2008 health and wellness industry sales an estimated US$102.8 billion this market is certainly worth taking a look at.

Compared to the low annual sales growth among conventional grocery stores in 2007 (roughly 5%), the health and wellness industry’s continued growth (overall 14.7%) is quite remarkable. Based on current market trends and historical data, it appears that these trends have staying power.

Natural/organic personal care products and organic food and beverages are the fastest growing categories, now accounting for one quarter of all health and wellness spending.

Natural Marketing Institute predicts approximate double digit growth to 2012.

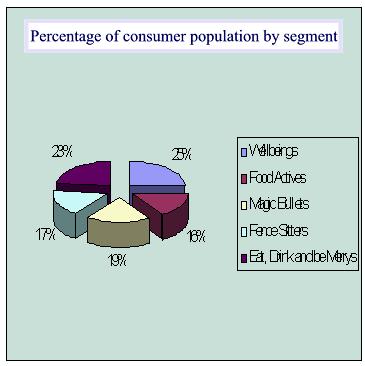

Consumer Segments

The industry is explored by using the following consumer segments:

- WELL BEINGS® continue to explore, experiment and adopt new health products and services and their positive attitudes and values influence can be seen across the spectrum from increased usage of health categories and alternative healthcare to their influence on environmental issues.

- FOOD ACTIVES® are driven by balance, and have continued to revert back to the basics of health nutrition.

- MAGIC BULLETS® are the segment of the population most driven by their preference for supplements and functional foods.

- FENCE SITTERS® are the consumers most driven by family dynamics, are seeking more health convenience and are experimenting with new options in healthy foods that taste good too.

- EAT, DRINK & BE MERRYS® the final segment of the consumer population continue to be driven by taste and vanity.

WELL BEINGS®

The first consumer segment that we will look at is the WELL BEINGS. The WELL BEINGS are driven to health by all means and comprise 25% of the US population.

They have a high use of healthy food and one-third of all spending is on health and natural foods. They are more successful than other segments for maintaining a healthy eating even though they find it challenging to maintain their healthy lifestyle. They are more likely to choose natural/organic foods over conventional food. They enjoy minimally processed foods and soy food on a regular basic. They are more likely than other segments to consume vegetarian dishes and dishes of whole grains and high fibre.

They worry about preventing health conditions and are especially interested in optimizing energy. TheWELL BEINGS have above average use of alternative healthcare. They are also more likely to participate in fitness activities such as walking, weight training, swimming, cardio training and running.

The Wellbeing is also the first to try new products, actively seek and purchase products to protect the health of the family. Of all segments theWELL BEINGS are more likely to be the greenest shoppers.

FOOD ACTIVES®

The second consumer group from the Natural Marketing Institute’s Health & Wellness Trends report is called the FOOD ACTIVES. This group compromises 16% of the US population and two out of three are female.

Dedicated to health through smart nutrition and weight management they believe eating healthy is vital, and over three-quarters eat heart smart. FOOD ACTIVES believe maintaining proper weight is the key to health. They have a tendency to count calories and use artificial sweeteners. They are more likely than the general population to walk, train with weights, garden and golf. They maintain a healthy lifestyle for family, actively engaged in health proactively through selected product purchases.

FOOD ACTIVES, as with many of us, worry about preventing health conditions such as cancer, heart disease, vision problems, obesity/overweight and high cholesterol. They lean towards foods with high fibre and protein, foods that are heart healthy with low carbohydrate, whole grains and limited fat.

FOOD ACTIVES have a low use of organic or natural foods. They do not believe that organic or natural foods are good value for their money.

FOOD ACTIVES also have the highest use of prescription drugs and have the lowest use of alternative health care.

MAGIC BULLETS®

The next segment of consumers explored is the MAGIC BULLETS which compromise 19% of the population. This group has an above average interest in and understanding of organic and natural foods and beverages. They also have the highest use of functional and fortified food and beverages.

Nearly 60% of this group manages their weight by eating weight loss foods and using artificial sweetners. They exercise more than the other consumer segments.

They more often walk, enjoy massage and gourmet cooking. There are more Hispanics in this segment than the general average.

FENCE SITTERS®

FENCE SITTERS are compromised of 17% of the population with a Hispanic incidence of 15%.

This group has the lowest belief in the connection between diet and health. They are less likely than average to use most of the healthy food categories. They are less concerned about sugar, high fructose corn syrup and artificial sweeteners. They do try to limit their fat and sodium use. This segment is more likely to buy products based on price.

This group has the lowest belief in supplement efficacy and usage but also have the lowest prescription use.

They have average to lower rates of lifestyle activities and like to gamble.

EAT, DRINK & BE MERRYS®

The final consumer segment are the EAT, DRINK & BE MERRYS They compromise 23% of the population and are 42% male. They are the least likely to agree that healthy food is important to a healthy lifestyle. They are driven more by taste and to select emotional feel good foods. They are not likely to read labels and they buy store brands based on price.

This segment has a lower concern over most health issues and are the most likely to be obese. This is because of their less active lifestyles. They are more likely to be white, less educated and younger. This segment also has a low regard for the environment and find no money value for organic or natural foods.

©Natural Marketing Institute (NMI), 2008

Information Source

Source: Natural Marketing Institute "Health & Wellness Trends Report", April, 2008

Data and information used with permission of Natural Marketing Institute (NMI).

Natural Marketing Institute (NMI) is a leading business consulting and market research firm within the world of health and wellness. Their consulting and research specialists have utilized a diverse mix of primary and secondary research tools and methodologies to assist companies with strategic brand development, insightful market analysis, consumer profiling, and much more.

Consumer Corner - Health and Wellness in pdf file |

|