| | Introduction | Changing market for meat | Processed meat | The market for selected processed meat products | So what? | Sources

,

Introduction

Consumers are increasingly demanding ready-to-eat and ready-to-cook meat products with great quality and taste.

Customer awareness and acceptance regarding the convenience of meat products is an important factor in the growth of the processed meat industry.

In this article, the processed meat market data are analyzed to understand the market dynamics and the factors that may have contributed to changes in consumption in Canada and Alberta.

Changing Market for Meat

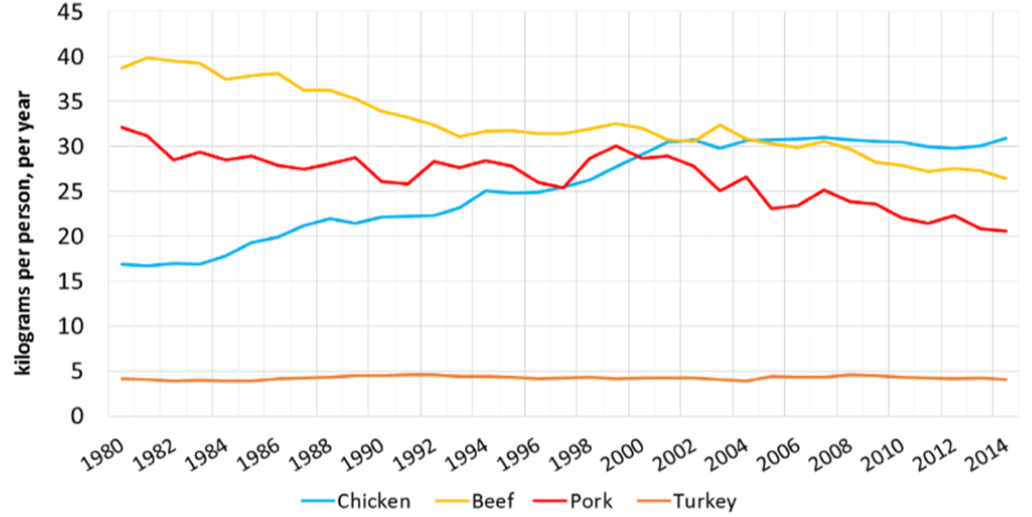

Over the past few years, the market for meat has undergone considerable change. Figure 1, depicts per capita consumption of animal protein sources in Canada in terms of food available per person, per year.

According to Statistics Canada, Canadians have witnessed an overall decrease in per capita protein consumption. More specifically, beef and pork consumption has decreased. But there has been an increase in per capita disappearance of chicken, while turkey has remained fairly stagnant.

Despite declining consumption rates for beef and pork, processed meat, especially bacon, sausage and luncheon meat sales have grown over the years. There is evidence to show that consumers are rethinking their consumption of processed meat products because of the convenience, availability of perceive healthier options and the high cost of fresh meat. Manufacturers are introducing chilled and frozen products with less sodium and fewer ingredients in an attempt to clean up the labels. They also introduce chicken and turkey varieties as “healthier” alternatives. Other new introductions include processed meat with different flavours and claims such as “convenient”, “all-natural” and “gluten-free”. Different private label products with premium claims, unique flavoring or other product attributes can also be found in the market as consumers look for affordable ready-to-eat products

| Figure 1: Per Capita Protein Disappearance of Chicken, Beef, Turkey, and Pork in Canada (1980-2014) |

Source: Statistics Canada

Processed Meat

Processed meats are meat-based products that have undergone a variety of different processing methods including smoking, curing, fermenting, drying, canning and salting. Often times, meat is processed to either extend the shelf-life of the product and/or to improve taste. Figure 2 illustrates the segments and sub-segments that comprise meat products. Figure 3 illustrates categories of processed meats according to the Food and Agriculture Organizations of the United Nations (FAO).

Figure 2: Segments and Sub-Segments of Meat Products

Source: FAO, http://www.fao.org/docrep/010/ai407e/ai407e09.htm

Figure 3: Categories of Processed Meat Products and Typical Examples

Source: FAO, http://www.fao.org/docrep/010/ai407e/ai407e09.htm

The Market for Selected Processed Meat Products

According to Nielsen retail sales data, the market for sausages, luncheon meats and bacon in Alberta has

been growing. As shown by figure 4, there has been an overall growth in sausage, luncheon meat and bacon between 2010 and 2015 in terms of volume kilograms.

In 2014, bacon experienced negative growth with regards to volume. This may have been due to the Porcine virus which resulted in a supply shortage in the North American market.

Figure 4: Processed Meat Sales in Alberta (Volume in Kilograms)

Source: Nielsen Market Track Data, ALBERTA GB +DR +MM - 52 Weeks ending December, 2010 to 2015

Additionally, the market for sausages, luncheon meats, and bacon in Alberta has also been growing in terms of Dollar volume. This is shown in figure 5.

Figure 5: Processed Meat Sales in Alberta (Volume in Dollars)

Source: Nielsen Market Track Data, ALBERTA GB +DR +MM - 52 Weeks ending December, 2010 to 2015

An analysis of retail prices of these selected processed meat categories contains some noteworthy trends. The consumer price index (CPI) measure for Canada for processed meat shows an increasing trend. A significant jump in CPI for processed meat can be observed in early 2014 and this increasing trend continued until late 2016. Again, this trend can be attributed to the supply shortages of bacon and pork based processed products which drew their prices significantly up during the PEDV outbreak.

Source: Statistics Canada

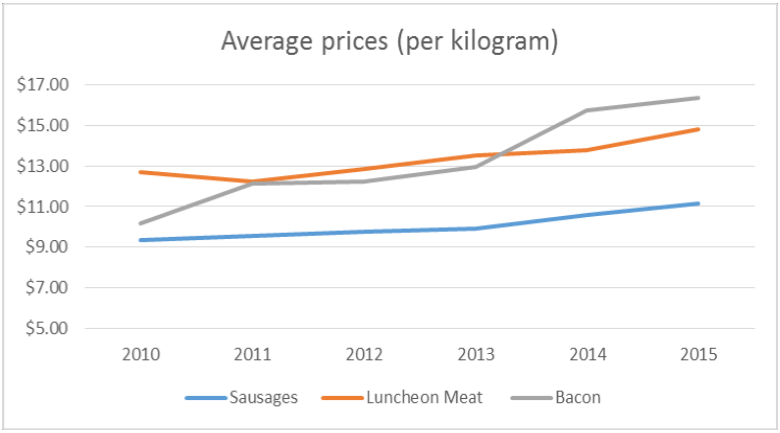

The average annual prices per kilogram of sausage, luncheon meat and bacon sold through Alberta retail channels from 2010 to 2014 also show an increasing trend. A significant increase in bacon prices that is observed in this average annual prices could also be attributed to the PEDV outbreak in U.S. and Canada. The fact that Alberta economy was performing well during the period analyzed, may have contributed to increasing demand for processed meat products.

Source: Nielsen Market Track Data, ALBERTA GB +DR +MM - 52 Weeks ending December, 2010 to 2015

The overall increase in processed meat prices can be attributed to the increasing costs of inputs especially, fresh meat and labor costs), exchange rate fluctuation as most of the processed meat products are imported to Canada and Alberta, and increasing demand with a low level of supplies in the market. Increasing demand may be driven by the convenience factor and the availability of novel processed meat products with a variety of flavors and claims such as ‘natural’ and ‘healthy’.

Market research information also provides evidence that Canadian consumers continue to purchase ready to eat processed meat products despite negative reporting about the health impact of processed meat products.

Technomic research has found that sandwiches are one of the main meal items of Canadians and North Americans, and therefore, demand for deli meat is expected to grow.

Chicken and turkey deli meats are leading the way as consumers believe these are healthier option.

So What?

- Driven by Canadian consumers’ demand for convenience and snack food trends, demand for processed and ready to eat meat products is expected to grow in the future.

- Value-added categories such as deli, bacon and sausages made out of poultry is also driving growth as Canadians perceive poultry products to be healthier than their non-poultry counterparts.

- Canada’s growing immigrant population will continue to spark interest in exciting new flavors and therefore, demand for new and unique flavors will continue to grow.

- Value-added processing is a priority area for economic growth in both Federal and Provincial government Strategies. Therefore, agri-food processors can capitalize on the opportunities that are being created in the processed meat product industry in Alberta and Canada.

Sources:

We would like to acknowledge Stephanie Budynski for contribution to this article.

|

|