| | Whole foods canadian expansion | Alberta restaurant industry | Data highlights | Sources

.

Whole Foods Canadian Expansion

Whole Foods Market is a leading organic and natural food chain in the U.S., with over 400 U.S. stores. The retailer currently has 10 stores in Canada. The majority of these are in Ontario (Toronto region, plus one in Ottawa) and in the Vancouver area. In February 2015, they announced plans to expand beyond those two provinces. Alberta is next, with a fall 2016 opening in Edmonton and a summer 2017 opening for Calgary. A store is also planned for Victoria, BC in summer 2017 as well.

This is a new player coming into the traditional grocery retail dynamic in Alberta. Whole Foods provides a high touch, humanized customer experience – a higher end retailer promoting local and authentic. While there are some independent specialty food stores that strive to provide a similar experience, none at the scale and with the larger established brands behind them. It should be interesting to see how both the Alberta consumer and retailers respond.

The entry into the Alberta market has the potential to offer new opportunities to Alberta companies as the Whole Foods brand is built upon local as well as organic and natural products. To quote Joe Rogoff, president of Whole Foods Markets Pacific Northwest Region, “We will be working with growers, suppliers, ranchers and manufacturers in Alberta…. to source as many local products and services as we can find”. These local companies will have to meet the higher standards required by Whole Foods. They are somewhat more rigorous than other retailers require and incorporate elements of sustainability, animal welfare, community and authenticity above traditional organic standards. In their 2014 annual report, they state “The highest standards weren’t available, so we created them. These values do cost, Whole Foods prices are considered to be higher than other food retailers.

According to Whole Foods’ News Room, once complete, each Whole Foods Market store will provide local shoppers with a wide selection of natural, organic and local products. Shoppers will find a community butcher, fishmonger, baker and a team of chefs creating prepared take-out meals, all under one roof.

Shoppers can look forward to fresh, organic fruits and vegetables, specialty items, high-quality meats and poultry, everyday pantry staples and sustainable seafood. The stores’ scratch bakeries will provide a variety of breads and pastries made fresh daily, and their prepared foods departments will offer options for lunch, as well as quick meals for dinner.

See more at: Whole Foods Market

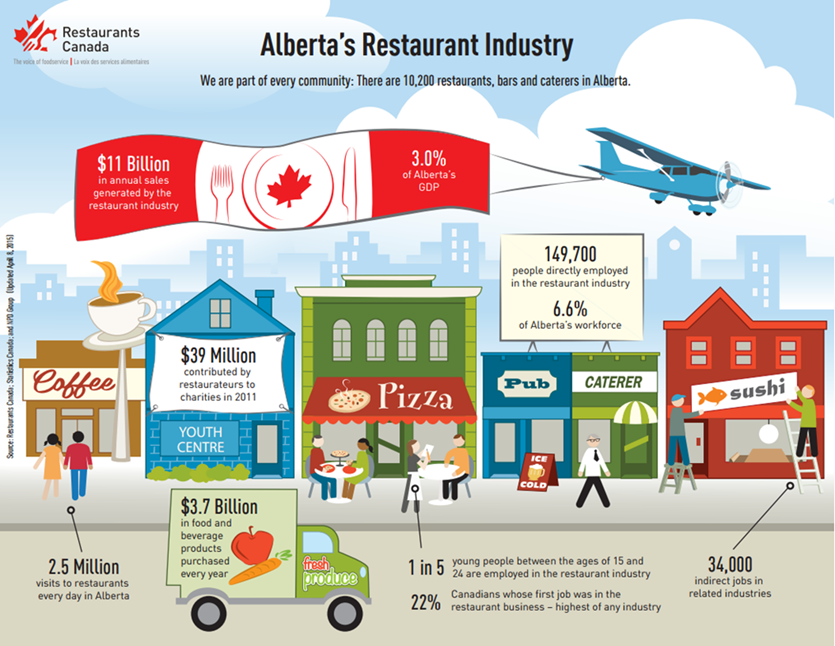

Alberta Restaurant Industry

The 10,200 restaurants, bars and caterers in Alberta generate $11 billion in sales and account for three per cent of the Alberta GDP. The fact that this subsector purchase $3.7 billion worth of food and beverages per year has important implications for Alberta agri-food producers and processors.

Source: Restaurant Canada

Data Highlights

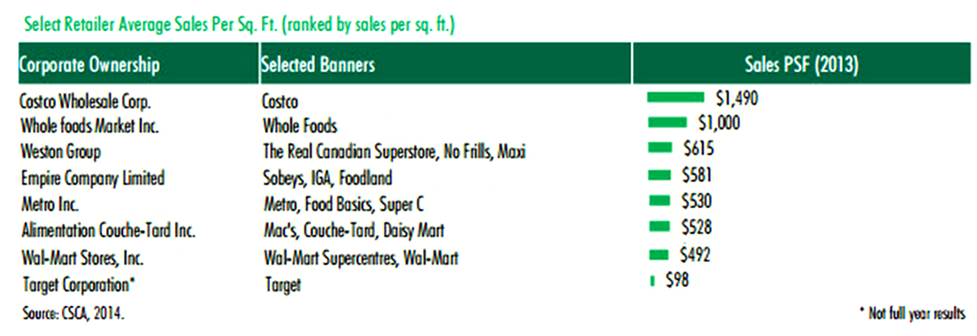

Retail sales productivity

A recent study from the Centre for Study of Commercial Activity (CSCA), examined retail sales productivity of many Canadian retailers over 12 months period in 2013. Looking at only the grocery retailers shows that the discounter,

Costco, has the highest average sales per square foot (PSF) at $1490. Whole Foods, the specialty organic/natural grocer ranked second among food retailers with a value of $1000 average sales PSF. Grocery based companies such as the Weston Group ( Loblaws) and Empire Company Ltd. (Sobeys) had average sales PSF of $615 and $581 respectively.

Monthly food service and drinking places receipts

Food service sales were down in the first quarter of 2015 as compared to the last quarter of 2014. A drop in sales following the holiday season is usually expected, but sales were up in the first quarter of 2015 compared to the first quarter of 2014.

Food Service and Drinking Places Sales in Alberta |

2014 | 2015 | Percentage Change |

Quarter 1 2014 | Quarter 2

-2014 | Quarter 3 -2014 | Quarter 4

2014 | Quarter 1

2015 | Q4 to Q1 | Annual Q1 Change |

$1,999 | $2,200 | $2,249 | $2,237 | $2,077 | -7.16% | 3.91% |

Data in Millions where applicable

Source: Statistics Canada |

Sources:

|

|