| | Specialty food stores and seasonality | Sobeys company analysis | Data highlights | References | Alberta Food Consumer View home page

................,,,

Specialty Food Stores and Seasonality

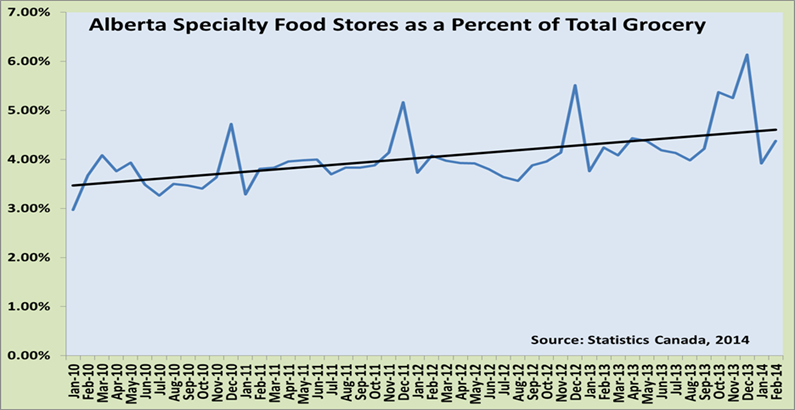

Specialty food retailing is a minor component of the Alberta retail landscape, comprising just 4.5 percent of all grocery store sales in the province. Despite this, as of 2013, it is a $518 million industry, up 16 percent from 2012.

Specialty food stores will witness greater economic success with more consumers utilizing the channel as an additional way to fulfill their food demand. Figure 1 (over) demonstrates the increasing share of grocery sales that specialty stores are claiming.

Figure 1.

A characteristic feature of specialty food stores is high seasonality. The Christmas season is responsible for 12 percent of all sales and typically provides $18 million over the average month. The graph below depicts monthly specialty food sales for Alberta, clearing showing superior performance in the holiday season.

Given the economic benefit of the holiday season, specialty retailers may desire to capitalize on the opportunity and amp up their marketing efforts. This will improve not only seasonal performance, but year-long performance as consumers begin to divert more funds to the specialty channel.

Figure. 2

In December, consumer’s primary attention will be purchasing gifts for others. Though their main attention will be on selecting the perfect cheese set or chocolate gift-basket, their presence at your location provides ample opportunity to up-sell and provide a superior shopping experience.

Customers have the intention of shopping at your location to provide a particular gift to someone. Depending on your products, it would be beneficial to offer other complement items to make the gift “complete.” And of course, stocking holiday cards, giftware, and packaging will benefit the customer with one-stop-shopping and save them the time of having to go else-where for those items.

Customer retail experience may be enhanced by providing a cohesive shopping experience. Your customers will likely be in the Christmas spirit, and you may further elevate their moods with the right décor, music, and even scents. This will also be beneficial for your customers suffering from holiday stress, helping ease them into the gift-giving mood. The end result is customers associating positive feelings with your location, encouraging them to return after the Christmas tree is taken down and they had time to recover from excess turkey left-overs.

Sobeys Company Analysis

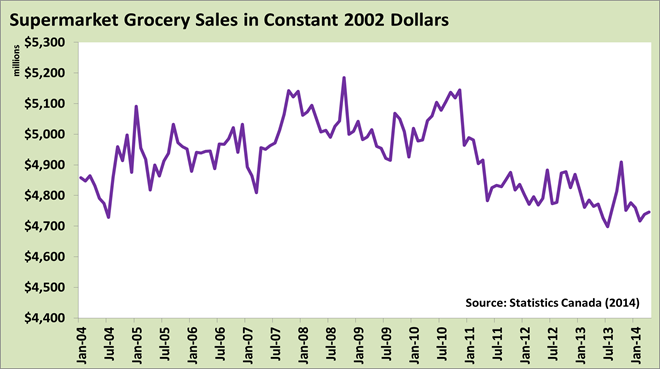

The Canadian grocery market is intensely competitive. Grocers are in a low price stalemate and discounting. Accompanied is a decrease in real spending at supermarkets (see figure on right).

Sobeys, a wholly-owned subsidiary of Empire Company Limited. Banners include: Sobeys, Safeway, IGA, and Thrifty Foods. Post-merger, the company holds 21 percent of Canada’s grocery market share.

The Canada Safeway acquisition was resolved November 2013 for $5.8 billion providing 213 stores and expected market synergies of $200 million over three years ($29 million realized so far).

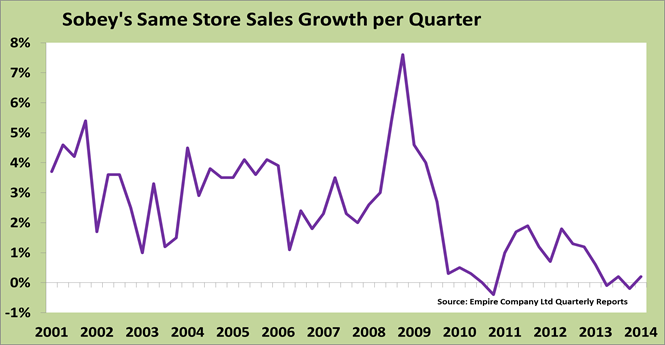

Expansion is the main source of company growth. Since 2010, Sobeys is unable to maintain same-store growth rates (see Figure 3). Though Safeway provides a sales boost, it neglects the issue of same-store dormancy. This may be a long-run risk factor.

Key Indicators—Compiled by Jordan Mahar, Post-Farm Gate Business Analyst.

Key Indicators - 2014

Beta | 0.18 |

Profit Margin | 31.7% |

5 Year Sales Growth

exc. Safeway | 39.8%

19.9% |

Current Ratio | 1.01 |

Quick Ratio | 0.50 |

Inventory Turnover

COGS/AVG INV | 16.6 |

Debt Ratio | 0.53 |

Debt-Equity Ratio | 1.13 |

Solvency Ratio | 0.09 |

Asset Turnover | 1.72 |

Fix-Asset Turnover | 5.75 |

ROA | 0.09 |

ROE | 0.04 |

Financial ratios for Sobeys show strong superior inventory turn-over and less leverage, but pre-merger they lacked a strong national presence. Loblaw merged with Shoppers Drug Mart, which provides great channel diversity opposed to Sobey’s greater concentration in the supermarket channel. This may provide Loblaw with a greater ability to respond to changes in customer preferences.

As can be seen in Figure 4, supermarkets are competing for decreasing real dollars. This is a potential risk for Sobeys as it increases its concentration in grocery industry.

Loblaw’s diversification may make the company more resilient to market shifts. 2014 fiscal year end, Sobeys announced, it reviewed its retail store network. It decided to close 50 under-performing stores (many located near additional locations). These stores generate sales of $400 million over 1.5 million square feet. This move further emphasizes Sobeys concentration in the supermarket arena.

Overall, Sobeys has achieved its goal maintaining its market position. It has been conducting this through national expansion and concentrating in grocery supermarkets. There is a trade-off however. In general, concentration increases company strength in their industry, but also its exposure to market shocks.

Figure 3.

Figure 4.

Data Highlights

Industry employment -Grocery Retail employs over 50,000 Albertan’s, providing almost three percent of the economy’s jobs. It is also a major employer in the retail sector, providing nearly a quarter of the positions in the industry. Employment growth this quarter has been mild, but significant with a slight uptake. This growth has been slightly softer in the retail industry as a whole, however. This likely signifies slight job recovery following holiday lay-offs.

Average Alberta Grocery Retail Employment |

| Quarter 1 | Quarter 2 | Percent Change |

| Employment | 55,465 | 55,942 | 0.86% |

| Percent of Total Retail | 23.20% | 23.01% | -0.84% |

Source: Statistics Canada 2014

Monthly retail trade—Retail sales are up this quarter compared to the previous with strongest gains in the beer & wine category. Following a first quarter lull, convenience and specialty has also seen an uptake, though this is likely to be a seasonal variation. Supermarkets have also seen a considerable increase as holiday left-overs ran out and consumers needed to restock their refrigerators.

Grocery Sales in Alberta |

| Quarter 1 | Quarter 2 | Percent Change |

| Supermarkets | $2,494 | $2,684 | 7.61% |

| Convenience | $173 | $189 | 9.55% |

| Specialty | $118 | $134 | 13.27% |

| Beer & Wine | $505 | $671 | 32.86% |

| Data in millions where applicable. Source: Statistics Canada, 2014 |

References

Trends in Retail - Issue 1 in pdf copy |

|