| | [ Purpose / Results | Market Outlook | Economics | Special Crops Program | Methodology | Acknowledgements ]

Purpose of Survey

Prepared by: Reynold Jaipaul

To address some of the data and information needs of the Specialty Crop industry in Alberta, the Statistics and Data Development (SADD) Unit has been conducting an annual Specialty Crop Survey. Now into its eighteenth year, the survey attempts to capture data on area (seeded and harvested acres), yield and production, for the various types of specialty crops grown.

Data gathered from the survey are used primarily to generate related provincial and sub-provincial estimates by the SADD Unit. In turn, these estimates are used to validate some of the Alberta estimates generated by Statistics Canada, as well as to provide industry and other stakeholders with benchmark statistics for some of the "new" and emerging crops grown in the province.

Survey Results

Prepared by: Chuanliang Su

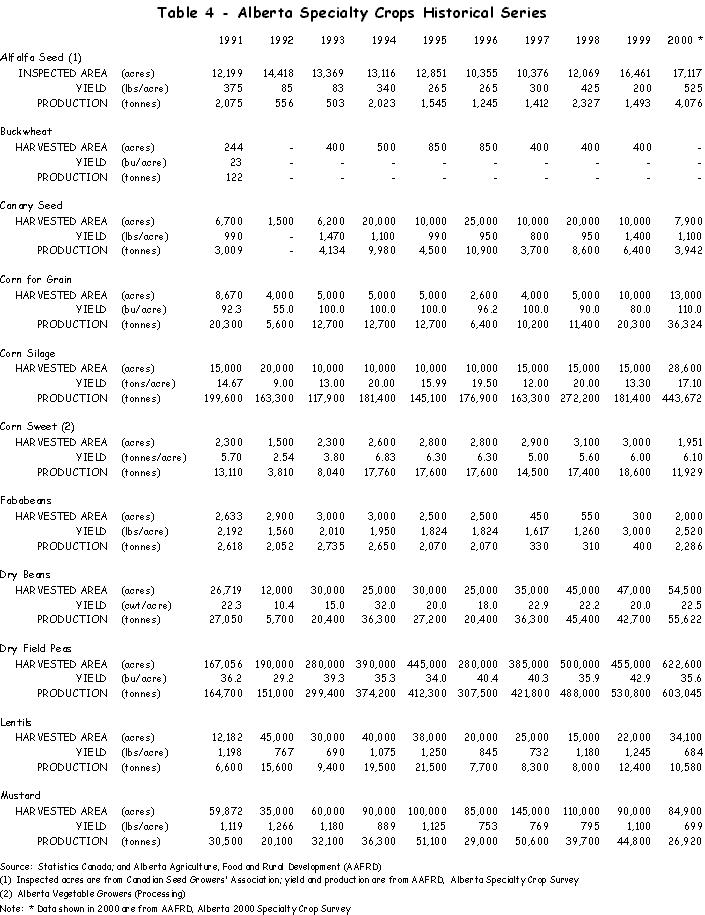

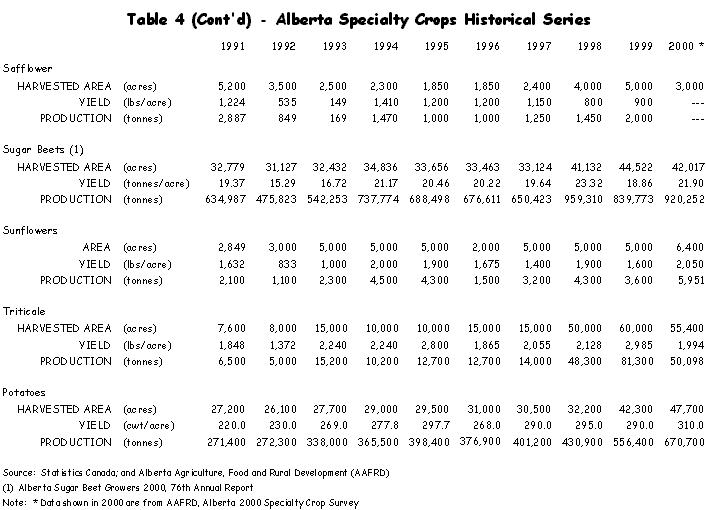

Area, Yield and Production in Alberta

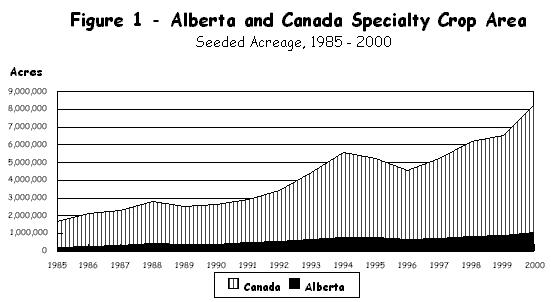

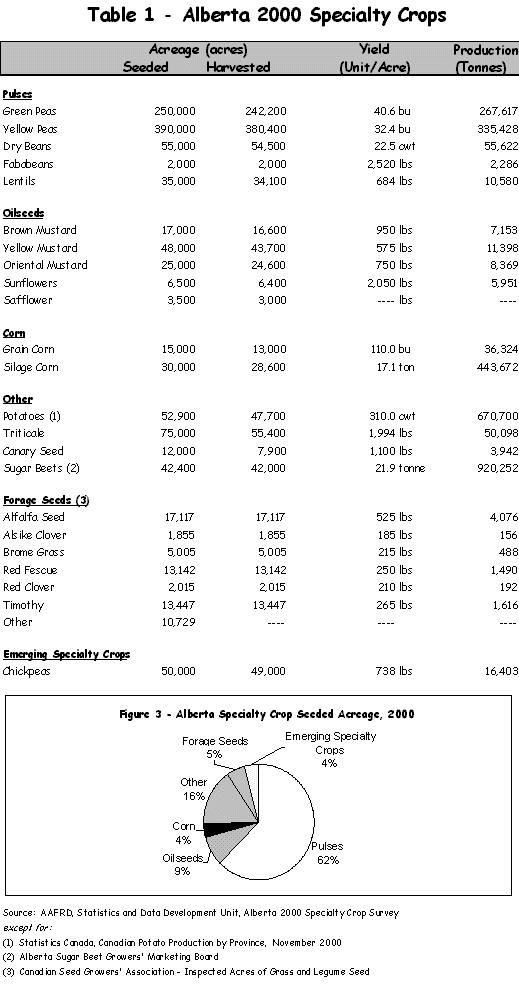

Specialty crop acreage continued to increase in 2000, as seen in Figure 1. Total harvested specialty crop acreage in Alberta, excluding forage seed crops and potatoes, reached a record one million acres, representing an increase of 31% from 764,000 acres in 1999. The low commodity prices for major grains/oilseeds, the need for diversification/crop rotation and a good cash return from some specialty crops were just a few reasons behind the upward trend of specialty crop acreage in recent years.

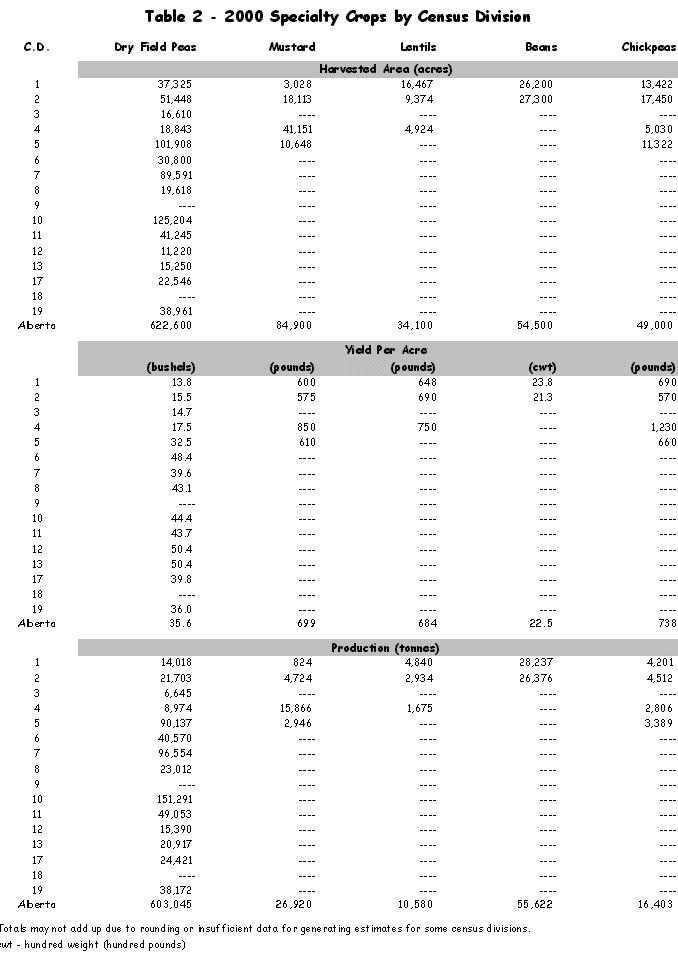

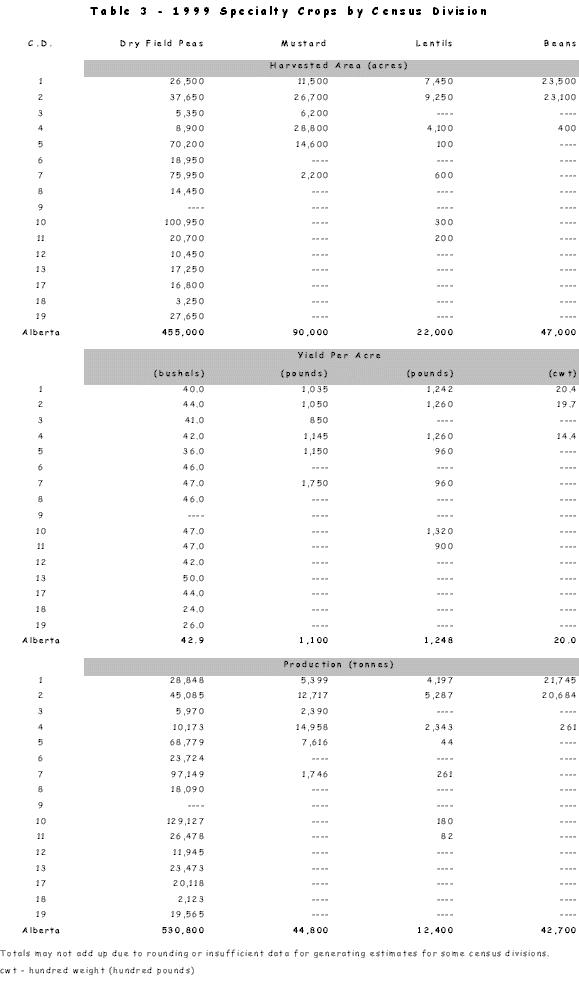

The dry conditions experienced in 2000 in the Southern Region and Eastern areas of the Central Region had reduced the yield of many specialty crops grown in these areas. In 2000, mustard and lentils, grown primarily in these two areas, had significantly reduced yields as compared to 1999. Other specialty crops in the area, such as dry field peas and chickpeas, also suffered a substantial yield loss due to the dryness. However, crops grown under irrigation had benefited from the heat in the area in the 2000 crop season. Alfalfa (for seed) had a record yield of 525 pounds per acre and dry beans had a near record yield of 2,250 pounds per acre. Most alfalfa (for seed) and dry bean acreage was irrigated in 2000.

About 5 to 10 percent of crops in the Peace Region could not be harvested in 2000 due to the wet conditions in the late fall. However, producers managed to harvest all dry field pea crops.

Specialty Crops in Western Canada

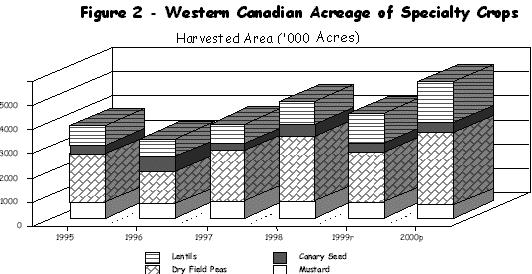

The upward trend of specialty crop acreage can also be seen in other provinces in Western Canada. In 2000, a total of 7.28 million acres of specialty crops, excluding forage seed crops and potatoes, were harvested in Western Canada (see Figure 2). {Estimates for British Columbia, Saskatchewan and Manitoba are from Statistics Canada's November Estimate of Principal Field Crops, Canada, 2000; estimates for Alberta are from AAFRD, Alberta 2000 Specialty Crop Survey}.

Dry field peas remained the largest specialty crop in 2000. Production of total dry field peas in Western Canada was estimated at over 2.8 million tonnes from about 3.0 million harvested acres in 2000. Lentils was the second largest specialty crop. Total harvested acreage was estimated at 1.7 million acres with a total production of 0.92 million tonnes. The estimate of mustard seed production was 0.22 million tonnes from a total of 0.55 million harvested acres. Canary Seed harvested acreage was estimated at 0.4 million acres and production at 0.17 million tonnes.

Saskatchewan remained the largest producer of specialty crops in 2000. Saskatchewan harvested 5.4 million acres of specialty crops, including 2.22 million acres of dry field peas, 1.64 million acres of lentils, 650,000 acres of chickpeas, 455,000 acres of mustard seed, 355,000 acres of canary seed and 20,000 acres of sunflower seed.

In 2000, 145,000 acres of sunflower seed were harvested in Manitoba, accounting for 85% of total sunflower area in Western Canada. In addition, Manitoba harvested 230,000 acres of dry beans, 150,000 acres of dry field peas, 130,000 acres of grain corn, 40,000 acres of canary seed, 33,000 acres of lentils and 30,000 acres of buckwheat in 2000.

British Columbia had a total of 10,000 harvested acres of dry field peas and 22,000 harvested acres of fodder corn in 2000.

Crops

Market Outlook for Selected Specialty Crops

Prepared by: Charlie Pearson

Dry Field Pea Markets

Feed peas have been a success story over this past year, reflecting our ability to sell a record Alberta and Western Canadian crop at relatively high prices. The growth in the demand side came both from the edible and the feed market (both domestic and export). Smaller crops in India (the major pulse crop consumer in the world) and Australia (a major supplier of pulse crops to Southeast Asia) created additional export opportunities for edible peas. On the feed pea side, a smaller European pea crop combined with the meat and bone meal ban resulted in a substantial increase of Canadian feed peas being exported to this region. Feed peas are becoming increasingly more popular in domestic rations as both an energy and protein source. The end result will be a very tight carryover at the end of the 2000/2001 crop year.

The coming year will be challenging again given another record Western Canadian acreage. High nitrogen fertilizer prices and farm managers who have found a good fit for peas within their crop rotations are the major factor in this increase. Statistics Canada seeding intentions survey forecasts Western Canadian pea acreage at 3.6 million acres for 2001, up over 15 per cent from the record 2000 acreage of 3.1 million acres.

Larger European pea production, combined with lower priced soybean meal will keep feed pea prices under pressure. The continued ban on the use of meat and bone meal in European feed rations will allow a continued large export program for feed peas during the first half of the crop year, but this is likely to slow during the last half of the crop year. A positive result of this is that feed peas will continue to be competitively priced into domestic feed rations as an energy source with the implication of continued increases in rations. Look for domestic feed pea prices to hold in the $3.25 to $3.75 per bushel range in the coming year.

Larger pulse crops in Southeast Asia (our major importer) and Australia (major competitor) will result in lower edible pea prices in the coming year. Canada will have good opportunities to move similar volumes to the 2000/2001 crop year, but likely at prices closer to $4.00 to $4.50 per bushel versus the $4.50 to $5.00 per bushel range of the past six months.

Lentil Markets

Larger Canadian and world lentil production has kept prices under pressure this crop year, with a range of 13 to 16 cents per pound for green lentils and 15 to 17 cents per pound for red lentils, versus 20 to 24 cents per pound in 1999/2000. World lentil production has grown from about 2.2 million tonnes in 1997/1998 to about 2.7 million tonnes in the current crop year with increased production in Canada, Australia and the United States offsetting declines in Turkey. The driving force has been strong competition among the major lentil exporters. The export market is somewhat segregated in that Turkey and Australia mainly export red lentils, whereas Canada has mainly exported green lentils.

Western Canadian farm managers are forecast to have seeded 1.6 million acres to lentils this spring, down about 7 per cent from 2000. The acreage seeded to the different types of lentils will also shift slightly with red lentil (Crimson) acres increasing, small seeded varieties (Eston, Milestone) staying relatively stable, and larger seeded types (Lairds) coming down.

Assuming average yields in the 1,100 to 1,200 pound per acre range and a normal quality distribution, prices for all classes of top quality lentils should hold in the 13 to 15 cent per pound range, with large seeded types more likely at the top end of the range and red lentils more likely at the bottom end. Increased production in Turkey and Australia will likely pressure red lentil prices lower than current values.

Chickpea Markets

World chickpea production dropped to just over 5.5 million tonnes this last year versus 6.5 million tonnes normally. The major shortfall in chickpea supplies occurred in India with production of 4 million tonnes, down 1 million tonnes from 1999. Canadian chickpea production in 2000 was a record 388,000 tonnes. The increase in production has been close to amazing given that virtually none of this crop was grown in Canada six years ago. The additional supplies will allow chickpea exports to triple compared to previous years. Domestic use will also be up this year, reflecting increased use in domestic livestock feed rations.

Chickpea prices for premium quality kabuli chickpeas have ranged from 33 to 38 cents per pound for 9 mm size, 30 to 33 cents per pound for 8 mm, and 25 to 29 cents per pound for 7 mm. Desi chickpeas started out in the 12 to 14 cent per pound range last fall, but have since increased to the 16 to 18 cent per pound range.

Western Canadian farm managers seeded about 900,000 acres of chickpeas this spring, with about 40 per cent seeded to desi and 60 per cent to kabuli. Based on average yields of about 1,100 pounds per acre, this would result in production of 450,000 tonnes. Larger chickpea crops are forecast in India, Australia and Turkey. This will likely result in somewhat lower prices in the coming year. New crop chickpea prices are hard to find this summer but early indications are 9 mm kabuli offers in the 25 to 28 cent per pound range, 7 mm varieties such as B90 and Chico types in the 18 to 20 cent per pound range and desi prices in the 15 to 16 cent per pound range.

Mustard Seed Markets

Western Canadian mustard production in 2000 was just over 200,000 tonnes, a 50 per cent decrease from 1999. Canadian mustard exports averaged about 160,000 tonnes, with quantities distributed equally between the US (mainly yellow mustard), Europe (mainly brown mustard) and Southeast Asia (mainly oriental). Domestic use averages about 70,000 tonnes per year. Brown and oriental mustard prices have averaged in the 11 to 12 cent per pound and 10 to 11 cent per pound range, respectively, over the past year. Yellow mustard seed prices were around 15 cents per pound during the first nine months of the crop year, but have since increased to the 19 to 20 cent per pound level, reflecting concerns about the lower mustard acreage in 2001 and the impact of the dry spring on yield prospects.

Mustard seed acreage in the coming year is expected to be about 312,000 acres, a 40 per cent decrease from 2000. Most of the reduction in acreage will be in the brown and oriental varieties of mustard. A tighter Canadian mustard seed supply has resulted in higher new crop prices, with current deferred delivery contract offers for yellow mustard around 17 cents per pound, and brown/oriental prices in the 13 to 14 cent per pound range.

Economics of Speciality Crop Production

Prepared by: Nabi Chaudhary

Costs and returns for livestock, crops and several other enterprises have been monitored in the province in an extensive way since the 1960's. These studies have been viewed as an important tool for assisting producers in their cropping decisions and the federal and provincial governments in developing policies and programs for different farm enterprises. Where information gaps existed in other provinces, results from these studies have served as the basis to fill those gaps.

The Economics Unit (formerly known as Production Economics Branch) in the Economics and Competitiveness Division of Alberta Agriculture, Food and Rural Development has been conducting economic studies on various farm enterprises for the last several decades. Since the early nineties, much greater emphasis has been placed on developing costs and returns data on specialty and/or alternative crops for farm diversification purposes.

Because of continued depressed prices and volatile markets for traditional cereals and oilseeds, producers have been looking into diversifying their operations into new and emerging specialty crops. As mentioned above, results from these studies have been very helpful to primary producers when making cropping decisions. Furthermore, individual producers have also used the results from these studies to compare costs and returns and profitability margins of their farms with the group averages from the respective areas in order to develop better management practices. Agri-businesses and other stakeholders have used the results of the economic studies for feasibility purposes.

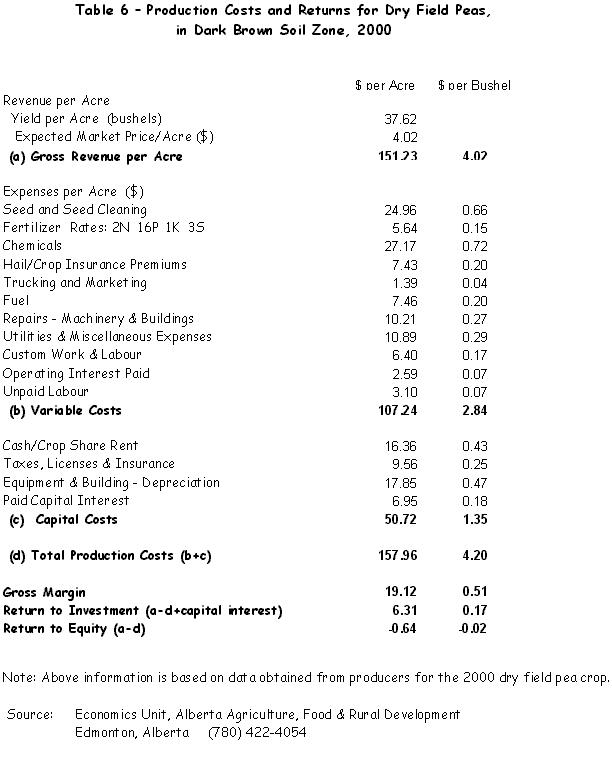

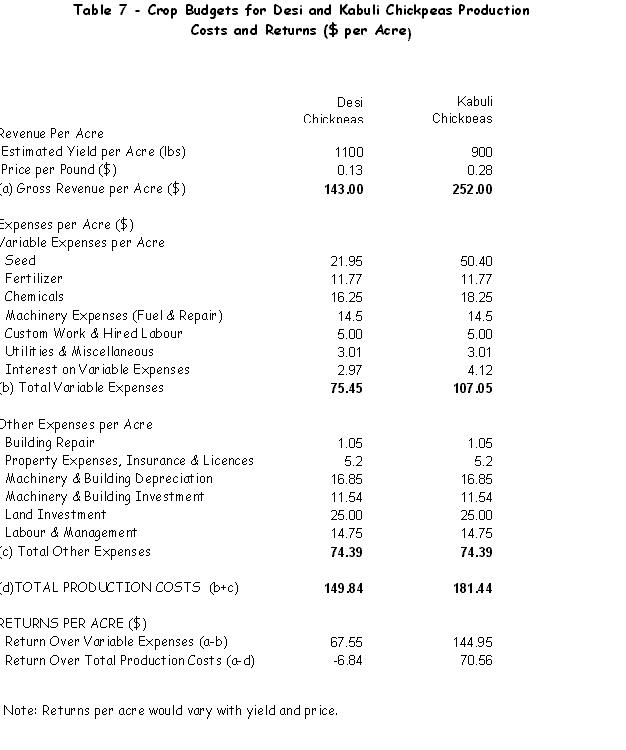

The following tables provide information on production costs and returns for dry field peas and chickpeas (the new cinderella crop on the prairies):

Alberta 2001 Specialty Crop Report - New Crop Development Unit

Methodology

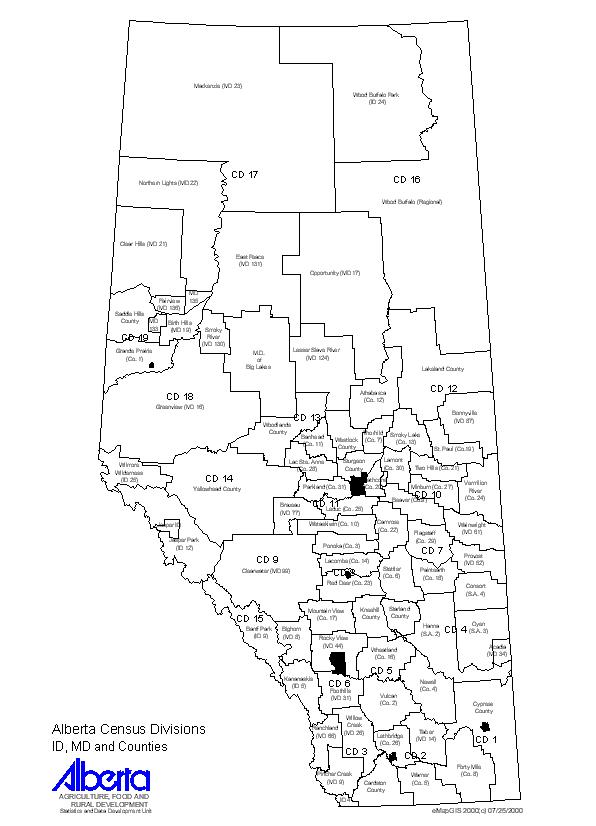

The Specialty Crop Survey which is provincial in scope, collects data through a non-probability sampling procedure. In December 2000, survey questionnaires were mailed out to 4,640 specialty crop producers across Alberta. The questionnaires specifically asked survey participants to provide, at their earliest convenience, information on the type of specialty crop grown, area (seeded and harvested acres), yield and production for the year 2000. Survey participants were also made aware that participating in the survey was voluntary. Moreover, all individual responses would be kept confidential under the provisions of the Federal Statistics Act, as well as under the Provincial Freedom of Information and Protection of Privacy (FOIP) Act, by which the SADD Unit is governed and operates. As of April 6, 2001, a total of 1,225 questionnaires were returned. Of this total, 1,169 were usable and formed part of the basis in the generation of the Alberta 2000 specialty crop estimates.

Survey responses received were reviewed for data completeness, validated and entered into an electronic database. The data was then subjected to some computerized analyses, the results of which were rolled up into group summaries, to preserve data confidentiality of individual survey respondents. In turn, the group summaries, in conjunction with consultations with industry, published sources (e.g. Statistics Canada) and Alberta Agriculture, Food and Rural Development (AAFRD) subject area/provincial specialists were used to generate the provincial and sub-provincial (Census Division) estimates, where appropriate.

It cannot be over emphasized that extensive consultation is done with AAFRD's subject area/provincial specialists and industry, in the derivation of the provincial/sub-provincial estimates, especially in instances where specialty crop production tended to be localized/regionalized. For example, mustard and lentils are grown mainly in the Southern Region and Eastern areas of the Central Region. Largely due to proximity and familiarity with local conditions, provincial specialists in district/regional offices tend to offer useful information and valuable insights on crop conditions and yields, particularly when attempting to firm up some of the sub-provincial estimates generated from the survey. Likewise, administrative data showing yield and crop area grown under private contracts also tend to add value to some of the estimates.

It should be noted that the derived estimates are subject to error. Some of the possible causes of error include data coding, entry editing and tabulation. Nonetheless, we believe that the statistics published in this report are reliable estimates for Alberta.

Acknowledgments

We gratefully acknowledge the participation of producers of specialty crops across the province. Without their cooperation, this report would not have been possible. In addition, the cooperation of Alberta Agriculture, Food and Rural Development staff, including Chuanliang Su, Reynold Jaipaul, Nabi Chaudhary, Charlie Pearson, Dr. Stan Blade, Shukun Guan, Guangzhi Liu, Melodie Mynzak and Brenda Kerychuk is very much appreciated.

For additional information relating to the various sections of this report, please do not hesitate to contact the subject area specialist referenced under each section.

For additional copies of the report, please contact:

Maureen Wenger, Survey Operations Manager

Survey Services Team

Statistics and Data Development Unit

Alberta Agriculture, Food & Rural Development

Phone: (780) 422-2903

Email: maureen.wenger@gov.ab.ca |

|