| | Introduction | Supply and demand | Slaughter price expectations - the most important factor | Cost of gain-outside influences on feeder prices | Animal performance and cost of gain | Ratios - estimating the impact of demand variables on price | The supply of feeders | Arbitrage | Systematic analysis of the feeder cattle market | Return to Livestock Marketing page

.

This is an updated fact sheet from the Economics and Marketing section of the Alberta Feedlot Management Guide, Second Edition published September 2000. The 1200 page guide is available for purchase on CD-ROM. This information is also available in the Livestock Marketing section of the Agricultural Marketing Manual.

Introduction

The feeder cattle market is more volatile than the slaughter cattle market, as well as more likely to show considerable price variation between regions. As a result of this complexity and variability, an organized and systematic approach is necessary in order to analyze the feeder market. This module discusses the principle factors that affect feeder cattle prices, and relates these factors through a formula to the Alberta market for replacement cattle. This formula is a tool that industry participants can use to estimate the price of a feeder animal of a given weight, well ahead of a sale date.

Supply and Demand

The feeder cattle market is a reasonably good example of what economists call a “competitive market,” where forces of supply and demand interact to determine the product price (See: How Demand and Supply Determine Price). The supply of feeders in the long run (from year to year) is primarily a function of changes in the breeding herd and the calf crop, while in the short run (within a given year), numerous other considerations such as weather, seasonal production patterns, and price expectations will affect marketings.

The demand for feeders is a derived demand. Demand for feeder cattle is influenced by the cattle feeding and backgrounding industries and is related to the economic conditions within those sectors. Increased demand for replacement cattle will lead to higher prices in the marketplace, while reduced demand will lead to lower prices. Similarly, an increase in the supply of feeders will tend to lower the market-clearing price, while a decrease in supply will lead to higher prices.

The demand for feeders

The supply of feeder cattle does vary with the cattle production cycle, but supply is more of a known by market participants than is demand. Demand is the more important factor in determining market price. Therefore, it is important to understand where demand for feeders comes from and what factors can affect demand.

The demand for feeder cattle comes from the cattle feeding, backgrounding and grazing industries. The North American cattle finishing industry is comprised of a large number of operators facing input and product prices over which they have limited control. The price for their product, fed cattle, is determined in a competitive market, while most input prices such as feed and interest rates are dictated by the larger marketplace. The only major input price over which the cattle finishing industry has influence is the price of feeder stock.

In a perfectly competitive industry, both economic theory and history indicate that prices will be bid up or down until there are no net profits or losses in the industry. In practical terms, when cattle feeding becomes profitable, feedlot operators tend to bid up the price of feeder cattle. Similarly, when feedlot operators experience or anticipate losses in cattle feeding, they tend to bid less for feeders. In the long run, there are few or no net profits or losses in cattle feeding for the average feedlot. However, since there is no such thing as an average feedlot, less efficient operators consistently face losses and eventually drop out of the industry, while more efficient feedlots consistently make profits and expand. Under certain circumstances, feeder and/or slaughter cattle prices can remain “out of line” for a long time, leading to extended periods of losses or profits in the cattle finishing industry. Extended periods of profits or losses often result from an unanticipated shift in slaughter cattle prices.

To summarize, feeder prices are bid up and down depending primarily on economic conditions in the cattle finishing industry. The two principle factors that affect this bidding process are:

- slaughter cattle price expectations

- projected cost of gain.

Feeder price formula

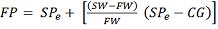

Combining these two factors in a simple formula summarizes how demand affects feeder cattle prices:

Where:

FP = feeder price at a given weight ($/cwt).

SPe = slaughter price expectation: finishing industry’s average expectation of price of

slaughter steers or heifers at the time when slaughter weight is reached ($/cwt).

SW = slaughter weight of fed cattle (lb).

FW = feeder weight (lb).

CG = finishing industry’s average cost of gain, excluding cost of feeders ($/cwt).

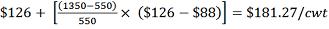

Consider a case where the anticipated fed steer price is $126/cwt, the average cost of gain in the industry is $88/cwt, and the average slaughter weight is 1350 lb. According to the feeder price formula, the price for a 550 lb steer calf could be predicted as follows:

The feeder price formula is essentially a breakeven calculation for the entire cattle feeding industry (See: Breakeven Analysis for Feeder Cattle). It has been tested on historical data and found to be an accurate predictor of feeder cattle prices (Pugh, 1984). Only in the occasional year when there are large shifts in feeder cattle marketing (e.g. widespread drought) has the predicted price varied markedly from actual prices. However, during the course of any given year there can be a number of deviations in feeder cattle price from predicted levels, primarily because of short-term supply disturbances such as interest rates and feed prices.

Slaughter Price Expectations - the Most Important Factor

The information required to calculate a predicted price of feeder cattle, based on this formula, is readily available. This module will discuss one factor from the feeder price formula at a time. Let us begin with the most important variable, expected slaughter cattle price (SPe).

It is not necessary to perform a detailed analysis of the slaughter cattle market to predict a future cattle price. Producers only need to know the industry’s average expectation of slaughter cattle prices at one specific point in the future. Fed cattle price expectations, at any given time, are based on two main factors - the current cash price and the most recent quotations of the appropriate live cattle futures contract on the Chicago Mercantile Exchange (CME) adjusted for the Canadian exchange rate and Canadian basis. It is true that many operators base their fed cattle price expectations primarily on current slaughter prices. Other feedlot operators purchase feeders no matter what the going price is, particularly if they have recently experienced profitable feeding margins. However, a significant group of cattle finishers base their fed cattle price expectations on trading of live cattle futures contracts. This method assumes that there are no significant cattle or beef trade restrictions in effect between the two countries.

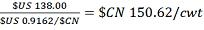

Consider the example of a 550 lb. steer to be marketed on October 1st as a light feeder. To estimate the slaughter price, first estimate when the steer would reach slaughter weight. Based on an expected average daily gain of 3.3 lb and an expected slaughter weight of 1350 lb, the steer in this example would reach slaughter weight in about 240 days, or about June 1st. Therefore, the June live cattle contract on the CME might be a good barometer of industry expectations of slaughter price. Assume that the most recent quotation of the June live cattle futures contract is $US 138.00/cwt. This quote is a good indicator of what the trade currently expects US steers to be selling for in June. The price must then be converted into Canadian dollars and translated into a local market basis, for example, Alberta direct-to-packer sales for A-grade fed steers.

To estimate the applicable US/Canadian dollar exchange rate as of next June, the futures market is again the best tool. The June Canadian dollar futures contract is closest in time to the June live cattle futures, and that quote is adequate. (If the Canadian dollar was actually being hedged, however, it would be preferable that the September futures be used, since the June dollar futures would expire before the cattle are sold in June.) Assume that the June Canadian dollar future is at US $0.9162. Converted to Canadian funds, the $US 138.00/cwt slaughter steer price becomes:

The next step in calculating expected slaughter cattle prices (SPe) is to translate the CME live cattle price into an Alberta local price. The easiest way is to use basis tables that have already been prepared and consist of average values for the time of year being considered. It may also be worthwhile to consult with sources in the industry to determine whether or not basis levels for the current year are likely to follow average trends. For the purposes of this example, assume that the five-year average basis for Alberta direct sale steers in June is $CN 5.87 under the converted June CME live cattle futures. The final estimate of expected Alberta slaughter cattle price, SPe, becomes $CN 150.62 - $CN 5.87 = $CN 144.75 per cwt.

Expectations of future slaughter cattle prices are not static; they change constantly as new prices or information about the slaughter cattle market become available. New information is quickly translated into revised expectations, as evidenced by shifts in the futures market. Revised expectations for fed cattle, in turn, immediately change the outlook for feeder cattle prices in the future. Live cattle and feeder cattle futures contracts tend to track in parallel (See Figures 1 and 2).

Cost of Gain-Outside Influences on Feeder Prices

The second major factor in estimating feeder cattle prices is the projected cost of gain (CG). While cost of gain ranks second to slaughter price expectations in importance to feeder cattle prices, it is nonetheless very important. Variations in cost of gain can explain why feeder cattle futures prices are not always in line with live cattle futures. Cost of gain is particularly important in analyzing the outlook for lighter-weight feeder animals. For lighter weight cattle the cost of gain applies to a much larger amount of gained weight than for heavy feeders. Cost of gain per pound is also dependant on the weight of the animal on feed, and therefore must be determined separately for each different weight class of feeders.

Estimating a projected cost of gain in a feeder cattle price projection is similar to calculating cost of gain in a breakeven worksheet (See: Breakeven Analysis for Feeder Cattle). The difference is when calculating a breakeven, producers should use costs specific to their operation. While when trying to predict future feeder cattle prices, they would use projected industry average costs. Example 1 calculates a projected cost of gain based on typical industry practice. Industry estimates of projected cost of gain can be obtained from various publications and sources in the trade. For example, estimated costs of gain based on the Canfax Trends model are published monthly in Cattlemen magazine.

Example 1. Estimated costs of gain

550-lb steer calf to 1350 lb Steer

Pounds of gain: 800

Days on feed: 240

Cost of feeder for steer calf = $890/head

Feed:

Barley $1.78/day

Silage $0.15/day

Supplement $0.09/day

Daily feed cost = $2.02/day

Total feed cost = $2.02/day x 240 days = $484.8

Other costs:

Veterinary and induction = $ 30.00

Buying and selling costs = $25.00

Yardage $0.5/head/day x 240 = $120

Death loss 2% x $890/head = $17.8

Interest 4 % x $890/head x 240/365 = $23.4

Total Production Costs = $701/head

Cost of Gain: $701/800 lb = $0.88/lb

Example 1 clearly shows that feed cost is by far the most important component in the cost of gain. Thus, when predicting future prices for feeder cattle in Alberta, expected barley price is the second most important variable after slaughter cattle price expectations.

Other components of cost of gain in addition to feed costs include interest, yardage, death loss, buying and selling costs, veterinary and induction costs. While these costs are important to the individual operator, prices for these inputs tend to change infrequently compared to feed prices. Furthermore, both the size of their change and the effect of any change on overall cost of gain tend to be relatively small compared to feed costs. For the purpose of analyzing the feeder cattle market, it is necessary to know the other components of cost of gain or at least have estimates of their values. However, concentrate on the impact of barley prices and how a change in barley price expectations will affect the cost of gain.

Animal Performance and Cost of Gain

Observers of feeder cattle sales are sometimes confused by the broad range of price quotes for feeders of similar weight. These price differences are not arbitrary. They are based on feedlot expectations of animal performance and final carcass characteristics, according to the current condition and genetic characteristics of the animal. An animal that achieves a higher average daily gain, or a lower feed conversion ratio, will have a substantially lower cost of gain than the industry average. These variations in animal performance are built into feeder cattle prices. The calf producer who consistently produces a high-performance feeder calf should be rewarded with higher than average prices. This is particularly true when feed costs are high.

Ratios - Estimating the Impact of Demand Variables on Price

Often a goal when analyzing the feeder cattle market is to predict the effect of a change in one particular factor on the feeder price outlook. In such instances, the relative price impact of the change is more important than predicting an actual specific price. The use of ratios based on the factors found in the feeder price formula is a useful method for estimating relative impacts of these factors on feeder cattle prices. Two ratios in particular have value for this application:

Ratio of slaughter weight to feeder weight (SW/FW): This ratio shows the change in feeder price to be expected from a unit change in slaughter price. For example, the ratio for an 800 lb feeder steer might be 1350/800=1.69. A ratio of 1.69 implies that for every $1/cwt change in slaughter price expectations there could be a $1.69 change in the price of 800 lb feeders. For a 500 lb calf fed to the same slaughter weight (1350 lb) the ratio is 1350/500 = 2.7. Clearly the impact of a change in slaughter price expectations is greater on lighter weight cattle. This, in part, explains the greater price volatility experienced in lighter weight feeders compared to the heavier feeders.

Ratio of gained weight to feeder weight ((SW-FW)/FW): This ratio shows the change in price to be expected from a unit change in cost of gain. For a 800 lb steer fed to 1350 lb the ratio would be (1350-800)/800 = 0.69. Thus, for every $1/cwt change in cost of gain expect a $0.69/cwt change in 800 lb feeder prices. Consider the gained weight to feeder weight ratio for a 500 lb calf, which would have a value of (1350-500) /500 = 1.7. Again the impact of a change is much greater on the lighter animals, explaining the greater price volatility in the lighter weight ranges.

The Supply of Feeders

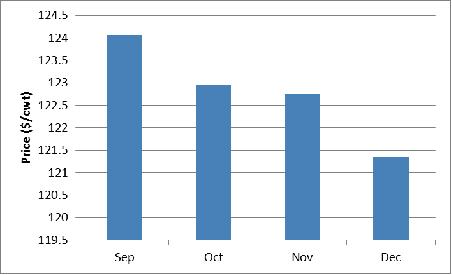

Although demand considerations dominate the price determination process in the feeder cattle market, supply factors can have a large effect on prices, particularly from week to week. For example, there is a tendency for calf prices to soften during the peak of the fall run, when supply is the greatest. Figure 3 highlights the seasonal variation in fall prices of 500-600 lb feeder steer calves in Alberta over the 2008-2013 period. On average, the lowest prices for these animals have occurred during the peak of the fall run, primarily in response to higher volumes of marketing.

Figure 3. Five year average Alberta 500-600 lb steers prices seasonality during fall

(September to December), 2008-2013

Some of the largest price swings for replacement cattle can occur because of weather influences. For example, dry weather can reduce the availability of forage, prompting a surge in feeder cattle marketing within the region affected by drought. This was the case in Western Canada during the summer of 2002. Dry weather resulted in forced marketing and sharply lower replacement cattle prices.

Weather can also affect the demand for feeders in a region. Ample spring moisture tends to support the price of grassers. When pasture is readily available, the industry average costs of gain declines dramatically. Lower average costs of a gain permit higher bidding for replacement cattle. This was demonstrated in Alberta during the spring of 1990, when ample rainfall was one factor leading to an increase in feeder cattle prices.

Arbitrage

Arbitrage is the simultaneous purchase and sale of the same or equivalent item in two different markets, in order to profit from price discrepancies. It is an important pricing influence in feeder cattle markets. The potential for arbitrage prevents large price differences between regions. Take trade between Canada and the United States in feeder cattle is an example. When feeder cattle prices in the United States are very high relative to Canadian prices, exports of feeders to the United States increase, and prices in Canada are pressured higher.

Systematic Analysis of the Feeder Cattle Market

The principle determinants of feeder cattle price are well documented and readily available. It is possible for a producer to systematically put together the information necessary to formulate a price outlook for the class of feeders to be sold or purchased in the future. The basic approach is to calculate an industry breakeven, which summarizes the demand for feeders of a particular weight or type. This information should be supplemented with analysis of any supply considerations or arbitrage factors that could affect the market at the time for which a price is being forecast.

Finally, the operator must regularly update forecasts as new information becomes available, and resist the temptation to be swayed by temporary aberrations thought to impact the feeder market. On a sale date, prevailing forces of supply and demand alone will dictate the prices at which feeder cattle change hands.

Additional information

Pugh, G., 1986. “The Economics of feeder cattle and calf pricing in North America”. Canadian Farm Economics Vol. 20 (1): 3-7. |

|