| | Executive Summary | Table of Contents | 1.0 A General Description of the Farm Business | 2.0 The Management Team | 3.0 The Vision Statement | 4.0 The Mission Statement | 5.0 Strategic Objectives | 6.0 Financial Objectives | 7.0 Pursuing a Sustainable Competitive Advantage | 8.0 The Business Strategy | 9.0 Marketing Strategy | 10.0 Operating Plan | 11.0 Organization Plan | 12.0 The Financial Plan | 13.0 Risk Management | Appendices

Executive Summary

The future success of the Father Son Farm Partnership will depend on a successful transitioning of management responsibilities from the father to the son over the next five years. This is intended to position the farm partnership to be able to proceed with passing ownership shares from the father to the son.

The general principals guiding the management of the farm business over the next five years is for the business to be prepared for multiple possible outcomes. In particular to ensure the farm business has sufficient agility and resilience to deal with variability in production and prices as well as unexpected shocks and stresses that impact on key objectives.

The key activities outlined in the business plan focus on the farm business developing as a learning organization in which knowledge is the key resource. These activities include:

- The father and son working with their accountant will implement processes for monitoring the financial performance of the farm business and support the ongoing development of a strong financial position that will support future changes in the business.

- The father will support the son in developing decision making capabilities and balancing the multiple objectives of economic returns, financial risk, strategic fit and organizational fit.

- For the father and son to build on production capabilities, continuously assess key cost drivers and continually seek innovative ways to manage production costs.

- For the father and the son working together to build on the proven ability to meet contract terms to be able to use contracting to capture market opportunities.

- the father and the son working together to build relationships to continuously understand changing customer needs and to identify opportunities to provide commodities with enhancing features that lower transaction costs to buyers.

- The son will undertake to apply risk management thinking on a continuous basis in order to enhance the ability to identify, assess and mitigate risk events that might impact on key objectives.

Table of Contents

Executive Summary

Table of Contents

1.0 A General Description of the Farm Business

2.0 The Management Team

3.0 The Vision Statement

4.0 The Mission Statement

5.0 Strategic Objectives

6.0 Financial Objectives

7.0 Pursuing a Sustainable Competitive Advantage

7.1 External Analysis

7.2 Internal Analysis

7.3 Key Success factors

7.4 The Competitive Edge

8.0 The Business Strategy

9.0 Marketing Strategy

10.0 Operating Plan

11.0 Organization Plan

12.0 The Financial Plan

13.0 Risk Management

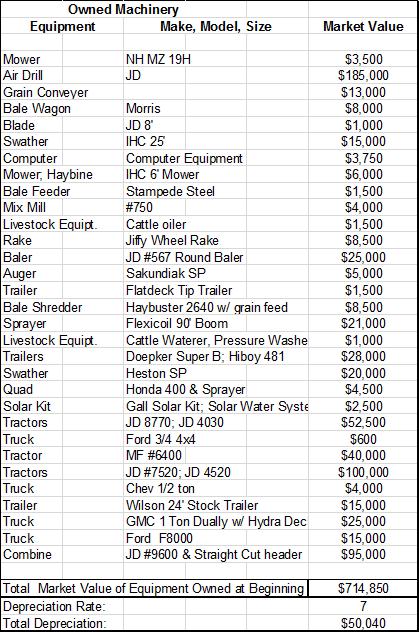

Appendix A – The Farm Resources

Appendix B – Historical Farm Production - Crops

Appendix C – Historical Farm Production - Cattle

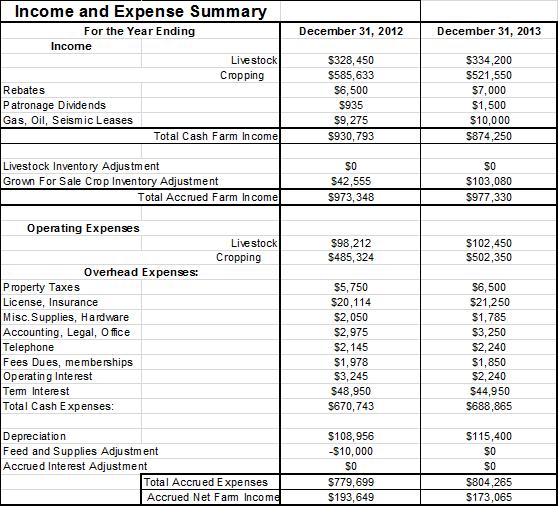

Appendix D –Historical Financial Performance

Appendix E - Current Financial Position of the Father Son Partnership

Appendix F – Projected Financial Performance

1.0 A General Description of the Farm Business

- The Father Son Partnership farm is located 20 miles southwest of the City of Red Deer Alberta.

- The farm consists of 1440 acres of owned land of which 1375 are cultivated. An additional 1275 acres are cash rented with 470 acres of cultivated land, 700 acres of pasture and the remainder being bush areas and yard sites.

- The soil is largely a Class 2 with few limitations.

- The farm cropping program includes barley, canola, wheat, hay, silage and annual pastures.

- The livestock operation consists of a cow-calf enterprise with 300 commercial cows marketing calves each fall. In the past five years the farm has made the switch to selling calves in the late fall rather than back grounding them in their own feedlot then selling them at feeder weights. This has allowed the farm to devote more acres to grain production.

- The strength and focus of the farm operations has been the ability to produce high yielding crops.

- The owners have developed a complete line of modern cropping and forage equipment. There has been no investment in precision agriculture technology at this point.

- The farm has two building sites with modern homes. The main farm site has adequate grain storage, fertilizer storage, machinery storage and modern livestock facilities.

- The farm business was established as a partnership arrangement covering all farm assets 10 years ago with the father owning 60% and the son 40%.

- The partnership earns all the farm revenues and pays all the operating expenses as well as the principal and interest payments on debt. The remaining funds are split 60% to the father and 40% to the son from which personal withdrawals for living are made. After withdrawals, any remaining funds are added to the individual’s partnership interest. Currently the father holds 65% and the son 35%.

- The farm has one full time employee.

- The father has had responsibility for the management of the business. This includes major financial decisions, managing employees and planning operations. The son has recently taken on the responsibility for decision making related to marketing the crops and livestock.

- Initially the business goals were to expand the land base using debt. In the past 5 years the managers had pursued a number of land purchases and were not successful. They realize now that the added debt of purchasing land in their district could have created financial difficulties. The business goals now focus on ensuring the business has the financial capacity to deal with year to year variability in prices and costs.

- A key short term objective is for the son to take over the management responsibility of the farm business in the next five years. This is related to a longer term objective of using debt (estimated at $500,000) to facilitate a transfer of ownership from the father to the son.

- The purpose of the business plan is to develop a path forward that ensures the future viability and sustainability of the farm business while the son takes over the management of the business.

2.0 The Management Team

- The father has 35 years of farming experience and 25 years managing his own farm business. He is responsible for key areas of decision making as well as monitoring financial performance of the business, setting business goals, organizing cropping and harvest operations and employee supervision.

- The son has been involved in the farm business for 10 years and has focused primarily on operations and machinery maintenance. In the past few years the son has taken extension courses in marketing and has taken on a greater role in the planning and decision making related to grain and livestock marketing.

- The full time employee has been responsible for the care and feeding of the cattle herd as well as operating equipment during seeding and harvest.

- The bookkeeping has been done by the father while the accounting function is handled by a firm in Red Deer. The accountant has only provided tax preparation services with no comment on the financial structure or performance over time.

- The father has developed strong relationships with the primary lender and considers the lender to be a resource in planning and monitoring financial performance.

- The father works closely with the agronomist on staff with a local crop input supplier to plan and evaluate cropping alternatives.

- The key concern for the management team is for the son to take over all management decision making in the next three years.

The areas where the son has to develop management capabilities for modern times have been identified as:

- Strategic decision making skills in order to develop a vision for the farm business as well as develop strategies built on a competitive edge.

- Financial management skills required to understand the strengths and limitations of financial structure and performance. A key management challenge will be to develop the financial capacity of the business to handle an additional $500,000 in debt that will be required to transfer more ownership from father to son.

- Economic skills to be able to effectively evaluate the efficiency of resource use and in particular assess new technologies in terms of their impact on the whole farm business.

- Risk management skills to effectively implement process to identify, assess and manage risk events that could impact on specific objectives of the business.

- Relationship building skills to establish beneficial relationships with lenders, input suppliers, landlords and other key stakeholders.

- Developing the farm business to be a learning organization. This would include specific actions to ensure there is learning from past decisions and continuous improvement in decision making.

The action steps to facilitate upgrading these capabilities include the following:

- The father and son to invest time and energy in assessing the industry, the market, and the competition for resources that will shape the future business environment their farm business will have to operate in.

- The father and son to continuously identify and assess alternative strategies for leveraging capabilities to capture market opportunities where the farm business might have a competitive edge.

- The son to seek training in financial management in order to gain skills in understanding and managing the financial affairs of the business. The bookkeeping task will be outsourced to the accountant’s office.

- The son to take steps to assess the Agri-Profits program as a means of monitoring cost per unit of production, gaining insights on key cost drivers and making improvements to reduce costs.

- The son to develop a network of outside individuals to support risk management processes built on identifying, assessing and managing risk forces that might impact on business objectives.

- The father to transition the relationships with lenders and other stakeholders to the son.

- The son to develop a set of management gauges for monitoring performance in the key areas of production, marketing human resources and finance.

3.0 The Vision Statement

The future vision for the farm business is to be a viable and sustainable business managed by the son.

- The farm will maintain its focus on crop production and continuously pursue above average crop and livestock production performance.

- The farm will take steps to gain detailed knowledge of cost drivers and cost control procedures that can contribute to low cost production.

- The farm will develop a network of resource people to assist with financial management and risk management.

- The farm will undertake to identify and realize opportunities to provide commodities with enhancing features that lower transaction costs for buyers.

- The farm will have the capacity to finance $500,000 that would be used to facilitate the transfer of ownership from the father to the son beginning 6 years from now.

4.0 The Mission Statement

The current farm business has achieved a balance of achieving acceptable financial performance, gaining financial strength, achieving desired environmental performance and achieving a desired lifestyle. Key elements include a strong working relationship between the father and son as well as between their respective families. Past decisions include not paying high prices and incurring high levels of debt to purchase additional land. This has given the farm some financial stability during a period of time in which there was considerable variability in production and market prices. The farm business will seek to maintain this balance while undertaking the transfer of ownership and management to the son.

5.0 Strategic Objectives

The farm business will focus on knowledge as the means of gaining a competitive edge. Critical areas of activity for the farm business in the future will be:

- Continually striving for low cost production.

- Developing relationships that enable the farm business to become the preferred supplier to a particular market segment

- Continuously learning and innovating to provide grain, oilseed and livestock products of superior quality and value that improve the well-being of the customers in specific market segments.

6.0 Financial Objectives

Understanding and monitoring financial performance will be a key area of knowledge and competitive edge. The critical areas of financial performance that will affect the future viability and sustainability of the farm business are:

- Ensuring the farm has the financial capacity to deal with the year to year variability in prices and costs.

- Achieving profitability and cash flow performance that ensures a strong working capital position.

- Achieving the financial capacity to be able to finance $500,000 to support the transfer of ownership from father to son.

7.0 Pursuing a Sustainable Competitive Advantage

The farm business recognizes that there will be competition both for inputs as well as in gaining access to various market segments. In this environment the farm business realizes the need to provide a superior value/cost equation to customers and other stakeholders.

7.1 External Analysis

The farm business is part of an increasingly complex system with many inter-connected and interdependent components. The interaction among the key elements in this system will affect the viability and sustainability of the farm business. Key drivers shaping the external environment include:

The commodity cereals, oilseed and beef markets tend to be dominated by large multi-national firms in which the primary producer is a price taker.

- Technology is will continue to advance and generate opportunities for increased productivity and providing attributes that can enable the farm to provide a superior value/cost equation to customers .

- A growing population will likely continue to drive food production. However there will be increased variability in market prices.

- Society’s concerns for the environment will contribute to greater consumer and regulatory forces shaping resource use and the environment.

- There will be increased competition for the key resources of land, capital and energy.

- Interest rates have been favorable over the past five years. However there is no certainty that this will continue. An increase in interest rates of 1.75 to 2.0% would cause interest costs on term debt to increase by an estimated $20,000 per year.

The farm recognizes that decisions focused on productivity and profitability must also account for the continuous change emanating from economic, social and ecological systems. Working together, the father and son have developed a systems perspective that contributes to developing flexibility, creativity, innovation and diversity in the farm business so it can better respond to whatever the future might throw at it.

7.2 Internal Analysis

The strengths and limitations that could impact on the competitive position of the farm business include:

- The strategy of not incurring additional debt to buy land and increase the scale of operations has been a limiting factor during the times of high grain prices. However this strategy has allowed the farm to develop a strong working capital position that could provide an advantage during periods of lower grain prices.

- Higher quality land has allowed the farm to achieve above average production in both crops and livestock along with reasonable costs. This may provide an edge in terms of lower unit costs of production and having funds to invest in technology.

- The farm is dependent on rented pasture land to support the cow herd. Maintaining relationships with landlords is strong however circumstances can change. The farm may have to face the decision of how to replace lost pasture land and whether to keep the cow herd.

- The father has developed strong relationships with landlords, lenders and crop input suppliers as well as grain and cattle buyers. The farm has a proven ability to reliably meet contract terms specifying quantity and quality.

- The machinery and equipment is in good shape and serves the farm well. However machinery will have to be replaced in the next few years which will require debt financing. Ideally this purchase and financing would be completed before the farm incurs debt to facilitate the transfer of ownership.

- The farm has not taken any steps in adopting and implementing precision technologies in crop production. This may lead to a weakness in not capturing the returns these technologies can generate and not being able to compete for key resources. However this can be a future opportunity. The son recognizes the need to be able to evaluate technologies for their ability to increase returns to the whole farm business.

- Using debt to facilitate the passing of ownership to the son in the next ten years mean capital is leaving the business while the debt remains with the business. This could weaken the financial structure of the business and the ability to recover from significant shortfalls in production or market prices. The timing will be critical.

7.3 Key Success factors

The farm business has the capacities to implement the following activities and practices that will enhance its ability to compete in the market and achieve long term objectives:

- For the father to train the son in developing decision making capabilities and to effectively balance the multiple objectives of economic returns, financial risk, strategic fit and organizational fit.

- For the father and the son to monitor the financial performance of the farm business to ensure the farm maintains and continues to develop a strong financial position that will support future changes in the business.

- For the father and son to build on production capabilities, continuously assess key cost drivers and continually seek innovative ways to manage production costs.

- For the father and the son working together to build on the proven ability to meet contract terms to be able to use contracting to capture market opportunities.

- For the father and the son working together to use relationship skills to continuously understand changing customer needs in order to identify and assess opportunities to provide commodities with enhancing features that lower transaction costs to buyers.

7.4 The Competitive Edge

The farm business will seek to develop and sustain the competitive edge of providing a better value/cost equation for customers than do competitors through the following:

- Build on the advantage of higher producing land to achieve lower costs per unit of production.

- Build on relationship skills to sustain superior market responsiveness to opportunities to add service attributes that lower transactions costs to buyers.

- The father has developed considerable knowledge related to production, marketing, relationship building and capturing market opportunities that fit the capabilities of the farm business. This knowledge advantage could enable the son to continue capturing opportunities to increase returns with acceptable risk.

8.0 The Business Strategy

The overall business strategy is for the farm business to be prepared for multiple possible future outcomes. Critical activities focus on sustaining a competitive position with a market segment combines with ensuring sufficient resiliency to deal with unexpected shocks and stresses. These include:

- Maintain current scale of operation and develop the financial management skills of son in order to gain enhanced financial control.

- Leverage production capabilities to achieve a return on total farm assets of four per cent or greater.

- To invest in crop production technologies that contribute to achieving acceptable return to total farm assets at acceptable levels of risk.

- Leverage knowledge of market needs to provide commodities with enhancing features such as delivery of large lots that lower transaction costs.

- Leverage superior knowledge of quality standards and grades to continue being a reliable supplier of quantity and quality through contracts.

9.0 Marketing Strategy

The farm business will implement marketing strategies that focus on identifying and realizing pricing and delivery opportunities for the grain, oilseed and cattle commodities along with identifying and realizing opportunities to provide value to specific market segments. This strategy would have the following elements:

- Leveraging a strong knowledge of price patterns, local basis levels and patterns, marketing tools and sources of market information to capture pricing and delivery opportunities.

- To continue using of production costs to determine break even prices and establishing target prices for crops and livestock.

- Continuously seeking to understand what attributes customers’ value along with what processes or procedures best enhance the value of the commodities to buyers and achieve price premiums and financial success.

- Continuous learning from past marketing decisions in order to eliminate mistakes.

10.0 Operating Plan

The farm business has developed the following resource base.

- The farm consists of 1440 acres of owned land of which 1375 are cultivated. An additional 1275 acres are cash rented with 470 acres of cultivated land, 700 acres of pasture and the remainder being bush areas and yard sites. The land is located in a high rainfall area contributing to high yielding crop production levels.

- The crop production system implements a no tillage rotation with inputs applied to achieve target yields. The father has worked with an agronomist in determining the required level of inputs to achieve target yields each year

The key objectives and action plans for the operations component of the farm business are as follows:

- The son will start working with the agronomist and undertake to focus on economic yields with an objective of achieving a $2 return for every dollar on inputs.

- The crop production practices do not include any precision technologies. Beginning in the current year the son will assess the net benefits of different technologies on the whole farm business. Those technologies that have a reasonable likelihood of contributing to %ROA at acceptable risk and fit with the organization and operations of the farm business will be adopted and implemented.

- The cow herd will be maintained at its current level as well as continue marketing weaned calves. The son will assess the economic and logistical feasibility of weaning the calves at home and adding an additional 100-150 pounds before marketing them. This would be a change from the current practice of selling the calves right off of the cows.

- In order to better understand and manage the key cost drivers in both crop production and cattle production, the son will assess the benefits and costs of participating in the Agri-Profits program offered by Alberta Agriculture and Rural Development.

11.0 Organization Plan

The key objectives and action plans for the organization component of the farm business are as follows:

- The farm business will continue to operate as a partnership with the longer term (5 to 10 years) objective of using debt financing to pass increased ownership from the father to the son.

- The farm currently has one full time employee who spends 70% of his time on the cattle operations and the remainder on field work in the spring and fall.

- The father has worked closely with the employee in the past however going forward it will be up to the son to provide leadership to the employee and take action to ensure the employee remains with the farm.

- The father anticipates having a reduced workload on the farm and there may need to be additional hired help during busy time. This further emphasizes the need for the son to develop the leadership qualities required to organize operations and effectively manage hired employees.

- The father has in the past developed strong relationships with outside resources including lenders, input suppliers, accountants and advisors. Going forward ti will become the responsibility of the son to develop these relationships.

- The father has been the primary decision maker on the farm business. Going forward the son will take over the decision making activities for the whole business.

The father and son working together will adopt a decision making process with the following core elements:

- Framing to bring focus to the true problem or issue at hand.

- Gathering Information that asks the right questions interprets information properly and determines when there is sufficient information for making effective choices.

- Coming to Conclusions that ensure decision makers apply appropriate levels of analysis including weighted decision frameworks that enable consideration of multiple objectives.

- Learning from past decisions and ensuring there is continuous improvement in decision making. In order to develop the financial skills required the son will investigate training programs either available at the Olds College or on-line.

12.0 The Financial Plan

The business model for making money will be based on the following key assumptions:

Canola | Feed Barley | CPS Wheat |

Price Probability | Price Probability | Price Probability |

| $/bu | chance | weighted value | $/bu | chance | weighted value | $/bu | chance | weighted value |

| $9.00 | 15% | $1.35 | $2.25 | 15% | $0.34 | $4.50 | 15% | $0.68 |

| $9.50 | 20% | $1.90 | $2.50 | 25% | $0.63 | $4.75 | 20% | $0.95 |

| $10.00 | 25% | $2.50 | $2.75 | 25% | $0.69 | $5.00 | 20% | $1.00 |

| $10.50 | 25% | $2.63 | $3.00 | 20% | $0.60 | $5.25 | 25% | $1.31 |

| $11.00 | 15% | $1.6 | $3.25 | 15% | $0.49 | $5.50 | 15% | $0.83 |

| 100% |  |  | 100% |  |  | 19% |  |

| Weighted Price | $10.03 | /bu | Weighted Price | $2.74 | /bu | Weighted Price | $4.75 | /bu |

| Projected Crop Production 2014 | Canola | Barley Feed | CPS Wheat | Barley Silage | Hay | Total |

Acres | 400 | 400 | 800 | 100 | 140 | 1840 |

Price | $10.03 | $2.74 | $4.76 | $65.00 | $100.00 | 0 |

Yield | 42 | 88 | 72 | 7.5 | 1.85 | 0 |

Value of Production ($/acre) | $421 | $241 | $343 | $488 | $185 | $613,778 |

Total Variable Costs | $303.77 | $227.40 | $238.01 | $221.31 | $122.50 | $442,157 |

Total Cash Fixed Costs | $36.00 | $34.50 | $34.50 | $34.50 | $34.50 | $64,080 |

Total Cash Expenses | $339.77 | $261.90 | $272.51 | $255.81 | $157.00 | $506,237 |

Margin | $81.49 | -$20.78 | $70.21 | $231.69 | $28.00 | $107,541 |

|  |  |  |  |  |  |

Break-Even Selling Prices | Canola | Barley Feed | CPS Wheat |  |  |  |

To Cover all Cash Costs | $8.09 | $2.98 | $3.78 |  |  |  |

| Projected Crop Production 2015 | Canola | Barley Feed | CPS Wheat | Barley Silage | Hay | Total |

Acres | 450 | 350 | 800 | 100 | 140 | 1840 |

Price | $11.00 | $3.00 | $5.25 | $65.00 | $100.00 | 0 |

Yield | 45 | 90 | 75 | 9 | 1.85 | 0 |

Value of Production ($/acre) | $495 | $270 | $394 | $585 | $185 | $716,650 |

Total Variable Costs | $298.62 | $219.40 | $232.96 | $230.56 | $117.75 | $437,078 |

Total Cash Fixed Costs | $36.00 | $34.50 | $34.50 | $34.50 | $34.50 | $64,080 |

Total Cash Expenses | $333.12 | $253.90 | $267.46 | $265.06 | $152.25 | $500,558 |

Margin | $161.88 | $16.10 | $126.29 | $319.94 | $32.75 | $216,092 |

|  |  |  |  |  |  |

Break-Even Selling Prices | Canola | Barley Feed | CPS Wheat |  |  |  |

To Cover all Cash Costs | $7.40 | $2.82 | $3.57 |  |  |  |

Steer Calves | Heifer Calves |

Price Probability | Price Probability |

$/lb. | chance | weighted value | $/lb. | chance | weighted value |

$1.70 | 10% | $0.17 | $1.65 | 10% | $0.17 |

$1.75 | 15% | $0.26 | $1.70 | 15% | $0.26 |

$1.80 | 25% | $0.45 | $1.75 | 25% | $0.44 |

$1.85 | 25% | $0.46 | $1.80 | 25% | $0.45 |

$1.90 | 25% | $0.48 | $1.82 | 25% | $0.46 |

| 100% |  |  | 100% |  |

| Weighted Price | $1.82 | /bu | Weighted Price | $1.76 | /bu |

| 2014 | 2015 |

| Number of Bred Cows/Heifers | 300 | 300 |

| Live Calves Born | 290 | 290 |

| Number of Calves weaned | 288 | 288 |

| % Weaned Calves | 96.00% | 96.00% |

| Steer Calves Weaned | 144 | 144 |

| Heifer Calves Weaned | 144 | 144 |

| Weaning Weight Heifers | 650 | 650 |

| Weaning Weights Steers | 700 | 700 |

| Heifer Price Received | 1.76 | 1.75 |

| Steer Price Received | 1.82 | 1.80 |

| Total Calf Revenue | $348,192 | $345,240 |

| Cull Cows (#) | 35 | 38 |

| Cull Cow Price | $1,250 | $1,325 |

| Cull Cow Revenues | $43,750 | $50,350 |

| Cull Bulls | 2 | 3 |

| Cull Bull Revenues | $1,450 | $1,500 |

| Less Purchased Bulls | $7,000 | $11,500 |

| Number of Bred Heifers | 40 | 38 |

| Less Value of Bred Heifers | $60,000 | $57,000 |

|  |  |

| Total Value of Production | $327,842 | $331,590 |

| Less Cash Costs | $185,000 | $195,000 |

| Gross Margin | $142,842 | $136,590 |

|  |  |

| Break Even Selling Price Heifers | $0.94 | $0.99 |

| Break Even Selling Price Steers | $0.97 | $1.02 |

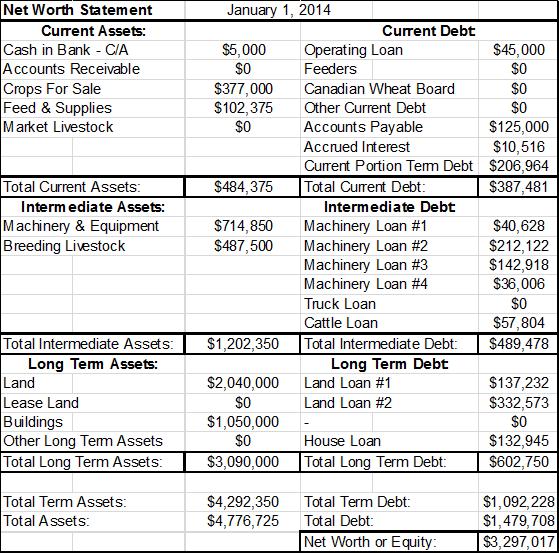

The past financial performance and current financial position of the farm business (presented in Appendices D and E) are considered to be quite strong as indicated by the following measures of financial structure.

| Current Ratio: | 1.25 |

| Debt to Equity Ratio: | .45 |

| Equity to Assets Ratio: | .69 |

| Solvency Ratio: | .31 |

| Working Capital: | $96,894 |

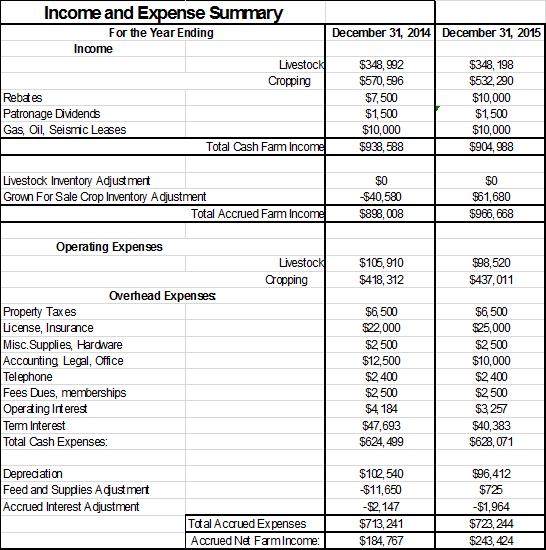

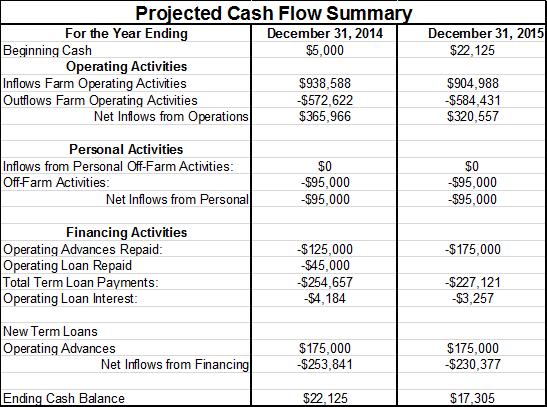

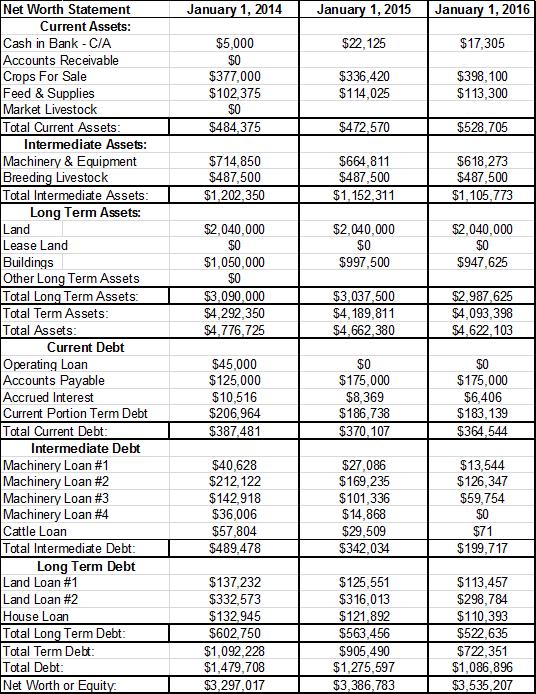

The expected financial performance for the farm business over the next two years is presented in Appendix F. The expected profitability performance under aligns with historical performance and is considered to be reasonable for the current farm business. The cash flow performance is also considered to be both reasonable and acceptable with a continued increase in the working capital position of the business. The forward projections have produced the following key indicators of financial performance and financial structure.

Key Indicators of Financial Performance | For the Year Ending December 31, 2014 | For the Year Ending December 31, 2015 |

| Net Accrued farm Income | $184,767 | $243,424 |

| % ROA | 2.99% | 4.11% |

| Debt Servicing Capacity Ratio | 0.94 | 1.25 |

.............

Key Indicators of Financial Structure | January 1, 2014 | January 1, 2015 | January 1, 2016 |

| Current Ratio | 1.25 | 1.23 | 1.45 |

| Net Worth Ratio | .69 | .73 | .76 |

| Working Capital | $96,894 | $86,996 | $164,160 |

| WC as % of Operating Expenses | 15.43% | 13.85% | 26.14% |

The farm business recognizes that the financial management skills and capabilities of the business will be a critical element in achieving financial success. In the coming year (2014) the son will take responsibility for implementing the following actions:

- The father and son will develop forward plans for the business in order to gain an assessment of expected outcomes for profitability, cash flows and financial structure.

- The bookkeeping will be outsourced to the accountant’s office. The bookkeeper will generate quarterly income statements and budgeted versus actual assessments in order for the son to more closely monitor financial performance. The son and father will update forward plans when necessary.

- The son will take action to access training in financial management in order to effectively participate in quarterly meeting with the accountant and annual meetings with the primary lender.

- The father and son will take steps to carefully assess all past financial decisions in order to learn from these decisions and refine their decision making processes.

13.0 Risk Management

Risk management is a key factor in the overall strategy of being prepared for multiple possible outcomes while making progress to the objectives of transferring management responsibilities (short term) and ownership (longer term).

A key source of uncertainty will be variability in production and market prices. Production risk in crops will be managed through full use of crop insurance available through Agriculture Financial Services Corporation (AFSC). Production risk in the cattle enterprise will continue to be dealt with through proactive approaches to animal health and nutrition. Price risk will be managed through full use of marketing tools including the Spring Price Endorsement (SPE) available with crop insurance as well as forward contracting tools. As well the Cattle Price Insurance Products (CPIP) will be used to manage uncertainty in cattle prices. The son will be responsible for identifying and realizing both pricing and delivery opportunities for crops and market cattle.

Financial risk includes factors that affect profitability, cash flow performance, debt servicing capacity and access to capital. The negative effects of these factors will be managed through managing the debt level of the farm business together with the monitoring and assessment processes established in the financial plan.

The son will undertake to apply risk management thinking on a continuous basis in order to enhance the ability to identify, assess and mitigate risk events that if they were to occur could have an impact on the objectives set for the business. This will be achieved by working with a management advisor who can put this process into practical application that becomes a normal part of tactical and strategic thinking.

A key element in risk management is identifying the individual responsible for taking action to implement the risk management strategy. An initial assessment of risk events that might impact on the objectives of the farm business along with possible strategies and the individual responsible is as follows:

| Potential Risk Events | Risk Strategy | Responsibility |

| Reduced Working Capital | Manage debt levels, ongoing monitoring of financial performance including budgeted versus actual. Consider use of Crop Choices tool to assess likelihood of achieving required levels of financial performance | Father and Son working with accountant’s office |

| Crop price variability | Forward contracting and Spring Price Endorsement (SPE) available with crop insurance. | Son |

| Cattle Price variability | Cattle Price Insurance (CPIP) products | Son |

| Reduced access to key inputs including capital | Build strong relationships based on respect and information exchange. | Father transitioning to son |

| Strategy of pursuing value/cost opportunities with unique market segments becomes obsolete | Continuously seek to understand what attributes customers’ value along with what processes or procedures best enhance the value of the commodities to buyers and achieve price premiums and financial success. | Father and son to invest time and energy in understanding customer values |

| Limited labour availability | Continuously seek to determine actions needed to retain employee.

Consider investment in auto-steer to improve working conditions. | Father transitioning to son |

| Increased competition for rented land | Continue to build relationships with landlords taking time to understand what they value most in a rental relationship. | Father transitioning to son |

| Changing policy and trade factors. | Take time to monitor events in the policy and trade arenas, consider participation in producer organizations | Father. |

| Changing land use regulations including fertilizer practices. | Monitor changes in regulations work with agronomist to determine options available for dealing with regulations impacting on fertilizer use | Father transitioning to son |

| Hazards | Annual meetings with insurance agent to ensure coverage is appropriate for changing circumstances | Father transitioning to son |

Appendix A – The Farm Resources

| Land Owned (without building values) |

| Parcel # | Legal Description | Name of Title | Total Acres | Cult. Acres | Market Value |

| 1 | SE 13-31-27-4 | Father Son Farm | 160 | 145 | $360,000 |

| 2 | NE 7-31-26-4 | Father Son Farm | 160 | 150 | $300,000 |

| 3 | NW 8-31-26-4 | Father Son Farm | 160 | 140 | $300,000 |

| 4 | E 1/2 17-31- | Father Son Farm | 320 | 310 | $360,000 |

| 5 | N 1/2 1-31- | Father Son Farm | 320 | 310 | $360,000 |

| 6 | N 1/2 16-31 | Father Son Farm | 320 | 320 | $360,000 |

Total Owned Land | 1440 | 1375 | $2,040,000 |

| Land Rented and Crown Leases: |

| Parcel | Legal Description | Owner | Total Ac. | Cult. Ac. | Cash Rent |

| 1 | NE 18-31 | Land Owner | 160 | 160 | $9,000 |

| 2 |  |  | 160 | 150 | $8,000 |

| 3 |  |  | 160 | 60 | $3,600 |

| 4 |  |  | 160 | 100 | $6,000 |

| 5 |  |  | 155 |  |  |

| 6 |  |  | 160 |  |  |

| 7 |  |  | 320 |  |  |

| Total Rented Land: | 1275 | 470 | $26,600 |

| Total Deeded and Rented Land at Beginning of Year | 2715 | 1845 |  |

..........

| Land Owned: (without building values) |

| Parcel # | Legal | Name on Title | Total Acres | Cult Acres | Market Value |

| 1 | SE 13-31-27-4 | Father Son Farm | 160 | 145 | $360,000 |

| 2 | NE 7-31-26-4 | Father Son Farm | 160 | 150 | $300,000 |

| 3 | NW 8-31-26-4 | Father Son Farm | 160 | 140 | $300,000 |

| 4 | E 1/2 17-31- | Father Son Farm | 320 | 310 | $360,000 |

| 5 | N 1/2 1-31- | Father Son Farm | 320 | 310 | $360,000 |

| 6 | N 1/2 16-31- | Father Son Farm | 320 | 320 | $360,000 |

Total Owned Land: | 1440 | 1375 | $2,040,000 |

|

| Land Rented and Crown Leases: |

| Parcel # | Legal Description | Owner | Total Ac. | Cult. Ac. | Cash Rent |

| 1 | NE 18-31 | Land Owner | 160 | 160 | $9,000 |

| 2 | NW 18-31- | Land Owner | 160 | 150 | $8,000 |

| 3 | SW 18-31- | Land Owner | 160 | 60 | $3,600 |

| 4 | SW 23-31- | Land Owner | 160 | 100 | $6,000 |

| 5 | N 1/2 140310 | Land Owner | 155 |  |  |

| 6 | NW 22-31- | Land Owner | 160 |  |  |

| 7 | W 1/2 20-31- | Land Owner | 320 |  |  |

| Total Rented Land: | 1275 | 470 | $26,600 |

| Total Deeded and Rented Land at beginning of Year | 2715 | 1845 |  |

....................

| Buildings Owned: |

Land Parcel # | Building Description | Market Value |

1 | House | $250,000 |

1 | Grain Storage | $350,000 |

1 | Machinery Storage | $150,000 |

1 | Livestock Facilities | $75,000 |

2 | House | $200,000 |

2 | Garage | $25,000 |

| Total Market Value of Buildings at Beginning of Year $1,050,000 |

Appendix B – Historical Farm Production - Crops

Appendix C – Historical Farm Production - Cattle

| 2012 | 2013 |

| Number of Bred Cows/Heifers | 295 | 300 |

| Live Calves Born | 285 | 290 |

| Number of Calves Weaned | 280 | 285 |

| % Weaned Calves Average Weaning Weight | 94.92%

675 | 95.00%

678 |

| Total Weaned Weight | 189,000 | 193,230 |

| Average Price Recieved ($/lb) | $1.75 | $1.88 |

| Total Calf Revenues | $330,750 | $362,306 |

| Cull Cows (#) | 35 | 38 |

| Cull Cow Price | $1,450 | $1,500 |

| Cull Cow Revenues | $2,900 | $4,500 |

| Less Purchased Bulls | $7,000 | $11,500 |

| Number of Bred Heifers | 40 | 38 |

| Less Value of Bred Heifers | $60,000 | $57,000 |

|  |  |

| Total Value of Production | $310,400 | $348,000 |

| Less Cash Costs | $221,250 | $57,000 |

| Gross Margin | $89,150 | $117,656 |

Appendix D –Historical Financial Performance

Appendix E - Current Financial Position of the Father Son Partnership

Appendix F – Projected Financial Performance

|

|