| | Introduction | What is a forward contract? | Definitions | Basis contract | Figuring a basis contract | Flat (or cash) price contract | Forward contract specifications and terms | Deciding when to forward contract | Forward contracting examples | Summary | Further information | Return to Livestock Marketing page

.

This is an updated fact sheet from the Economics and Marketing section of the Alberta Feedlot Management Guide, Second Edition published September 2000. The 1200 page guide is available for purchase on CD-ROM. This information is also available in the Livestock Marketing section of the Agricultural Marketing Guide.

Introduction

The structure of the Canadian cattle industry has seen many changes. Those changes have led to increased concentrations at both the packer and feedlot levels of the industry. In this new environment of fewer packers, larger feedlots and smaller margins, more and more buyers are securing their cattle supplies well in advance to avoid risks of volatile price fluctuations. At the same time, sellers have welcomed the opportunity to minimize price risk by forward contracting cattle. Forward contracting may help producers deal with higher price risk, narrowing margins and the need for additional financing.

Forward contracting is a way for cattle sellers and buyers to price their livestock ahead of an expected sale date. When used properly, forward contracting can reduce price risk. Although there are different types of contracts available to sellers, most forward contracts involve slaughter cattle.

Forward contracting offers a marketing alternative which may help individual producer’s situations. It should, therefore, be considered and evaluated along with other marketing choices. The information in this module will help cattlemen make an informed decision on whether forward contracting is a suitable marketing alternative for them.

What is a Forward Contract?

A forward contract is a legal, binding commitment between a buyer and a seller. It guarantees a price for a specified amount and quality of product to be delivered at a certain time to a place specified in the contract. Regardless of whether the buyer is a packer or a feedlot, a buyer, who uses a forward contract, is attempting to reduce price risk by "locking in" a price well ahead of the expected purchase date.

Other advantages of forward contracting

Agricultural lenders will often look favorably at farm managers using price risk management tools such as forward contracting. A farm manager, who uses good price risk management, will usually find that lenders are often much more willing to lend money it at a lower interest rate.

Before forward contracting

It is very important that sellers determine their breakeven price and decide what an acceptable rate of return is before forward contracting. (See the module:Breakeven Analysis for Feeder Cattle). A forward contract cannot guarantee a specific profit because of the specification requirements in the contract and the possibility of increasing input costs during the life of the contract. However a forward contract can reduce the adverse impact caused by sudden and unexpected changes in the market price

Definitions

The following terms are often used in reference to forward contracting. They are defined below in that context.

Futures market - the Live Cattle and Feeder Cattle commodity futures contracts trade on the Chicago Mercantile Exchange (CME), in Chicago. These futures are most often used as part of the formula to establish a local Alberta price when forward contracting.

Cash (or Spot) market - current price for a specific commodity in a specific market at a specific place.

Basis - the price difference between the local cash market and the futures market at a specific time. This number represents such things as current local supply and demand conditions, freight between markets and marketing fees

(See the module: Understanding and Using Basis Levels in Cattle Markets for more details.)

Contract specifications – a specific description of the cattle to be delivered under the terms of the contract agreement. Cattle not meeting these specifications may be subject to discounts, which may or may not be pre-established in the agreement. Cattle that exceed the contract specifications may receive premiums. Discounts or premiums should be laid out in the contract agreement at the time it is signed.

Delivery - the agreed upon time period to deliver the cattle.

FOB (Free on Board) - FOB point of origin means the cattle are sold at the farm or range or feedlot and the buyer pays the freight from that location. FOB delivery point or FOB delivered means the cattle are delivered to a pre-specified point, such as a feedlot or slaughter plant, and the seller pays the freight to that location. Most forward contracts are based on an “FOB delivery point” or “FOB delivered” basis, meaning the seller pays the freight.

Load lots - most cattle forward contracts are based on a load lot of 60 to 64 thousand pounds live weight, depending on the kind of animal. That is approximately one triple axle liner full of cattle. A load of 550-pound calves is about 110 animals and a load of 800-pound yearlings is about 77 animals. A load of finished steers is 40 to 45 animals. Numbers will vary depending on the weight and physical size of the cattle. For feeder cattle forward contracts, the load lot must be made up of uniform cattle.

Types of Forward Contracts

There are two main types of forward contracts; (i):The basis contract and (ii):The flat price or forward price contract which is the most common one.

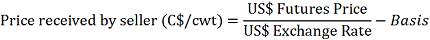

In any forward contract for cattle, there are three variables that influence the final price the seller receives for the cattle. Those three variables are:

- The futures price of the CME live or feeder cattle

- The exchange rate for converting US futures or US basis values to Canadian dollars, and

- The local basis

All of these three factors change constantly and, therefore, forward contract prices change constantly.

Basis Contract

Some buyers will offer a contract with a guaranteed basis price, called a basis contract, and leave it to the seller to decide when to lock in the cattle futures price and exchange rate. Some buyers’ basis contracts are offered with the basis quoted in Canadian dollars. Other basis contracts are offered with the basis quoted in US dollars. It is very important that sellers, considering a basis contract, know whether the basis is being quoted in Canadian or US dollars.

Cattle basis levels tend to follow a seasonal pattern and will change depending on the month when the cattle come to market. (See the module: Understanding and Using Basis Levels in Cattle Markets for more details.)

Each buyer may offer different basis levels in their contracts depending on their own specific requirements at that time the cattle are to be delivered. Let’s say, for example, that a "typical" basis for slaughter cattle for late March delivery was $7.00 per cwt. under the April futures contract. Let’s say a particular slaughter plant desperately requires more cattle at that time. To attract more cattle it may offer a contract with a basis of $4.00 or $3.00 or even $2.00 per cwt. under the April live cattle futures to attract additional sellers. Conversely, if a slaughter plant feels it has a sufficient supply of cattle for late March, it may weaken its basis to $9.00 or $10.00 per cwt. or more under the April contract.

Shopping for the best basis in a forward contract is just as important as selling to the highest bidder when trading on the cash market. Closely monitoring basis fluctuations is important when forward contracting on a basis contract. (See the module: Understanding and Using Basis Levels in Cattle Markets and Further Information section at the end of this module for historic and recent cattle basis levels in Alberta.)

A basis contract is not fully complete until all three components are decided and agreed upon by both parties. The other two components are the futures price and the exchange rate. In a basis contract, the final price, in dollars per hundredweight, remains undetermined if the seller waits until some later date to lock in the futures price or the Canadian exchange rate or both. The seller “locks-in” the futures value and exchange rate part of the contract by contacting the buyer.

The person or company on the buy-side of an unpriced basis contract is usually covering his or her price risk in the contract by hedging the cattle and the exchange rate in the futures market.

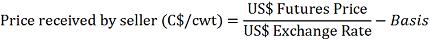

Figuring a Basis Contract

Example 1: slaughter cattle – basis in CDN dollars

- Slaughter (live) cattle for delivery to a Canadian slaughter plant in September

- Basis agreed to in Basis Contract signed on June 12th = C$ 12.00 under October Live Cattle futures

- October Live Cattle Futures locked-in by seller on August10th @ US$ 146.00

- Canadian dollar Exchange rate also locked-in by seller on September @ US$ 0.9219 per C$

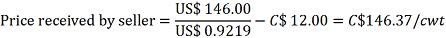

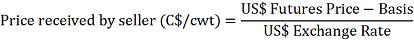

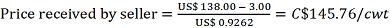

Example 2: slaughter cattle - basis in US dollars

- Slaughter (live) cattle for delivery to a Canadian slaughter plant in first week of June

- Basis agreed to in Basis Contract signed on March 6th = US$ 3.00 under June Futures

- June Live Cattle Futures locked in by seller on April 14th @ US$ 138.00

- Canadian dollar Exchange rate also locked in June @ US$ 0.9162 per C$

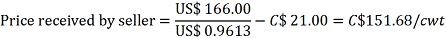

Example 3: feeder cattle - basis in Canadian dollars

- Feeder cattle for delivery to a Canadian feedlot in April

- Basis agreed to in Basis Contract signed on January 5th = C$ 21.00 under May Futures

- May Feeder Cattle Futures locked-in by seller on February 10th @ US$ 166.00

- Canadian dollar Exchange rate also locked in February 10th @ US$ 0.9613 per C$

Flat (or Cash) Price Contract

Buyers also offer flat price or a forward price contracts. In these contracts, the buyer has calculated a guaranteed price based on a forward futures price, forward exchange rate and basis. The buyer is offering certain price for slaughter or feeder cattle to be delivered at a certain time of the year. This net price is what is offered to the seller in the contract. A flat price contract appears less complicated to both the seller and the buyer and can be quickly and easily compared to the current cash market.

The buyer may or may not use the exact calculation above for calculating the contract price. However, for illustration purposes, suppose the buyer is using the same figures as in Example 1. The seller only sees that the buyer is simply offering $146.37 per cwt.

In a different situation, a buyer may have determined that, to attract sellers, he may have to offer a certain price. For example, a feedlot needs cattle for August but $146.00 per cwt does not seem to be attracting any cattle. The buyer may have to offer $148 or $149 per cwt. even if US feeder futures haven’t increased. The price change being offered is not directly related to a change in the futures market. It is a reflection of what local supply and demand conditions are indicating. Local supply and demand conditions affect what basis a buyer is prepared to or must offer to source cattle. It is useful to understand how the buyer established the price he is offering but it is not essential.

Flat price contracts may not use the futures market to base prices on. Sometimes another base is used such as a local price average, a four-or-five week rolling average, or any other acceptable "base" price. This type of contract is more prevalent in forward contracting of feeder cattle and calves since in many areas or times of the year, the US feeder cattle futures market may not be a good indicator of the local Canadian feeder market.

A cash contract may also be based on an independent or non-futures price. A buyer may decide to use some variation of a well-known market price such as a straight average or a rolling average or other visible price. For example, in July, a backgrounder is looking to buy fall calves. He or she may offer a four-week rolling or moving average of the Canfax average feeder price for a specific weight category. A rolling or moving average tends to "flatten out" any weekly fluctuations that may occur.

Forward Contract Specifications and Terms

All types of forward contracts contain specifications and terms that vary for slaughter and feeder cattle. This section summarizes the specifications and terms that may be found in slaughter and feeder cattle contracts.

Slaughter cattle contracts

A slaughter cattle contract may contain specifications and terms referring to grade, weight, yield, sex, conformation type, delivery date, delivery points and weighing conditions including shrinkage, stand, tag, and freight expenses. The discounts for cattle not meeting contract specifications and those affects on the settlement price may or may not be specified in the contract. If discounts are not specified, then the discounts at the packing plant on the day the cattle are slaughtered will be used. A contract may also specify premiums for such things as grade or yield or dressing percentage and, perhaps, others.

Contract specifications vary from plant to plant and between Canadian and United States plants. Grade, weight and yield requirements, as well as off-grade specs, can significantly differ between the two countries because of the difference in grading systems. For example, Canadian Packer 1 may require minimum specifications on slaughter steers of 65% yield grade 1, 30% yield grade 2, 5% yield grade 3, 600-750 lb carcass and 59.5% hot yield. While Canadian Packer 2 may call for 50% yield grade 1, 40% yield grade 2, 10% yield grade 3, 600 to 800 lb. carcass and 60% hot yield. At the same time, a US packer may have specifications of 70% Choice, 25% Select, 5% other grades, 600-900 lb. carcass and 63.5% US hot yield. It is important to clearly understand what is required of the seller to meet all the contract specifications.

Feeder cattle contracts

Contract specifications and conditions vary greatly for feeder cattle because Canada has no standard grading system for feeders. A lack of a feeder grading system makes it is more difficult to accurately describe feeder cattle. A buyer will look at type, sex, conformation, frame size, degree of fleshing, weight, feeding/grazing program and other things before offering a contract price. Delivery date and point, weighing conditions and freight expenses are also considered and specified in the contract. Contract weighting conditions will depend on access to an approved scale, shrink and length of stand. All these factors should be specified in the contract weighing conditions. Buyers may often want to view the cattle before offering a price to make certain the cattle will likely meet contract specifications.

Some type of flexibility should be allowed in the contract specifications to accommodate special circumstances. These are referred to as default conditions. For example, severe drought conditions, which make it necessary for cattle to be moved off pasture earlier than expected, could also make it very difficult for a seller to adhere to the contract specifications. In these unusual situations it is in the best interest of both the buyer and the seller to remain flexible. It is important to remember, however, that all forward contracts are legally binding agreements and not adhering to the requirements may result in legal action by either party.

Deciding When to Forward Contract

For buyers

There are several reasons why buyers, including packers or feedlots, may want to forward contract cattle including:

- bility to specify type and weight of cattle

- securing cattle supply in advance

- establishing a price in advance to limit upside price risk

- distributing cattle delivery more evenly

By contrast, there are also reasons why buyers would not want to forward contract. These reasons include:

- may affect ability to maneuver on the cash market when supplies are mostly contracted

- reduces opportunity to buy cheaper cattle given the chance

For sellers

Cattle sellers, including cow/calf producers, back-grounders or feedlot operators, also have reasons to forward contract including:

- securing a buyer in advance

- establishing a price in advance to limit downside price risk

- potential help in arranging financing

- lower initial capital required - no initial margins or margin calls required, as compared to hedging with future contracts

- taking advantage of strong prices or good basis at any time, even if cattle not ready to market

- encouraging sellers to keep marketings current

- securing a buyer in advance

- establishing a price in advance to limit downside price risk

- potential help in arranging financing

- lower initial capital required - no initial margins or margin calls required, as compared to hedging with future contracts

- taking advantage of strong prices or good basis at any time, even if cattle not ready to market

There are also times when forward contracting might not be the most suitable alternative for a seller including:

- reduced flexibility by eliminating selling to other buyers

- eliminates the opportunity to take advantage of price increases

- available contract prices do not meet profit requirements

- cattle, which fail to meet contract specifications, could be subject to large discounts

- sellers, who forward contract at a price in US dollars, still face exchange rate risk if exchange rate is not locked-in

- production risk, if contract cannot be fulfilled or contract specs cannot be met

- weak (wide) basis offered in contract

There are obviously several advantages and limitations for buyers or sellers when contemplating forward contracting. It is important for all participants to fully understand what is required of them. Sellers must know current market conditions, including typical basis levels. Sellers must also know their breakevens. Unlike hedging, forward contracting does not require a commodity broker so a seller can do the contract work with a buyer at no cost.

Forward Contracting Examples

Example 1 - Slaughter Cattle

Conditions: It is February 15th. A feedlot owner is feeding slaughter steers that he believes will be ready for market in late March. The calculated breakeven, covering all costs on these steers, is C$118.64/cwt. Packer A is offering a basis of US$ 5.00 under April Live Cattle futures FOB to the plant. The April futures market is at US$ 136.00. The exchange rate is $US 0.9033 per C$. Freight to Packer A is C$3.00/cwt. Therefore, the calculation to determine the final price if the seller accepts the basis contract and locks in the futures today is:

- FOB plant (US$) = Futures price (US$) – Basis (US$): US$ 136.00 – US$ 5.00(basis) = US$ 131.00/cwt.

- FOB plant (C$): US$ 131.00 / 0.9033 = C$ 145.02/cwt.

- FOB feedlot (C$) = FOB plant (C$) – Freight (C$): C$ 145.02 - C$ 3.00 = C$ 142.02/cwt.

The feedlot owner in this example assumes that the cattle will need C$ 4.00/cwt for grading costs (cattle that do not meet contract specifications).

- FOB feedlot after considering grading cost: C$ 142.02 - C$ 4.00 = C$ 138.02/cwt

- Profit (C$) = FOB feedlot – breakeven: C$ 138.02 - C$ 118.64 = C$ 19.38/cwt

The feedlot manager decides that a $19.38/cwt. profit is reasonable but he concerned about downside price risk. He flat-prices one load for a late March delivery.

Results: The steers are shipped the fourth week of March. The cattle are all in the ideal weight range, with no weight discounts, but grade with more finish than anticipated. The final grade discounts work back to $5.00 per cwt rather than to $4.00 per cwt first estimated by the feedlot owner.

- Actual FOB feedlot: C$ 142.02 - C$ 5.00 = C$ 137.02/cwt

- Actual profit (C$) = Actual FOB feedlot – breakeven: C$ 137.02 - C$ 118.64 = C$ 18.38/cwt

Example 2 - Backgrounder cattle

Conditions: It is early May. A producer has 125 grass steers that he believes weigh about 550 pounds. The steers have not been weighed individually or as a group. He wants to forward contract them for September and expects to put a 300 pound gain on them between May and September. The breakeven on these steers, including all costs such as the producer’s labour, is $150.00 per cwt at 850 lb. Feedlot Z is offering a forward contract for September of $155.00 per cwt FOB to the feedlot. The offer also includes a 0.05 sliding scale based on 850 lb. The sliding scale means that for every pound under or over 850 lb the price is adjusted up or down, respectively. (See the module: Understanding the Cattle Market Sliding Scale) For instance, the price for a 870lb feeder would be $154.00/cwt, after subtracting the discount of 20lb overweight $0.05 per each additional lb. The weighing conditions are two per cent pencil shrink subtracted from the weight at the feedlot’s scale. He decides to contract the cattle with the feedlot.

Results: The cattle are moved to the feedlot in early in September. The net weights and prices after shrinkage end up as follows:

- 75 head X 850 lb. X $155.00/cwt. = $98,812.50

- 10 head X 870 lb. X $154.00/cwt = $13,398.00

- 10 head X 900 lb. X $152.50/cwt. = $13,725.00

- 10 head X 830 lb. X $156.00/cwt. = $12,948.00

- 20 head X 800 lb, X $157.50/cwt. = $25,200.00

- 125 head total income $164,083.50

- Average weight: 846 lb.

- Average price: $155.16/cwt.

- Net result: $155.16 - $1.00 (freight) = $154.16/cwt.

- Profit or Loss: $154.16 - $150.00 (breakeven) = $4.16/cwt. (profit)

Example 3 – Calves

Conditions: It is July 10. A cow/calf operator has 200 calves (100 steers and 100 heifers) that will be weaned in mid-October. Rather than ship the calves and take the going price for that day, he decides to look into forward contracting them. After checking around, he finds a reputable local order buyer who forward contacts calves (his customers are both finishing feeders and back-grounders). The buyer bases his contract on a four-week rolling average of the Canfax average feeder prices in central Alberta. The prices from the two weeks before the calves are shipped, the week they are shipped and the week after shipping are averaged to get the price on the appropriate weight category. At the time the cow/calf manager accepts the contract, he also agreed on weighing conditions, price conditions, sliding scale and freight.

Results: The calves were shipped October 20 and the steer average weight was 550 pounds. The heifers averaged 450 pounds. The following average prices were reported by Canfax:

| 500-600 lb. Steers | 400-500 lb. Heifers |

| Week 40 | $157.80/cwt | $150.96/cwt |

| Week 41 | $158.54/cwt | $154.23/cwt |

| Week 42 | $160.83/cwt | $156.19/cwt |

| Week 43 | $163.47/cwt | $156.23/cwt |

| 4-Week Average price | $160.16/cwt | $154.40/cwt |

This four-week average price is the base price. The price is adjusted based on actual steer and heifer weights as well as the contracted sliding scale.

Summary

Forward contracting is becoming a more acceptable marketing alternative as cattlemen try to minimize increasing risk and shrinking margins. There are two main types of contracts offered and both may contain many different specifications and terms. Producers who are considering a forward contract must understand all the specifications required for the cattle and how the price will be adjusted if the specifications are not met. It is important to remember that this is a legal contract and all terms and conditions should be clearly identified and understood.

Most types of cattle may be forward contracted provided they are supplied in load-lots of uniform type. There are several different companies in western Canada and the US Northwest that offer contracts for both slaughter and feeder cattle. Producers should review these company’s specific contracts step-by-step to make certain they thoroughly understand their responsibilities.

Sellers must also thoroughly understand slaughter cattle and feeder cattle basis. They must also be familiar with what is a “typical” basis level. See the module:Understanding and Using Basis Levels in Cattle Markets for a thorough explanation of cattle basis.

Further Information

Alberta Agriculture and Forestry

“Marketing Guide” – Understanding the Cattle Market Sliding Scale |

|