| |

Projecting Payments on Ongoing Credit Card or Payables Debt | |

| |

|

|

| |

|

|

| | Very often, credit cards and payables (and often other short term debt) will continue on an ongoing basis through a projected period. An example would be a farm credit card that is revolved monthly, and as such, the amount owing month over month is never reduced, and no interest is ever paid. In those kinds of situations, reporting repayment terms would show that the account is being repaid, and unless projected new current debt is shown in the New Current Liabilities section at the bottom of the Cur-Liab Page, the projections would show a reduction of debt that will not in reality happen.

.

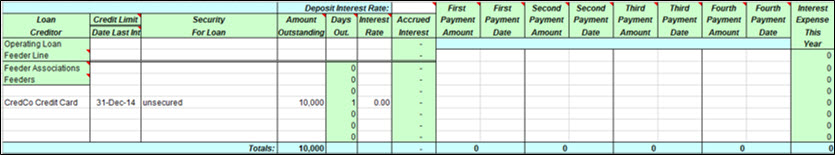

If the specific current liability is at a typical amount, and it is expected it will revolve to approximately that amount month over month in the projected period, and repaid monthly, for example, in time frames that will result in no interest being charged, it is suggested that the liability be shown to not have any projected repayment requirement or interest rate. An example of how the entry would look follows:

The theory behind this approach, is that although the debt will be repaid monthly, for example, it will also be reborrowed monthly, so, there will be no net change in the debt, or interest charged during the projected year. Of course, if this is not what is expected to happen, then repayment would need to be recorded differently.

The following Net Worth Summary page shows the impact of this entry on this debt over the projected year: |

|

| |

|

|

| |

For more information about the content of this document, contact Dean Dyck.

This document is maintained by Brenda McLellan.

This information published to the web on September 29, 2015.

Last Reviewed/Revised on September 18, 2017.

|

|