| | Most farm operations have assets that are not part of the farm’s production unit. Examples might be things like a motorhome, other RV’s, or personal ATVs, possibly some personal vehicles, or non-farm real estate such as a rental property or recreational property. These are considered to be non-productive assets to the farm operation, and will normally not be entered on the Land Page or Machinery Page, but rather, will be entered in the appropriate section(s) on the Other Assets Page. The major consideration about where they will be entered, is whether or not you want to include depreciation on those items as a cost on the farm’s projected income statement.

.

Depreciable assets such as buildings on the Bldg – Qta page and machinery on the Machinery page will have an appropriate depreciation rate entered so annual depreciation can be calculated and included in the projected income statement. All assets included on those pages will have depreciation calculated at that rate on the market value entered. Normally, it is the preference for depreciation on non-farm related assets not to be calculated and included. If this is what is desired, those items, along with their values can be entered in the appropriate sections on the Other Assets Page – for example, items such as personal vehicles, ATV, and RVs might be entered, along with their estimated market value, in the section entitled “Beginning Other Intermediate Term Assets”, and items such as commercial real estate and recreational property might be entered, along with their estimated market values, in the section entitled “Beginning Other Long Term Assets”.

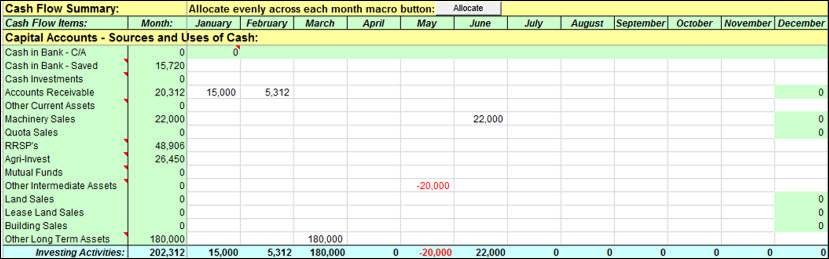

When those non-farm items as noted above are sold then, the sales will be recorded on the CF SUM page by showing the amounts sold in the appropriate columns. If items in those categories are going to be purchased in the projected period, negative amounts (representing a negative source of cash) will be entered in the appropriate column(s). See the example below for illustration:

The above example shows a situation where an $180,000 long term asset (in this case a lake lot) will be sold in March, and a personal intermediate asset (in this case a holiday trailer) will be purchased for $20,000 in May. Those changes will be uses, or sources of cash in the projection, and the changes will be reflected on the closing Net Worth statement. |

|