| | The future of grocery: e-commerce, digital technology and changeling consumers | Retail channels shifting and the market share | Data highlights | Sources reports

.

The Future of Grocery: E-commerce, Digital Technology and Changeling Consumers

The retail environment is more competitive and dynamic than ever before.

To be competitive, companies are evolving and reinventing themselves. Technology has transformed the way that industries such as music, books and video operate.

According to Nielsen, for the packaged goods and grocery industry, change has been more evolutionary than revolutionary. Digital is redefining what it means to “go” shopping. Lines between the physical and digital worlds are blurring.

Shoppers are increasingly accustomed to the benefits of digital in other retail settings and are beginning to expect them in grocery as well. Savvy retailers are winning by leveraging technology to enhance the shopping experience and meet consumers’ evolving needs.

What are some of the different e-commerce models available?

- Automatic on-line subscription service, in which orders are routinely replenished at a specified frequency (14 per cent of global survey respondents use this model)

- Virtual supermarkets which was first introduced by Tesco in a South Korean subway (13 per cent of global survey respondents use this)

- "Click and collect" services where consumers order groceries online for pickup at a store or at an other location: Order Online and pick up in store/drive-through (12 per cent of global respondents) or curbside (10 per cent of global consumers).

What is happening in the global market?

- One-quarter of online respondents say they order grocery products online and more than half (55 per cent) are willing to do so in the future.

- Growth of online grocery shopping is driven in part by the maturation of the digital natives: Millennials and Generation Z.

- Willingness to use digital retailing options in the future is highest in Asia-Pacific, Africa/ Middle East and Latin America regions.

- E-commerce is well suited for stock-up and specialty-needs retailing, because it can offer deeper product selections than may be available in brick-and-mortar stores.

- Use of online or mobile coupons and mobile shopping lists are the most cited forms of in-store digital engagement in use today.

- For in-store retailing, large stores have a sales volume advantage, but smaller formats are growing more rapidly.

What is happening in the Canadian market?

The Canadian E-tail report, which is a semi-annual survey of E- Commerce, shows that 82 per cent of Canadians researched a product online before they make a purchase. Female consumers under 44 years are most likely to purchase online.

However, the top six categories of online purchases did not include grocery.

According to a Bank of Montreal (BMO) report, Canada’s online grocery purchases represent less than one per cent of total grocery sales, compared to three per cent in the U.S. and four per cent in U.K.

Geographic factors (Canada has only a few densely populated cities), high capital cost for infrastructure development and insufficient demand for on-line grocery are identified as the main reasons for low on-line grocery sales. Some argue that slow adoption in Canada is less about consumers lacking desire to shop from the comfort of their home and more about the industry not recognizing the potential in e-commerce.

Non-exhaustive list of on-line groceries in Canada

Retail Channel Shifting and the Market Share

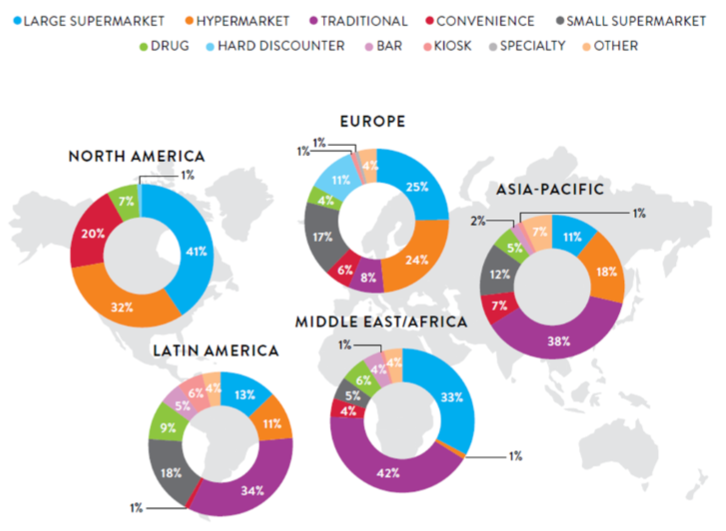

In addition to digital, evolving consumer tastes are also transforming the retail landscape. A recent study by Nielsen has examined retail sales trends and channel (size and type of stores) shifting behavior across the world.

According to this study, globally, the trade channel mix is becoming more fragmented as consumers shift towards smaller store formats. On a value basis, large supermarkets and hypermarkets account for just over half (51 per cent) of global sales, but smaller formats such as traditional, drug and convenience grew at a faster rate during the 12 month period from April 2014 to April 2015.

Channel structure and trends vary greatly between countries. In developed countries’ markets, 80 per cent of sales come from large supermarkets, hypermarkets and convenience stores. While sales in large supermarkets and hypermarkets were flat or declined slightly (+0.3% and -1% respectively) in the same 12 month period, sales in convenience stores, hard discounters and drug stores grew more rapidly (+2%, +2% and +1%, respectively).

In developing markets, the story is much different.

Traditional trade stores continue to be the dominant channel, accounting for 38 per cent of the total retail channel sales, but sales in supermarkets, hypermarkets and drug stores are growing at a faster rate. Sales grew by double digit rates in drug stores (13 per cent) and large and small supermarkets (11 per cent and 10 per cent, respectively), compared with only four per cent growth in traditional stores.

Convenience and drug stores demonstrate strong growth potential in both developed and developing markets, which underscores consumers’ desire to use brick-and-mortar stores for quick trips and special (often urgent) purchases. As a result, these channels deserve considerable focus from manufacturers.

Channel shares of regional trade

Source: Nielsen Retail Measurement Data

Note: Value in USD, adjusted for inflation – latest 12 months Collection dates vary by country and category, but most were ending between September 2014 and January 2015

When it comes to food and beverages in developed markets, sales are concentrated in large supermarkets and hypermarkets.

However, convenience stores are also a sizable player, accounting for 20 per cent of sales. In developing countries, food and beverage is the most concentrated category. Forty five per cent of category sales come from traditional stores. Even though hypermarkets and supermarkets are growing in the developing markets, the importance of traditional channels should not be ignored due to their significant market share.

Data Highlights

Food and Beverage retail sales, by industry Canada (Billion Dollars)

Source: Statistics Canada. Table 080-0020 - Retail trade, sales by the North American Industry Classification System (NAICS), monthly (dollars)

Alberta’s total food and beverage retail trade decreased by about three per cent in quarter two 2016 compared to quarter two 2015. The biggest drop occurred in convenience store sales. However, based on the total value of sales, supermarkets and other grocery store categories also reported a significant loss.

It is interesting to see an increase in sales for beer, wine and liquor stores during the same period. Economic conditions including a weaker Canadian dollar, above average prices for certain food categories and natural disasters all may have contributed to this situation.

When it comes to total retail spending per capita, Alberta ranked the highest among the provinces in Canada at $1425 per person. This is about 18 per cent higher than Canadian average per capita retail spending.

Sources Reports

|

|