| | Overview | History | Product use | Marketing timothy hay | International markets | Market access | Summary | Return to Special Commodity Marketing page

Overview

Worldwide, the term "compressed hay" refers to various forage products compressed into tightly bound, high density, low moisture bales. Compressed products marketed around the world include grass-seed straw aftermath, alfalfa hay, sudan grass/bermuda grass from the U.S. and oats green-feed from Australia. Canada produces "compressed hay" primarily from timothy and alfalfa hay, but other forage such as dehydrated corn silage is also used.

Forage grows extremely well under Canadian growing conditions. Canadian timothy and alfalfa is recognized in the Asian markets as both a palatable and nutritious source of fiber, and is in demand as roughage in Japan, China and several other countries. Timothy, native to Japan's Hokkaido region, is used as long-straw fiber in the diets of dairy and beef cattle there. Timothy is also used in the horse industry in the Asian markets. In addition, Alberta forage is used to produce a plant-based pet food for domestic use and export, primarily to the U.S.

Timothy hay field

Alfalfa field Photo: Karin Lindquist

History

Export shipments from the western provinces have increased from a trial shipment of 17 tonnes in 1981 to over 500,000 tonnes in 2012. Japan is Canada's largest customer for timothy.

Table 1. Canadian Exports of Forages – Calendar Year (tonnes)

| Product | 2012 | 2013 | 2014 | 2015 | 2016 |

| Cereal straw and husks | 38,195 | 29,009 | 24,167 | 19,924 | 26,262 |

| Alfalfa in cubes (dehydrated) | 37,367 | 44,865 | 33,040 | 38,698 | 22,691 |

| Alfalfa, (loose or in bales) | 148,703 | 129,935 | 104,498 | 70,072 | 87,578 |

| Hay, timothy | 247,586 | 203,226 | 211,644 | 205,571 | 203,048 |

| Hay, other | 60,979 | 53,004 | 44,523 | 47,233 | 48,012 |

| Clover, (forage) | 1 | 1 | 0 | 0 | 0 |

| Swedes, mangolds, fodder roots, sainfoin, forage kale,etc., w/n pelleted | 13,242 | 12,904 | 10,297 | 12,,449 | 11,712 |

Total Exports | 546,073 | 472,944 | 428,169 | 393,497 | 399,303 |

Table 2. Value of Canadian Exported Processed Timothy

| Year | 2012 | 2013 | 2014 | 2015 | 2016 |

| Exports - tonne | 247,586 | 203,226 | 211,644 | 205,571 | 203,048 |

| Value (MM $ CDN) | 86.28 | 73.79 | 79.32 | 81.27 | 76.45 |

Table 3. Canadian Processed Timothy Exports by Country (tonnes)

| | 2012 | 2013 | 2014 | 2015 | 2016 |

| Japan | 163,426 | 135,601 | 141,041 | 128,642 | 118,325 |

| South Korea | 24,150 | 16,905 | 15,880 | 13,043 | 15,903 |

| Taiwan | 3,144 | 1,488 | 1,021 | 633 | 601 |

| United States | 51,644 | 43,943 | 43,275 | 50,629 | 51,767 |

| Rest of World | 5,222 | 5,289 | 10,427 | 12,594 | 16,452 |

| Total Exports | 247,586 | 203,226 | 211,644 | 205,571 | 203,048 |

Product Use

Japan imports baled forage to supplement and replace locally grown roughage in the rations of dairy and beef cattle and horses. Timothy is grown extensively on the island of Hokkaido, Japan's major dairy-producing region. Hokkaido produces about 400,000 tonnes of timothy a year.

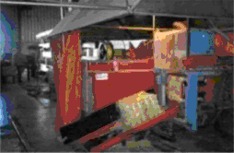

Timothy hay being double compressed

This local Japanese production of timothy bodes well for exporting nations, including Canada, for two reasons.

- Local Japanese production of timothy forage makes it a known commodity, and

- Many Japanese dairy rations are formulated with timothy hay in mind.

Continued growing awareness of the quality of timothy hay will support the shift to timothy, and away from less-palatable, native grown forages, such as bermuda grass, sorghum-sudan grass and rice straw.

Marketing Timothy Hay

Timothy growers marketing perspective

- The production of compressed timothy for the export marketplace can be very lucrative, however, many details must be considered.

- Processors require solid stands, with no contaminates of other plant species

- Weathering of product quickly down-grades the product

- Many foreign buyers still determine product quality visually. If samples from your delivered hay does not meet this visual inspection, it may be downgraded

- A simple rain shower at an inopportune time can result in discounts.

- Cost and return budget information is done annually, for selected Alberta regions.

Timothy processors marketing perspective

Compressed hay, being sold into an international marketplace, comes with more expenses, other marketing considerations, and therefore, more risk.

- Additional costs of selling into an international market including brokerage fees, container ocean freight and rail/container freight costs, export insurance, rejection insurance, port charges. Typically, a Canadian exporter may be paying ocean and rail freight of $95 to$100/tonne, broker fees of $6 to 10/tonne, export and rejection insurance of $5 to $8/tonne, and a port charge.

- Cost of setting up processing facilities and storage. Foreign customers require compressed hay year round, therefore, local processors must store the product in a dry, clean environment until processed and shipped.

International Markets

Canada's main timothy export market as of 2016 is Japan (58% of exports), with additional sales going to the U.S., Korea, Taiwan, the Middle East, and Europe.

The Asian market is driven by changes in consumer eating habits. Brought about in part by higher living standards, the changes have led to an increased consumption of milk, milk products and red meat. This has encouraged a significant increase in dairy and beef cattle numbers and boosted demand for high-quality, long fibre forage products. Forages provide fibre for proper rumen function. With a limited land base, smaller Asian countries must import large quantities of forage to supplement local production.

Baled timothy, ready to be dried down and compressed (processed)

1. Market size

Japan is an important market for Canadian baled forage products as the largest world importer of timothy. Overall, Japan imports over 30 million tonnes of compound feeds and feed ingredients a year. Of this total, more than three million tonnes are forages, two million tonnes of which are baled long-fibre forages.

Trade liberalization, export protocols, increased demand for fresh milk, growing acceptance for the substitution of other forage products for rice straw, and a steady expansion of the race horse industry are key factors that support the continued growth of Japanese demand for baled forage.

Table 4. Japanese Hay and Fodder Imports (excluding those in cubes) (MT)

Year | USA | Vietnam | Australia | Canada | Others | Total |

2009 | 1,384,840 | 2,046 | 406,954 | 167,654 | 9,574 |

1,971,068

|

2010 | 1,432,184 | 1,960 | 425,812 | 118,341 | 8,117 | 1,986,414 |

2011 | 1,509,309 | 5,490 | 373,784 | 100,506 | 10,392 | 1,999,481 |

2012 | 1,602,474 | 7,063 | 349,139 | 161,490 | 7,952 | 2,128,118 |

2013 | 1,497,504 | 10,275 | 366,824 | 144,045 | 9,180 | 2,027,828 |

2014 | 1,353,011 | 5,700 | 372,742 | 122,029 | 4,847 | 1,858,329 |

China has become the world's largest importer of combined forage types. Vietnam and Middle East countries have increased their forage import needs.

The United States is the largest importer of Canadian hay and fodder. Geographical proximity facilitates trade between the two countries.

2. The competition

Three countries compete for the Japanese baled forage market. The U.S. is by far the largest supplier, with Australia and Canada following suit.

In 2014, Japan imported 1,343,011 tonnes of compressed hay from the U.S., 72 per cent of its total baled hay imports. Australia exported 372,742 tonnes to Japan in 2014 were 122,029 tonnes, 6.6 per cent of Japanese imports. U.S. baled hay exports are mainly compressed forage grass aftermath from ryegrass and tall fescue straw, while Australian baled hay products are primarily compressed green feed oats. Australian exports to Japan have increased substantially over the past five years. The Australian forage export industry has grown and ocean freight rates give Australia a freight advantage to Canada.

Other competitors in the all-type forage market are Spain, Argentina, South Africa, Italy and East Europe countries.

Market Access

Timothy hay exports markets are driven by 4 key considerations: foreign customers' preference, quality specifications, product form and export requirements.

1. The customer

To the grower, the densified hay processor is the producer's customer. However, the real customer of baled hay is the foreign end user, the export market. To supply hay to the international market, Canadian growers should first contact a number of hay processors, thoroughly familiarize themselves with what the market demands, and then choose a processor to do business with.

Different processors may set different requirements and standards for raw material, based on market opportunities and their end-user preference. Contract options and services may also vary between processors.

Densified hay processors secure a supply of hay through various means. Some rely solely on spot market purchases. Others contract hay production from producers for three to four year periods at fixed or annually-adjusted prices. Still other processors go a step further and perform harvesting and storage functions on their contracted acres. With dryland yields averaging 1.7 to 2.5 tonnes/acre and 4.0 tonnes/acre on irrigation, 130,000 to 170,000 acres of clean, solid-stand timothy hay fields are required annually to meet market demand.

All Canadian exports are shipped via container.

2. Product quality

The high cost of transportation to reach distant markets drives processors' demands for high quality forages. Shipping low quality roughages at high freight rates is economically unsound. Quality timothy hay, to the Japanese end user, means long, course stems with long heads. The market wants leafy stems with a good green color and a minimum of brown leaves. The product must be free of mold, weeds, soil, Agropyron (quackgrass) and Hordium (barley) plant species, and other contaminants.

Stand purity is also important, although some processors have markets for different mixtures of hay, timothy straw, and mature off-colored hay. This information is best obtained from processors.

The moisture content must be below 12 percent. Low moisture eliminates the chance of mold and moisture damage during transport and storage in hot, humid climates. The market does not set crude protein or fibre standards. Buyers rely on subjective evaluations of visual appearance, color and smell, etc. This, too, will vary annually, especially in wet years when good quality roughage may be in short supply.

3. Product form

Baled forage destined for the export market is usually densified or compressed which reduces shipping costs.

Large double-compressed sleeved bales, each weighing about 400 kilograms, have taken over from smaller bales in popularity. They are more efficient to handle for both the exporter, importer and feed user. The densified bales are mechanically packed into 40-ft containers, transported by truck to an inland container yard and then by rail to a Canadian port. From there they are loaded on ocean-going container ships bound for offshore markets.

Processors accept delivery from hay producers in different forms, but large round or large square bales have become common. Bales are typically all reprocessed and compressed. Bales are broken open, dried down mechanically to 10 to 12 percent moisture, compressed and baled, poly-wrapped, then loaded into containers. Samples from each lot are kept for reference.

Wrapped compressed bales, waiting to be loaded into a container for shipping

Some Canadian companies have been investigating the provision of Japanese customers with Total Mixed Rations, which would result in sending a much larger compressed bale overseas, with timothy roughage in the bale and other feedstuffs to make the bale the only feed the animal would require. Bales could be as large as one tonne. Complete ration bales are attractive to more integrated, larger Japanese farms.

4. Export requirements

Export requirements vary by country. The Japanese Ministry of Agriculture, Forestry and Fisheries (MAFF) prohibits the importation of soil or plant species that could potentially be infested with Hessian fly larva or eggs. The Hessian fly is found throughout Western Canada and tends to infest wheat, barley, rye and other wheatgrass species, including quackgrass, (Agropyron/Hordium) plant species. However, a protocol that kills any Hessian fly larva and eggs has been developed and applied to overcome that concern.

Canada has successfully negotiated a visual inspection protocol with Japan. The protocol allows shipments of baled forage to be inspected by a Canadian Food Inspection Agency (CFIA) inspector or an inspector designated by CFIA. If certified free from prohibited material, a Phytosanitary certificate is issued, and the shipment will be allowed access to Japan. However, Japanese inspectors will also visually inspect all shipments and can refuse entry if they discover any prohibited material. Entry refusal initiates a trace-back protocol established in Canada.

China also has stringent import requirements to prevent the import of plant diseases, such as Verticillium Wilt. Imports of Round-up Ready Ready alfalfa is not allowed and care is taken to ensure that pesticide residues are at acceptable levels.

A major pricing factor affecting export sales of compressed hay is the risk of rejection. Rejected lots, landed overseas, results in great expense, considering ocean freight has already been paid. Rejected product causes great concern and cost to exporters, so care is taken to avoid those circumstances.

Summary

Markets for compressed forages are continuing to expand. In addition to the Japanese market, demand is increasing from China, Vietnam, Indian and Middle East countries. Competition is strong from Australia and eastern European countries, some of which have a competitive freight advantage to Canada. Canadian producers must continue to produce a consistent, high-quality forage to meet our export customers' demands. |

|