| | Background | Turf grass mixes/blends | Alternative species | Creeping production in USA | Creeping production in Denmark | Creeping production in Canada | Expected demand | Expected supply | Speculators | Return to Special Commodity Marketing page

...

Background

Creeping red fescue (Festuca rubra) is a long-lived perennial, creeping rooted grass. It is primarily grown for use in the turf grass industry, going into lawn mixes with other turf grass species such as perennial ryegrass and Kentucky bluegrass. However, the seed production life of a stand is generally short, lasting only one to two years. Due to its creeping ability, creeping red fescue tends to sod in quickly. Seed head production is gradually suppressed as the stand ages and the number of vegetative tillers increases, making older seed stands unproductive.

Creeping red fescue seed production began in Canada in the 1930s. It developed into a dual-purpose crop that provided revenue from the seed production in the summer and allowed for grazing in the fall. It is primarily grown for seed in the Peace River region of Alberta and British Columbia, Canada. In the 1940s, markets for creeping red fescue seed expanded as the need arose for a turf-forming grass to seed on airfields and around military bases. The seed is now used in mixtures for seeding lawns, golf fairways, pastures, and for soil conservation purposes. The majority of creeping red fescue seed produced is exported out of the country (Table 1).

Creeping Red Fescue Seed Field, Clairmont AB

Seed grown from the Boreal variety continues to be the main source of creeping red fescue seed produced in Canada. Although official statistics are not kept for non-certified acres and overall production, annual Canadian production averages around 35 to 40 million lbs. The Peace River region is the largest producing area of creeping red fescue seed in the world, with annual acreage in the 100,000 to 120,000 acre range.

Table 1: Canadian Creeping Red Fescue Exports, 2010-2014

| Canadian Creeping Red Fescue (CRF) Exports | 2010 | 2011 | 2012 | 2013 | 2014 |

| creeping red fescue, certified (millions CDN $) | 3.05 | 7.53 | 6.95 | 4.46 | 2.50 |

| creeping red fescue, o/t cert. (millions CDN $) | 9.13 | 7.22 | 11.09 | 15.84 | 17.41 |

| total CRF exports (value, millions CDN$) | 12.18 | 14.74 | 18.03 | 20.29 | 19.91 |

| creeping red fescue, certified (tonnes) | 2,174 | 5,411 | 4,130 | 2,368 | 1,219 |

| creeping red fescue, o/t certified (tonnes) | 6,826 | 5,633 | 7,562 | 9,078 | 7,989 |

| total CRF exports (tons) | 9,000 | 11,044 | 11,692 | 11,445 | 9,208 |

p = preliminary

o/t = other than

Source: Statistics Canada

Pricing

Since no futures market is in place for grass and legume seed, most seed is sold on a cash basis, either immediately or forward priced. End users will inquire for new seed through their brokers or direct contact with processors. Processors will then bid on the business, basing their price on what they will have to pay for the seed from growers, or on inventory purchased earlier. However, a number of factors influence the price of creeping red fescue. The vast majority of Canadian grown creeping red fescue production is exported; therefore the international marketplace has a large influence on prices Canadian growers receive.

Factors that influence the price of fescue include:

- changes in the Canadian dollar

- other turf grass species, primarily perennial ryegrass and Kentucky bluegrass.

- fine fescue seed production in the US (Silverton Hills, Oregon) and in Denmark.

- Canadian production

- expected demand (seasonality)- economy, housing starts, winterkill, weather conditions in the eastern USA (overseeding)

- expected supply - geographic production areas, inventory, time of delivery

- on farm supply estimates/carryover

- Certified vs. common production

- speculators

Currency

Almost all export business is quoted in US dollars; therefore, daily currency changes will affect what is offered to growers in Canada.

Example: Day 1: CDN to USA $ @ .8000:1, CRF @ 50.0˘/lb CDN (=40˘/lb US)

Day 2: CDN to USA $ @ .8100:1, CRF @ 49.4˘/lb CDN (=40˘/lb US)

In this example, the Canadian dollar rose 100 points to the US dollar, making foreign buyers having to pay more for Canadian products. However, the price for CRF, FOB USA, did not change. Canadian processors are still offered a 40˘/lb US price to sell, but due to the rise in the Canadian dollar, Canadian prices have actually fallen .6˘/lb (a 1.2% decrease). To maintain the same margin, a Canadian processor/seller would only be able to offer 49.4˘/lb CDN to their growers.

Turf Grass Mixes/Blends

Two main turf grass species share the same marketplace as creeping red fescue seed; 1) Kentucky bluegrass, and 2) perennial ryegrass. Two other turf grass species, turf type tall fescue and annual ryegrass, also compete, but to a lesser extent. All can influence creeping red fescue prices. These turf grasses are considered "cool-season" type species, and are used around the world (as opposed to the warm season turf grasses - bermudagrass, bahaigrass).

The turf grass seed industry is a huge marketplace, a $40 billion industry in the USA alone. To fill turf grass needs, and to ensure good growth and year round color and survival, most turf grass applications are done in "mixes". Annual ryegrass can be added to mixes to ensure rapid growth (early green color) and protection for the slower growing perennial species. The rest of the mixture is normally a combination of 2-3 of the remaining three perennial species. Tall fescue, a more drought tolerant species, is used more so in the transition zone (area between cool season grasses and warm season grasses) of the US. Perennial ryegrass and Kentucky bluegrass seed are primarily used in conjunction with creeping red fescue seed to make more northern mixes. In addition to growing zones, the adaptation of turf grass species to shade, wear (traffic), heat, drought, is taken into consideration when companies prepare their lawn mixtures.

Sample lawn mixtures:

- Northern zone lawn mixture: 45% annual ryegrass, 35% perennial ryegrass, 20% creeping red fescue. This mixture requires over-seeding with Kentucky bluegrass.

- Northern zone lawn mixture (heavy traffic area): 40% creeping red fescue, 30% Kentucky bluegrass, 30% perennial ryegrass

- Transition zone lawn mixture: 45% annual ryegrass, 35% tall fescue, 20% creeping red fescue.

- Southern zone lawn mixture: 65% annual ryegrass, 20% perennial ryegrass, 15% bermudagrass.

North American Turf Growth Zones

Alternative Species - Kentucky Bluegrass, Perennial Ryegrass, Tall Fescue, Annual Ryegrass

Because of the blended nature of turf grass end use, it is good to know how other compatible turf species are doing worldwide. The US, by far the world's largest producer of turf grass seed, dominates the world in the production of Kentucky bluegrass, perennial ryegrass, tall fescue, and annual ryegrass. Oregon State is synonymous with grass seed production, the world leader in turf grass production.

Table 2: USA Turf Grass Seed Production Regions: State and Production

| USA 2002 Census | Farms | Acres | lbs |

| Oregon | 807 | 188,101 | 241,965,678 |

| Missouri | 3,548 | 319,954 | 64,790,097 |

| Washington | 51 | 4,922 | 5,211,265 |

| Kansas | 165 | 21,323 | 4,599,538 |

| Arkansas | 147 | 11,331 | 2,485,471 |

| Oklahoma | 73 | 6,595 | 1,295,319 |

| Idaho | 21 | 1,743 | 740,406 |

| North Carolina | 126 | 3,263 | 443,442 |

Total US Fescue | 5,172 | 565,011 | 322,822,225 |

Note: Missouri = high % of forage type tall fescue

| Washington | 165 | 48,502 | 29,082,417 |

| Idaho | 181 | 57,592 | 24,820,925 |

| Oregon | 96 | 18,090 | 16,349,068 |

| Minnesota | 59 | 22,074 | 5,368,880 |

| Kansas | 7 | 190 | 15,450 |

US Total Kentucky Bluegrass | 525 | 146,690 | 75,636,740 |

| | | | |

| Oregon | 814 | 280,222 | 456,542,090 |

| Washington | 26 | 1,395 | 1,644,391 |

| Montana | 9 | 3,425 | 632,289 |

| New York | 57 | 1,660 | 344,594 |

| Arkansas | 4 | 490 | 232,000 |

Total US Ryegrass | 1,039 | 289,454 | 459,772,834 |

Source: 2002 USDA Census of Agriculture

Note: production for fescue includes all types, including forage tall fescue and fine fescues

Note: production for ryegrass includes both annual and perennial

Oregon is the world leader in annual production of perennial ryegrass (avg. 240 million lbs), annual ryegrass (230 million lbs) and turf type tall fescue (220 million lbs). Due to stubble burning concerns, Kentucky bluegrass production is now concentrated primarily in Washington State and Idaho.

Production of these associate species in Oregon, Denmark, and elsewhere in the world will affect the price of creeping red fescue in Canada.

Table 3: Average price for Oregon Grasses, 2000-2004 (cents/lb US)

| | | | Year | | |

Crop | 2000 | 2001 | 2002 | 2003 | 2004 |

| Annual Rye | 0.14 | 0.19 | 0.16 | 0.18 | 0.2 |

| Bluegrass, Kentucky | 1.03 | 1 | 1.03 | 0.76 | 0.8 |

| CRF | 0.75 | 0.38 | 0.41 | 0.45 | 0.52 |

| Perennial Rye | 0.42 | 0.39 | 0.42 | 0.6 | 0.6 |

| Tall fescue | 0.56 | 0.51 | 0.34 | 0.37 | 0.39 |

| | | | | | |

| CRF (CDN $) | 0.99 | 0.25 | 0.35 | 0.42 | 0.44 |

Source: Oregon Agriculture Information Database, Alberta Agriculture

Due to the use of mixes in the turf seed industry, many end-users will adjust the % of each crop used in a particular mix in relation to the price of that product. A general lawn mix may contain 40% Kentucky bluegrass one year, and 25% the next, if the price of Kentucky bluegrass rises and is substituted with another species.

One has to remember that seed size will vary amongst each species, and by variety. A pound of creeping red fescue will have approximately .78 million seeds, whereas Kentucky bluegrass has 2.2 million seeds. Perennial ryegrass and tall fescue, both larger seeds, have around .22 million seeds/lb.

Creeping Red Fescue Production in the USA

The majority of creeping red fescue seed fields in the USA are found in the Silverton Hills of Oregon. Acres annually run from 8000-9000, with a 6-8 million lb seed crop taken off. Oregon's red fescue seed crop is less than 20% of Canada's annual production, making the production of "Canadian creeper" that much more significant.

Oregon producers, though, have the advantage of low transportation costs, higher yields, delivery points outside their doorsteps, and less paper work.

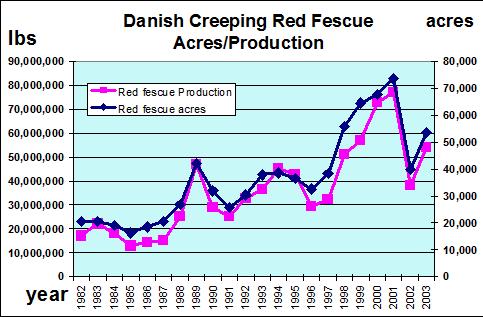

Creeping Red Fescue Production in Denmark

Danish creeping red fescue seed production now out yields Canada's output, with annual harvested acres in the 50-60,000 acres range, and average yields just under 1000 lbs/ac. Danish growers can also keep their creeping red fescue seed fields in for 4-5 years. EU subsidies (averaging 22˘/lb for all grass seed sold) helped expand Denmark's fescue acres, but with the EU subsidy system changing to a total-farm based format, seed production in the future is unknown. EU guidelines only allow for production of certified fescue, and almost all of Denmark's exports are within the EU. In years of excess production, Danish fescue has been exported to North America. This Danish expansion in production has reduced Canadian certified creeping red fescue sales to Europe.

Table 4: Danish Turf Grass Seed Production, 10 yr average (1994-2003)

Denmark | acres | lbs |

| Perennial Ryegrass | 70,562 | 76,097,508 |

| Red fescue | 50,138 | 49,941,979 |

| Sheep's fescue | 2,456 | 2,071,319 |

| Tall Fescue | 2,867 | 2,801,945 |

| Kentucky bluegrass | 20,371 | 16,449,113 |

Source: Danish Seed Council

.

Creeping Red Fescue Production in Canada

Canada, with annual production of creeping red fescue in the 30-40 million lb range, has a large influence on CRF prices. Almost all Canadian production is grown in the Peace River block of Alberta/British Columbia. Although yields are low compared to Oregon and Denmark, a relatively inexpensive land base and weather condition conducive to the production of fescue, Canadian growers continue to grow CRF in abundance. With dry, cold conditions in the winter months, fescue can be stored for a number of years, which is typically done in years of low fescue prices.

The Canadian Food Inspection Agency certifies pedigreed creeping red fescue production, with an average of around 16,800 acres inspected each year (1985-2004). Most inspected acres would be of the variety Boreal, but there is an increasing number of US proprietary varieties being grown for American companies. However, official production records (pedigree and common) are not recorded. Annual production estimates are presented by some processors, but are not 100% accurate.

Table 5: Inspected Acres of Creeping Red Fescue in Canada (1985-2004) |

Year | PEI | MB | SK | AB | BC | Total |

1985 | 47 | | 7 | 5,521 | 3,229 | 8,804 |

1986 | | | | 5,282 | 4,317 | 9,599 |

1987 | | | | 4,580 | 4,240 | 8,820 |

1988 | | 70 | 220 | 12,599 | 7,702 | 20,591 |

1989 | | 177 | 257 | 12,345 | 7,479 | 20,258 |

1990 | | 197 | 102 | 18,613 | 7,244 | 26,156 |

1991 | | 147 | 90 | 12,101 | 4,385 | 16,723 |

1992 | | | | 11,445 | 3,948 | 15,393 |

1993 | | 102 | 46 | 16,809 | 6,197 | 23,151 |

1994 | | 40 | 168 | 19,491 | 9,058 | 28,757 |

1995 | | 115 | 191 | 12,220 | 2,140 | 14,666 |

1996 | | 130 | 161 | 10,313 | 3,082 | 13,686 |

1997 | | | 84 | 13,106 | 7,770 | 20,960 |

1998 | | | 49 | 12,829 | 4,598 | 17,476 |

1999 | | | 40 | 10,576 | 5,226 | 15,842 |

2000 | | 130 | 210 | 13,442 | 3,935 | 17,717 |

2001 | | 60 | 270 | 14,439 | 5,091 | 19,860 |

2002 | | | 200 | 10,845 | 3,471 | 14,516 |

2003 | | | 80 | 5,927 | 903 | 6,910 |

2004 | | | | 7,643 | 7,650 | 17,297 |

Expected Demand (seasonality) - Economy, Housing Starts, Winterkill, Weather

The actual use of creeping red fescue by end users is very seasonal. For common fescue, it is mixed into turf mixes and used 1) in over-seeding operations during the fall (eastern USA states) and 2) in spring seeding (over-seeding, lawn mixtures, pasture situations). The amount of turf seed used for over-seeding purposes cannot be understated. Bermuda grass, a warm season turf grass species, goes dormant over the winter months. In the southern regions, to maintain the green color of the landscape, huge amounts of turf seed will be over-seeded into these stands to maintain a green color over winter

The demand for turf seeds in general is determined to a large extent by the economy and weather factors. Housing starts in the USA help dictate usage, as the greater the housing starts, the more consumption is expected. Likewise, with a strong economy, more care is taken in keeping lawns, golf courses and parks green over the winter months.

Spring usage can be expected to increase if winterkill is prevalent in the northern states. In addition to winterkill, good spring moisture conditions also add to increased usage in the spring. Moisture conditions help determine over-seeding amounts in the fall.

Due to the seasonality of usage, and with end-users switching their buying habits (additional buying) to a "buy-as-needed" method of doing business, farmers are now expected to hold supplies as needed. Local processors will buy/clean to build up sufficient inventories, but will no longer buy and clean large amounts of unpriced/un-sold seed. Therefore, expect slow bids and offers for seed in times of good supply.

The demand for "Boreal" creeping red fescue varies annually. Although certified fescue is normally only 10-20% of total production, demand for this product varies each year. Certified "Boreal" is generally exported to European countries, as European regulations only allow for the importation of certified varieties. Some certified "Boreal" is also exported to the USA. However, with very few other varieties present, buyers are aware that almost all "common" Canadian CRF seed production is of "Boreal" background. Therefore, in years of high fescue prices, buyers may buy higher priced common CRF, knowing that they are likely buying "Boreal" without having to pay higher premiums for certified seed.

Peace River Creeping Red Fescue Harvest - 2005

Expected Supply - Geographic Production Areas, Inventory

Canadian creeper production has to be factored in with production of substitute species elsewhere in the world. As mentioned above, other production regions around the world must be watched to determine supply situations for the turf seed species. Inventory levels, both on farm and in processors' hands, also helps determine price. Processors have to evaluate both old crop inventories, with expected new crop production, when determining a price. On-farm inventory is annually an estimate of carryover, with each company having their own thoughts on the situation.

Time of delivery

The larger end-user firms know they will require "X" amount of seed in the spring and fall, and will pre-order a lot of their seed from processors in advance. However, in case of larger than expected sales, this additional seed is often purchased in a "buy-as-needed/hand-to-mouth" basis. Canadian processors have to take into consideration, for quick sales, that delivery from the Peace country may take 3-5 days to reach an end user.

On farm supply estimates/carryover

With no "official" production and stock carryover figures available, the creeping red fescue "trade" (companies/processors/dealers), try to keep track of how much "seed" there is in the country, both in stock (cleaned and sold, cleaned but unsold,) and rough seed still stored on farms. The amount of on-farm carryover will factor into what buyers can offer the farmer. With creeping red fescue a bulky crop to store, many growers will opt to sell at "off-the-combine prices", to avoid the need for additional storage space. However, Canadian winters allow for low-risk storage of properly harvested fescue seed, so those with storage capabilities will store during periods of low prices. Increases in price in future years will draw these supplies into the market.

Speculators

Some creeping red fescue seed is still purchased unpriced (speculation) by some forage seed trade companies. However, speculators have become less and less in this age. Prior to the turn of the century, speculators would help kick-start pricing of product, resulting in companies and end-users taking positions on inventory by actually buying product well in advance of consumption. However, with modern technology (communication, production techniques increasing yields), and ample supplies in recent years, speculation has diminished

Certified vs. common production

Price quotes for certified creeping red fescue varieties typically range 5-10˘/lb above common seed. When the price of common seed rises to higher levels (> .60˘/lb), the spread may become narrower, as the willingness to pay more for the certified seed diminishes.

Certified seed inspection applications, risk of rejection, and other costs related to growing a pedigree crop has limited the amount of acres in Canada. Premiums paid for certified crops also factor into the price picture. The USA does not require certified seed. Certified seed sales to the US go into their higher end lawn mixtures. However, all creeping red fescue seed exports destined for Europe require the seed be certified. Therefore, what happens to the European fescue crop has a greater influence on Canadian certified fescue prices.

Certified Tall Fescue

Conclusion:

A large number of factors influence the local price quotes for creeping red fescue seed. There are numerous buyers in Canada, all affected by these factors. Keep in touch with these buyers. Their price quotes are generally a good indication of where prices are at and what direction they may be headed.

Reviewed by: Calvin Yoder, forage specialist Alberta Agriculture and Rural Development, Spirit River, AB calvin.yoder@gov.ab.ca |

|