| | Introduction

.

Agriculture commodity markets can be analyzed either technically or fundamentally. Fundamental analysis studies

supply and demand relationships that define the price of a commodity at any given time. (See How Demand and Supply Determine Market Price)

The second method, technical analysis, uses specialized methods of predicting prices by analyzing past price patterns and levels. While this has been described as "driving a car using only the rear view mirror," its wide acceptance by traders makes it a credible technique. Traders predict when price trends will change and how high or low prices will move by "charting" prices (usually futures) and looking for repeating patterns.

Both fundamental and technical analysis can be used to study commodity markets. Fundamentals, or supply/demand factors, tend to provide underlying reason to the market. Technical analysis is used to provide an indication of price trend, and an estimate of the timing and magnitude of price change. Of the two, fundamentals are the stronger force. However, because so many market participants follow technical indicators, response to those indicators can affect a market dramatically.

Charting tools

There are many techniques used to examine lines and patterns. These can vary with the individual, the type of analysis, and the fashion of the day. The most common techniques tend to be the most accurate, primarily because there are many people investing money using those common techniques. They can therefore become a self-fulfilling prophecy. Listed here are the most common techniques and their applications.

Bar or high/low/close charts

Bar charts are often used to plot price movements over a specific period of time, usually a day or week. These charts, sometimes called high/low charts, consist of a vertical line showing the price range for the period, and a small horizontal tick mark on the right side of the vertical line. In the case of a daily chart, the top of the line would be the day's high traded price, the bottom corresponds with the day's low price, and the tick on the right side of the line is the closing price. On some charts, there is also a tick on the left side of each vertical line denoting the opening price for the period. Figures 2 to 8 show bar charts.

Moving averages

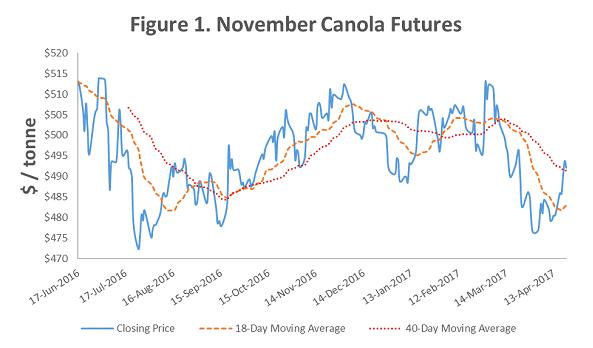

Simple and effective, moving averages smooth out the market trends, and filter out daily fluctuations. When current prices are above the moving average line, an upward trend is indicated. Similarly, a declining trend is shown when prices are below the moving average line. Moving averages are based on a selected period of time. Common moving average periods are 3, 10, 18, 40, 50, or 100 days for a daily chart, based on individual preference, and how well those particular averages "fit" with price action for that commodity. To calculate a simple 10-day moving average, for example, you add up the ten most recent day's closing prices, and divide that total by 10. As each day passes, the oldest closing price is dropped, and the most recent added on. These moving averages are plotted along with the daily price on the chart. Most charting programs and services provide automatic calculation by selecting a moving average for a price chart. As an example, Figure 1 shows a November canola futures contract’s daily closes and the 18- and 40-day moving averages.

Source: ICE Futures Canada

Advantages of Moving Averages:

- Easy and available.

- Can be applied to any consistent period of prices (daily, weekly, monthly or annually).

- The longer the period, the more reliable this indicator is considered to be.

Limitations of Moving Averages:

- Responds to general trends only.

- Is not highly precise.

- Short term moving averages can give false indications, especially in times of volatile prices.

Trend Lines

Trend lines are made by connecting two or more price highs or price lows with a straight line. The slope of the trend line indicates the trend. When prices cross the trend line, a change in trend is indicated. Trend lines work with most charts, but are normally used with "high/low/close" charts. Figure 2 shows a number of trend lines.

Advantages of Trend Lines:

- Reliable and accurate.

- More precise than moving averages.

- Work well with long or short term trends.

Limitations of Trend Lines:

- Work best with sustained trends.

- Positioning of trend lines is subjective and takes practice.

- Trends must be established before they become recognizable.

Channels

Channels are formed between two trend lines. One line follows price peaks, the other price lows. Channels have all the limitations of trend lines, but they provide a view of the trading range of prices.

The line defining the top of the channel is called the "resistance line" because it is considered

to be resisting prices moving above it. The line at bottom of the channel is the "support line" as it “holds” prices above it. Prices breaking out of the channel are seen as an indicator of a change in trend. In parallel channels, price cycles are usually apparent within the channel as the market "tests" the resistance line and then the support line. Converging or sideways channels, often called pennants or flags because of their shape, indicate a coming price change as price convergence "forces" the price to move out of the formation, either higher or lower. Figure 3 shows three cycles.

Advantages of Channels:

- Reliable and accurate, especially over long periods of time.

Limitations of Channels:

- Works best with sustained trends, the longer the better.

- Positioning of the support and resistance lines is subjective and requires practice.

Cycles

Often seen within channels, cycles are a view of the price discovery system at work. With pressures of supply and demand, prices are rarely constant. As prices approach the top of the channel, buyers become more hesitant and sellers become more aggressive. This increases supply and reduces demand, both of which pressure prices lower. At the bottom of the channel the opposite is true, with buyers clamouring for relatively low prices and sellers hesitating, both of which tend to make prices rise. Figure 3 shows a channel between the resistance and support lines. See "Resistance and Support Planes" below.

Advantages of Cycles:

- Reliable and easy to see, especially over a number of trading periods.

Limitations of Cycles:

- Requires a period of time to establish the cycle

- Imprecise as time spans can vary between oscillations.

- No indication as to how long the cycles will last.

Resistance and Support Planes

Planes are horizontal price levels or ranges. They indicate significant levels unique to that commodity. Many commodities will not trade above or below certain price levels for both fundamental and technical reasons. An example may be a price where buyers will substitute other products, such as palm oil for canola oil. Another example of short term planes is the contract high and low prices of a particular futures month. These planes tend to provide great resistance to price change.

Most traders follow long and short term planes in conjunction with trend lines and channels. They also keep track of any recurring price as resistance planes may also appear in the middle of a commodity trading range. Figure 4 shows resistance and support planes.

Advantages of Resistance or Support Planes:

- Keeps price levels in perspective with past price activity.

Limitations of Resistance or Support Planes:

- Often difficult to keep track of. (Not shown on charts or are off-the-scale.)

Corrections

After a price movement, the price often retraces its path or returns to an earlier price level as a part of that movement. The retracement is logical if you consider the market probably moved more than it needed to because of emotion. When the emotion subsides, the prices return to a more relaxed level. The amount of the return is usually about one third, one half or two thirds of the original price move. These percentages are called Fibonacci numbers, named after the mathematician that came up with the retracement theory. Figure 5 shows an example of a correction.

Advantages of Using Corrections:

- Provides price objectives after a significant price move.

Limitations of Using Corrections:

- Most applicable to short term projections.

Double tops and bottoms

These price patterns are formed by the market testing either market highs or market lows. In a double top, prices peak, retrace downward, and peak again at roughly the same price level. This pattern is a strong indicator of a coming downturn in the price trend. It is an even stronger indicator if the double top touches an established resistance plane. A double bottom is the reverse of a double top. Double tops and bottoms are very visible patterns, and because of their visibility, are the sources of considerable trading decision. Traders use a formation to estimate how far prices will move when the prices break out of the top or bottom. Measure the change between the tops of the peaks and the base of the valley; the projected price move will be that distance below the base of the valley. Figure 6 shows a double top.

Advantages of Double Tops and Bottoms:

- Visible and reliable indicator

Limitations of double tops and bottoms:

- Usually requires major resistance plane.

Head and Shoulders Formation

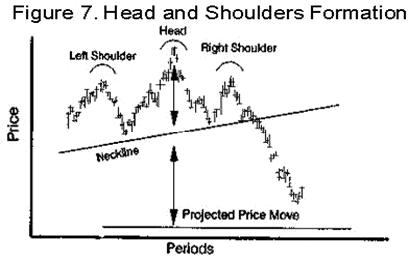

The head and shoulders formation is similar to the double top or bottom. It works as well upright predicting market highs as it does inverted, predicting lows. In the case of rising prices, the prices peak, retrace and peak higher yet, retrace again and then peak at roughly the level of the first peak. Traders watch for the creation of the last peak as a strong indication that the price trend has changed direction, in this case lower.

The head and shoulders formation also provides an indication of how far prices will move. The distance from the top of the head to the base of the neck is the projected distance that prices will move beyond the base of the neck. Figure 7 shows a head and shoulders formation.

Advantages of Head and Shoulders Formations:

- Easily observed.

- Definite identification of trend change.

- Provides some future price objectives

Limitations of head and shoulders formations:

- By the time the formation is identified the trend has changed and prices moved significantly.

Trading Volume

While not a line drawing technique, trading volume is often included on charts. It is the number of trades of futures contracts during the last trading period, as supplied by the exchange. Trading volumes provide a measure of activity in the market. Trading volume analysis is used concurrently with other indicators. High trading volumes are considered supportive to an established trend, either up or down. Declining trading volume after a price move on good volume may be an early indication that the trend is weakening. A violation of a support or resistance price level accompanied by an increase in trading volume enhances the probability of trend change. However, lack of trading volume when a price move occurs may indicate that the price move was an anomaly rather than the start of a new trend. Figure 8 shows a chart of trading volume and open interest.

Open Interest

This is the number of outstanding contracts at the time of reporting. One combined buy and sell position is equal to one open interest. Like trading volume, open interest is a measure of market activity and can be used as an indicator of support for a price movement. In general, increasing open interest shows trader support for the current price trend. Decreasing open interest shows falling support for the trend, and an increasing chance that a change in a trend will occur. Price retracements are typically characterized by declining open interest. Figure 8 shows trading volume and open interest.

A word of caution

Technical analysis gives indicators, not guarantees. To correctly analyze a market, consider both technical and fundamental factors. Remember that there is no assured way of predicting the future. There are people who predict the markets professionally. Armed with computers, historic information, and informed sources, even these people are far from infallible.

Accept technical analysis as one more tool for making market decisions. It can provide insight to prices and to the timing of trend changes. They are of little value without common sense and a working knowledge of the commodity involved.

Technical Analysis Tips

- Optimism is a normal human trait. Do not be caught looking for signals to support a market position and overlook signals to the contrary. This can be a very expensive mistake to make.

- Look at the long term. Historic high and low prices are useful to compare with current prices.

- Establish resistance and support planes. Move long-term highs, lows and trends onto short term graphs. This puts current prices into perspective and may provide pertinent limitations on current trends.

- Draw trend lines and trading channels.

- Maintain moving averages.

- Watch for obvious cycles, formations and patterns.

Make predictions and evaluate performance. Practice is the key. The more experienced you are, the better your estimates. Keep a diary of your estimates and compare them with the real world. This can be your best education in analyzing markets.

Summary

Technical analysis can be used to study commodity markets. The methods discussed here provide an overview of the basic techniques. There are many others, each with their own supporters and their own degree of success. With practice and dedication, producers will find technical analysis a valued addition to their marketing skillset.

Learning more

There are many, many ways to learn more about technical analysis. There are Internet-based and classroom-style courses as well as many, many books on the subject. A search on the Web or on-line bookstores will bring up many sources of more information. |

|