| | Introduction | Start-up costs | Planning forecasts | Cost of production and sales | Pricing your product or service | General and administration expenses | Sales Forecast | Cash flow planning | Balance Sheet | Income statement | Cash flow projections | Financial ratios | Monitoring your financial plan | Conclusion

The will to win means nothing without the will to prepare”

Juma Ikangaa

New York City Marathon

The development of realistic financial planning documents for a business is an important process. The following pages provides you with tips, that if followed, will result in the completion of financial forecasts worthy of presentation to lenders, investors, and others. The development of a good financial plan takes a team effort which involves your internal accounting/bookkeeping team, your external accountants, your management team, Alberta Agriculture and Rural Development staff, and you as the owner.

By reading through the following pages you will receive a high level understanding of the following:

- The purpose of good financial planning

- The approach to arriving at realistic Start-up or Expansion Costs

- The up-front homework and planning process in developing Key Assumptions for sales, cost of production and general and administration expenses

- The up-front homework and planning process required in developing Key Assumptions for cash flow planning

- An overview and an example of a Balance Sheet and Income Statement

- The importance of accurate Cash Flow Planning

- Overview of Key Financial Performance Ratios – purpose and formulas

- Comments on suggestions for monitoring the financial plan developed

TIP: Remember it takes time, good research and a great team effort to achieve a realistic financial plan on which good decisions can be made!

Introduction

Entrepreneurs, start-up companies, or existing companies will utilize and require the development of numerous financial documents during the planning and operational stages. Each plays an important role in planning and managing your business. Some may be used in the earliest stages - simply to determine whether or not your proposed or existing business is feasible or sustainable. Others will be used to provide information that will enable you to attract partners, investors or financing capital; while some will monitor and benchmark your business activities on an ongoing basis.

The structure of your business will determine the variation and format of some of the financial documents that you will utilize. The typical business structures are: sole proprietorship, partnerships or corporations. Additional types of business structures may possibly include new generation co-ops or joint ventures. Your financial and/or legal professional will assist you in determining the structure best suited to your business needs.

Critical business decisions need to be made before you invest significant time and capital. It is important to adequately complete market research, hold discussions with possible suppliers and be able to place estimated costs into models that will enable you to more accurately complete feasibility assessments.

The development of your financial documents is an important step in bringing your new start-up business, or new product launch to reality. Once prepared, these financial documents will assist you in attracting investors, satisfying the needs of your lenders, and monitoring your business on an ongoing basis.

Building these documents requires utilizing key assumptions. These key assumptions are the building blocks of information that are collected and used to develop your financial and business plans - and to help make critical decisions based on solid information. Key assumptions are critical to all aspects of the financial forecasts – balance sheets, income statements, cash flow, business plans and so on. They include detailed forecasted sales volumes; cost of sales, general administration expenses, and others.

Tip: It is important to understand that all three financial statements are related and connected indicators of the businesses feasibility, risk and profitability. (Balance Sheet, Income Statement, and Cash Flow).

As you go through the preparation of your financial documents and business plans, you will need to document and sort the information that is used to create these documents. A spreadsheet (or combination of several spreadsheets) is one of the most effective tools for gathering, compiling and managing this information.

Tip: Linking your spreadsheets to one another and merging the data together will make it much simpler and faster to update your documents.

It is highly recommended that you discuss your business start-up or expansion idea in advance with your financial coach so he or she may provide you with guidance in the key assumptions they suggest or recommend. They may help you develop detailed spreadsheets, and provide supporting comments.

Tip: The greater the accuracy of the key assumptions/information that is used in the initial planning stages of your business - the greater will be your ability to make good business decisions moving forward. Utilize your suppliers and other business contacts (as needed) to aid you in gathering up-to-date information.

Not all assumptions require a detailed breakdown. Your financial professional will aid you in finding the best spreadsheet tools suited to your needs. Every business is unique and therefore each may require additional or specific information to be collected.

Start-up Costs

What will it cost to get your business off the ground or implement expansion plans? Begin collecting the data. Talk to potential suppliers for initial pricing of supplies and materials. If you require capital, make some early inquiries to determine anticipated borrowing expenses and terms.

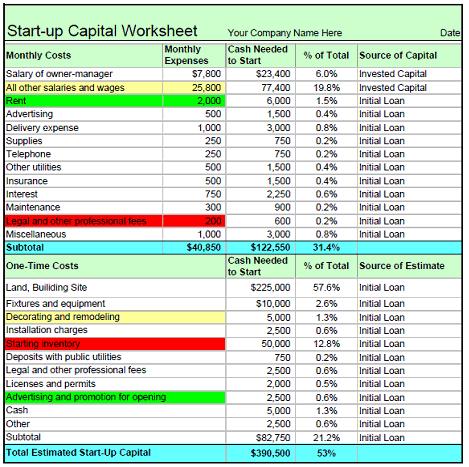

As you collect your information, keep a record of the information you gather. Below is a simple example of a common Start-up/Expansion Capital Worksheet. This example shows some of the basic information that would commonly be used in a start-up business.

Combine and add your own specific information that is right for your business.

Tip: You should use startup cost planning for a start-up company and also when expanding your business or launching a new product line. Customize the spreadsheet for your own purposes.

Tip: The greater the accuracy of the key assumptions/information that is used in the initial planning stages of your business - the greater will be your ability to make good business decisions moving forward. Utilize your suppliers and other business contacts (as needed) to aid you in gathering up-to-date information.

In addition to tracking the total estimated costs of starting up your business, this particular spreadsheet example also allows you to assign the source(s) of the capital required.

| Tip: You may come across items which require more in-depth data to be gathered or updating. Colour-coding the spreadsheet entries may help you identify those areas that require additional information or updating. For example (as shown in the example below) green areas may be used for items that you are very certain of. Yellow shaded areas require some additional information, while red areas may mean you require more extensive updating or critical information to be gathered. |  | It is important to have sufficient capital funding for the startup of your business. A startup capital worksheet will help you to calculate how much is needed before you begin to generate income. |

Figure 1-1 |  | Consider how long it will be before your business will be generating enough revenue to offset expenses.

In this example, most of the monthly expenses have been multiplied by 3 which in this case ensure the expenses are covered until the business generates sufficient revenue to cover costs.

A spreadsheet can easily accommodate additional lines as required. You may wish to link (merge) them together to quickly make changes and updates.

Missing or underestimating key expenses at this stage could be the difference between success and failure.

|

Tip: Developing smaller spreadsheets will assist you in recapping the individual costs associated with the project.

Remember: It isn’t necessary to utilize a spreadsheet in all cases, as long as you are realistic in your assumptions and you can support them when needed. |

Figure 1-2

Key Assumptions for Planning Forecasts

Similar to startup or expansion costs, you need to investigate and give careful consideration to the development of other key data that would be utilized in the completion of the opening balance sheet, forecasted profit and loss statements and the development of cash flows.

One of the first key assumptions that needs to be addressed in the startup of a new business venture, and or expansion, is the source of equity and or debt. This would be the assumption around the contributions to be made to the business by ownership, whether sole proprietor, partners, or shareholders. Contributions can take the form of cash contributions through share purchase, shareholders/partners loans, and contributions of assets in return for equity. You would be advised to develop a spreadsheet that shows the timing and amount of each contribution and the terms in which they are being made. The spreadsheet should show both contributions and the formation of the business and throughout the planning period.

Key Assumptions - Cost of Production and Sales

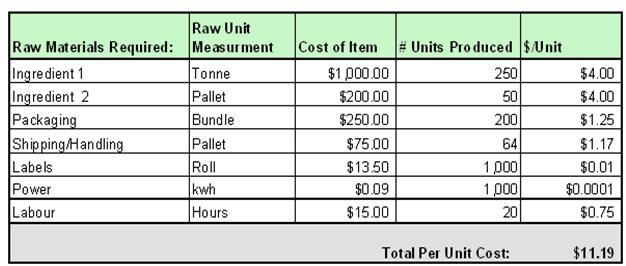

Production costs need to be forecasted. The production cost is determined by your research and accurate determination of the cost of all inputs that make up all your manufacturing costs. These costs should include all material costs, labour, service and manufacturing overhead requirements that are required in the development of your products.

Prior to forecasting your sales projections and revenue, you need to calculate a realistic cost for your product(s) and break the cost down into a per unit basis. The cost must include all production inputs: raw materials, utilities (power/water etc), packaging, handling expenses and any other items involved in production. Labour costs associated with production should be addressed here as well. Below is an example of a basic worksheet to calculate product cost.

Figure 1-3 | Tip: Once you calculate the input costs on a per unit basis, you can begin the sales and revenue forecasts.

Each individual product that you produce would require its own individual calculations for these per unit costs. |

Tip: If you manufacture a product, it is advisable that you include not only your material costs in your cost of sales, but all manufacturing costs such as rent (only equipment rent) utilities and labour - anything that is variable and related to manufacturing your product.

Key Assumptions – Pricing your Product or Service

Placing the right selling price on your product or service can be the difference between financial success and failure. In order to price your product or service profitably, you need to take into consideration many factors such as cost of production, your customer, your competitors and how much value the market places on your product.

The cost of production includes both variable and fixed costs. This is a very important step and is the foundation to establishing an accurate price for you product. Do not guess, know your costs and be sure to include all costs.

Price is not the same as value. Value is a perception in your customer’s mind. If you have a unique product that the customer needs or wants, they will place a higher value on it. Your price should reflect how much value your customer places on your product. If the product you are producing is commonly available and you have considerable competition customers will place less value on your product and it may be very difficult to establish a market share.

Critical Questions to ask yourself are:

- Do you have a unique product with high consumer value?

- Can you produce your product better or cheaper than all the other suppliers?

- Do you have much competition?

- What is the competition doing to maintain or grow their market share?

- Will people buy your product over the competition and why?

- How much would your customers be willing to pay?

- Is there room for your product in the marketplace?

Answers to these and many other critical questions will require thorough market research and other investigation efforts. Consider consulting a market analyst if you are unsure of your product/service potential.

Once you have established that you have a product worthwhile to market, and you have established a realistic price for your product (a cost price to produce, ship and market, plus a profit margin) you can then determine if the market will support your venture.

Tip: Research into pricing of similar or like products can include the use of your own inquiries into the marketplace, focus groups, trial markets or enlisting the assistance of professionals.

Key Assumptions – General and Administration Expenses

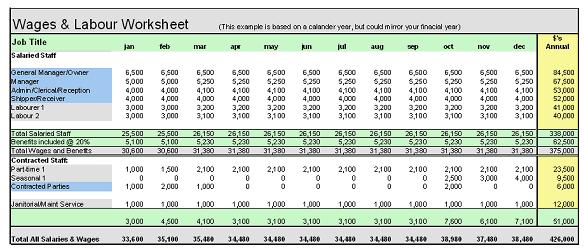

One of the most significant expenses a business will incur is that of salaries (wages and benefits). Create an accurate monthly estimate of your labour costs through each of your planning stages. You will also need to project labour costs in your cash flow summaries, to ensure your business can manage and meet payroll obligations. Below is an example of a labour cost spreadsheet that also estimates the company costs of employee benefits. If you intend to pay bonuses, you would simply add another row or rows as required. It will be critical to outline your assumptions as to the timing of these bonuses as your financial advisor will require this information to manage your cash flow. Bonuses should only be paid out if the company is profitable.

Figure 1-4 - A larger version of the Wages and Labour Worksheet (12K PDF) is available for your review.

Tip: Using a spreadsheet that allows you to easily make quick adjustments throughout the forecasted year and handle changes such as wage increases, personnel changes and so on, will help you manage and prepare for your cash-flow requirements document.

In this particular spreadsheet example, the jobs have been highlighted in different colours. This is to help assign their associated cost to either overhead costs (fixed) or cost of sales.

Often janitorial and maintenance services will be split between fixed costs and cost of sales.

Tip: You may wish to consider the development of additional spreadsheets to support other general and administration expenses.

Tip: At times you may have special sales, (seasonal highs or lows) that affect your forecasts. It is very important that you include in your key assumptions how you managed to arrive at these various forecasted levels. Maintain a record of your specific assumptions in these areas.

Key Assumptions - Sales Forecast

The preparation of your projected income statement is the planning for the profit of your financial plan. The example below is for a single product, you would need to complete this for each additional product and/or source of revenue.

Figure 1-5

Tip: As you are developing your sales forecast, it is critical that you document and develop a narrative in your business plan that can support your projections including the best estimate of timing of the conversion of sales to cash. The assumption of the timing from invoice to conversion of cash is required by your financial coach. Are these sales projections reasonable? Can they be supported though signed orders, contracts or letters of intent from your customers? Do you have a competitive advantage with your product that fills a consumer need or is at a price better than anything else currently on the market? Can your operation’s infrastructure support the volume of sales? Lenders or investors will need evidence that these projections are realistic. Over-estimating your sales forecasts could result in financial disaster.

Key Assumptions – Cash Flow Planning

To complete an accurate cash flow forecast it will be critical to make key assumptions around the following:

- The amount and timing of cash equity contributions by the owners

- The amount and timing (advancements) of any loans that will be requested for approval

- The timing and amount of payment for capital acquisitions (ie. land, building and development)

- The terms in which credit will be extended to clients – accounts receivable

- an understanding of the terms to be provided by suppliers – accounts payable

- You will need to obtain amortization tables for all loans applied for. This will provide you with the interest and principal split required for both your income statement and cash flow planning.

- Make an assumption on how the general administration expenses are paid (general administration expenses are paid in the month they are incurred)

Tip: In completing cash flow forecasts for existing businesses, to be accurate, the following additional steps will be required:

- The bank reconciliation for the previous month-end

- Have an aged listing for all outstanding accounts receivable as at previous month-end (you need to be prepared to make an assumption on how/if these accounts will be collected otherwise if uncollectable, they are a bad debt expense)

- Have an aged listing of accounts payable (and the timing of when they will be paid)

- If any loan payments are in arrears, a plan to catch up and make them current

One of the first steps in the cash flow planning for the next year of an existing operation will be to determine when opening accounts receivables will be collected in the next period and when outstanding accounts payable will be paid in the next forecasted period.

Tip: Quite often the development of an initial cash flow statement will initiate a revised cash flow statement that will include the additional financing required to fund the cash flow deficit.

The Balance Sheet

The Balance Sheet is a summary of the assets and liabilities and equity of a business at a specific point of time. In addition it provides a picture of the financial solvency and risk bearing ability of the business.

The Balance Sheet will vary slightly depending on the legal structure of your company whether it is a sole proprietorship, partnership or corporation. This is an example of what a typical balance sheet may look like for a corporate entity (Limited Company). If your business is a sole proprietorship, the equity section of the balance sheet will simply be the difference between the assets and liabilities - there will be no indication of original share capital reflected. If you choose to operate the business as a partnership or corporation, the owners' equity section will reflect the equity breakdown amongst partners depending on their percentage of ownership.

| Tip: As mentioned, balance sheets will look different depending on corporate structures.

A Sole Proprietorship will not be showing any share capital. Equity will simply be the difference between assets and liabilities. For Partnerships the equity portion will be shown as per the breakdown amongst the partners. In a corporation, (as per the example on the left) equity will be shown as share capital and retained earnings of the corporation. Shareholders loans can be considered equity, only if they have been postponed in favour of the banks or investors. Postponement means that shareholders cannot withdraw these loans without prior approval.

If you operate as a Sole Proprietorship it is suggested that you keep your assets and liabilities of your business separate from your personal assets and liabilities. Consult with your financial advisor so they may advise you in the best way for you to manage your assets and liabilities. |

| Figure 1.6 - A larger version of the Balance Sheet (13K PDF) is available for your review. |

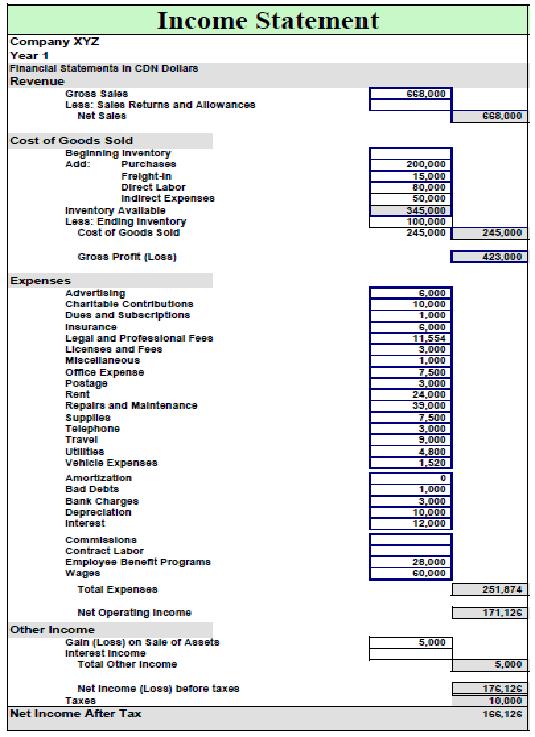

Income Statement (Profit and Loss Statement)

The Income Statement, commonly referred to as the P&L statement, summarizes the revenue and expenses for a specific time period (one month, one quarter, one year, etc.) The Projected Income Statement is a snapshot of your forecasted sales, cost of sales, and expenses. For existing companies the projected income statement should be for the 12 month period from the end of the latest business yearend and compared to your previous results. Any large differences in line items should be explained in detail.

| Tip: There will be no forecast in the income statement for the payment of taxes (for a sole proprietorship) The main difference between a company, partnership and the sole proprietorship is the area of taxes payable and remuneration. Your financial advisor will assist you in how you will reflect this in your forecast(s). For example there may be no salary expense in a sole proprietorship or partnership (they may be shown as withdrawals after profit calculations whereas active shareholders' remuneration for wages and bonuses may be shown as a management expense in the general administration section of the income statement. Depreciation expenses could also be handled differently in a sole proprietorship if these assets are utilized in the generation of revenues not associated to this venture. You are encouraged to engage professional assistance in the creation of these documents. Your advisor will help you complete these forms in accordance with general accepted accounting principals (GAPP).

|

Figure 1-7 - A larger version of the Income Statement (13K PDF) is available for your review.

Tip: The above example is for a startup company and this is why no beginning inventory is shown. Professional accounts may choose to show the cost of goods sold section in various formats depending on the industry. |

Tip: If the whole area of financial documents is new to you, you may wonder the difference between the income and cash flow statements. The income statement is your revenue and expenses for a point in time. The revenue is recorded at the point it is earned, not when payment is received and the expense is recorded at the time it is incurred, not paid. The cash flow statement forecasts the assumptions as to when revenues from sales, and other incoming funds are going to be received , and the assumptions on the timing of paying of expenses, capital putchases, and any loan repayments.

Cash Flow Projections

Once you have made your sales projections based on volume, calculate the cash flow projections by converting your sales volumes into income. In the example below accounts receivable are shown based on cash sales with 30/60/and 90 day receivables. Deduct outflows from all cash inflows and you will be able to predict your cash flow requirements for each month. If you find yourself in a negative position, it becomes a critical decision whether or not to move forward, with your business unless you can make valid adjustments to either your inflows or outflows through the extension of accounts payable or approved operating lines of credit. These options should only be considered if in future months there will be cash excess to pay down operating loans and or accounts payable.

For a new business, the cash flow forecast can be more important than the forecast of the Income Statement because it details the amount and timing of expected cash inflow and outflows. Usually the levels of profits, particularly during the startup years of a business, will not be sufficient to finance operating cash needs. Moreover, cash inflows do not match the outflows on a short-term basis. The cash flow forecasts will indicate these conditions and if necessary the aforementioned cash flow management strategies may have to be implemented.

Given a level of projected sales, associated expenses and capital expenditure plans over a specific period, the cash flow statement will highlight the need for and the timing of additional financing and show your peak requirements for working capital. You must decide how this additional financing is to be obtained, on what terms and how it is to be repaid.

Figure 1-8 - A larger version of the Monthly Cash Flow Projection (18K PDF) is available for your review.

Tip A good cash flow projection should forecast monthly amounts for month end receivables, payables and inventory. This information is often required so that management can calculate their operating loan margin requirements as stipulated by their lender. Forecasting these month end numbers and testing them against margin conditions, in advance, eliminates challenges you may experience with your lender if your unable to meet your conditions at a later date. Being able to test these numbers, allows you to alter your financial projections and take alternative measures.

Tip: The advantage of good upfront homework to arrive at realistic key assumptions will greatly assist your professional advisor, who may utilize existing financial automated spreadsheet planning and analyst tools. You should also be prepared to provide identified “what-if” scenarios (changes to revenues, cost of sales expenses and assumptions impacting cash flow) so that alternative projections could be quickly produced to provide for risk analysis.

Financial Ratios

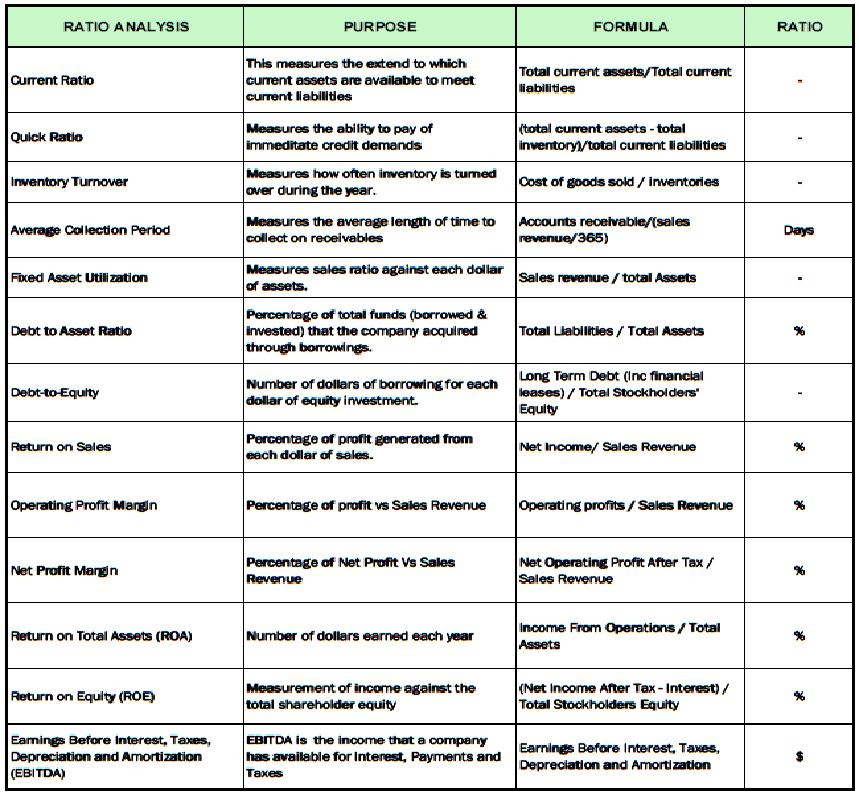

Ratios are useful when comparing your company with the competition on financial performance and also when benchmarking the performance of your company. Ratios can measure your company’s performance against the performance of other companies. Most ratios will be calculated from information provided by the financial statements. Financial ratios can analyze trends and compare your financial status to other similar companies. They can also be used to monitor your companies overall financial status. In the table below, many of the common ratios are shown along with the formulas that are used to calculate them.

Figure 1-9 - A larger version of the Ratio Analysis (24K PDF) is available for your review.

Liquidity ratios provide information about your company’s ability to meet its short term debt. The Current Ratio and Quick Ratio (also known as the acid test) represent assets that can quickly be converted to cash to cover creditor demands.

Asset Turnover Ratios indicate how well you are utilizing your company’s assets. Receivable Turnover, Average Collection Period and Inventory Turnover are the main tools to monitor your assets.

Financial Leverage Ratios indicate your financial state and the solvency of your company. They measure your company’s ability to manage and use long term debt. The Debt Ratio and Debt-to-Equity (Leverage Ratio) Ratio are used in these calculations.

Profitability Ratios include Gross Profit Margin, Return on Assets and Return on Equity ratios. These ratios primarily are used to indicate your company’s ability to generate profits, and return to the shareholders’ investments.

Your financial advisor will assist you in these ratio calculations and utilize the ones that best measure your company’s financial well being.

Monitoring Your Financial Plan

If you are new or uncomfortable in working with your financial business plan, work with a financial advisor who can guide you through the processes involved in continually monitoring the financial affairs of your business or business venture.

Keep your information current and review the documents on a regular basis (monthly or more often if needed). Review them with key individuals within your company.

Utilize monthly financial statements as part of your business management process. By reviewing these documents monthly, you will be prepared to make changes if and when necessary, always compare changes between your actual performance and your previously forecasted projection.

Use these documents to make adjustments to your business’ financial plan or strategies. Use them to plan new initiatives or new product launches.

A simple checklist such as the one below may help you in your ongoing management practices.

Figure 1-10 - A larger version of the Checklist (10K PDF) is available for your review.

Tip: Create and customize your own monthly checklist that helps you to be in control of the day to day operations. Take immediate action if you find areas that need attention on anything appears to be questionable.

Review these suggested tasks with your financial advisor to see if he or she has other recommendations to add.

Tip: If Key Performance Indicators (KPI) are not being met, an action plan needs to be implemented.

Conclusion

The information provided here gives you some guidelines and examples from which to begin the development of your own financial documents and/or business plan. Every company has a unique set of circumstances and due diligence is required on your part to seek out professional guidance in preparation of these important documents. The more you are able to accurately forecast and estimate your expenses, sales volumes and revenues – the more you will be able to make sound business decisions to proceed, stop or alter your business plans moving forward.

As you complete your documents, time will pass and some of the key assumptions in the information will change. Keep this information current; update the most critical assumptions regularly. Maintaining accurate up-to-date financial documents will enable you to have accurate information to present to a lender or potential investor. These documents will provide you with the management tools you need to make sound business decisions at any time.

Tip: Before a business and financial justification can be made to proceed with a start-up business, and or expansion the target market must be sharply defined, the product concept and positioning strategy must be confirmed; the benefits to be delivered and the value proposition defined and validated, as well as the physical attributes of the product features, specifications, and performance requirements. All costs of the proposed plans need to be well investigated and key assumptions documented.

It will be important to review the core competencies and determine additional resources and capabilities needed to achieve the financial plan. You need to clearly have a plan for sourcing additional resources, partnering, or outsourcing. Your financial plan is a way to clearly demonstrate the financial costs of that execution strategy. Ensure you have considered everything required to achieve your goals and have planned for their costs in your plans.

A good financial plan, developed with the assistance of financial professionals will be invaluable to ensuring good decisions are made.

|

|