| | Introduction | Background | Regulatory | Seeded acreage in Canada and Alberta | Markets: nutritional, industrial and other emerging uses | Marketing for producers | Environmental benefits | Licence application | Varietal selection and sourcing pedigreed seed | Growing hemp | Harvest | Economics | Additional web resources | Footnote references

This publication can assist producers at several levels:

- considering a hemp enterprise

- new entrants to hemp

- expanding their hemp enterprise to make informed decisions regarding crop production, handling and risk management

Introduction

Low prices of major commodity crops often prompt farmers to diversify their cropping options. These conditions have resulted in a recent influx of new industrial hemp producers. In the past five years, the national acreage of industrial hemp has grown about 25 per cent annually in Canada.

New, emerging opportunities related to fibre utilization for a diversity of industrial applications are expected to continue to create demand for more hemp feedstock in Alberta. Efforts to build whole hemp crop value chains, for both food and fibre, are underway in Alberta.

Background

The Industrial Hemp Regulations define industrial hemp:

“ the plants and plant parts of the genera Cannabis, the leaves and flowering heads of which do not contain more than 0.3 per cent THC w/w (tetrahydrocannabinol) including the derivatives of such plants and plant parts that contain no more than 10 µg/g (10 ppm) THC ”

Originating from Central Asia, industrial hemp arrived in eastern Canada with European settlers early in the 17th century. For the next 300 years, hemp was cultivated for food and fibre across the country, including in Alberta. However, in 1938 the Opium and Narcotic Act banned the cultivation, possession and processing of hemp in North America.

In 1994, Canada began to issue research licences to grow industrial hemp on an experimental basis (Figure 1). In 1998, the commercial production of industrial hemp was legalized in Canada with Health Canada being the authority to grant licences.

Currently, Canada is the only country in North America where the cultivation of industrial hemp is legal.

Figure 1. Industrial hemp crop (photo: Alberta Innovates – Technology Futures)

Regulatory

Health Canada controls the production, processing, possession, sale, transportation, delivery and offering for sale of industrial hemp. All industrial hemp grown, processed and sold in Canada must contain less than 0.3 percent THC in the leaves and flowering parts. In addition, a maximum level of 10 parts per million (ppm) for THC residues in products derived from hemp grain, such as flour and oil, has been set in the regulations.

All commercial industrial hemp crops are planted using only pedigreed seeds of varieties listed in Health Canada’s List of Approved Cultivars. Seed saving and the use of common seed are currently not allowed under the regulation.

The hemp industry initially grew varieties that were imported and of European origin. In recent years, Canadian plant breeding programs have developed a number of high yielding cultivars that are suitable to a wide range of growing conditions.

The Industrial Hemp Regulatory Act is currently under review. Several significant changes have been suggested at the national industry consultations conducted in 2013. A new act is expected to be approved in 2016.

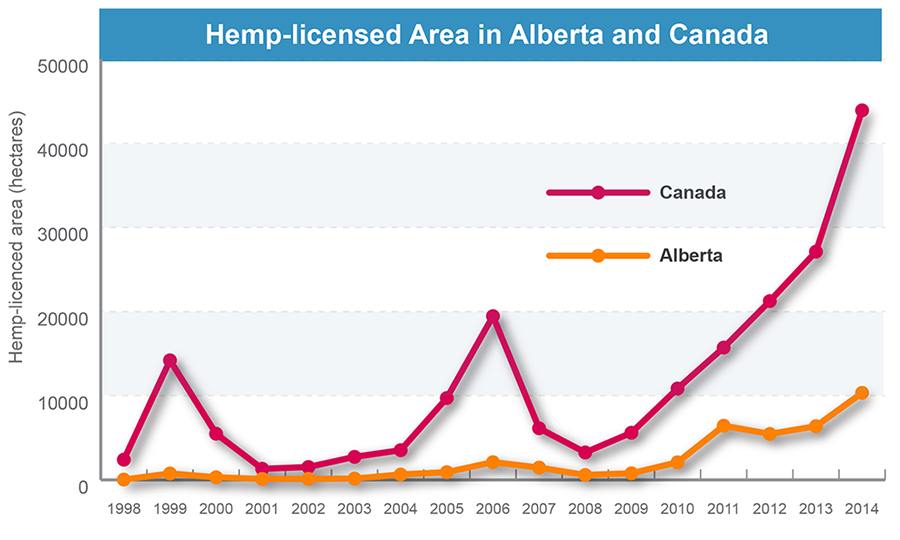

Seeded acreage in Canada and Alberta

As with many new crops, there has been considerable fluctuation in hemp production. The number of hemp producers rose from 78 in 2003 to 768 in 2014. Since 2009, seeded acres in Canada have increased consistently, largely driven by the hemp grain market (Figure 2). In 2014, some 108,000 acres (43,706 hectares) were grown in Canada.

The overall production acreage in Alberta trended upwards with a total of 15,892 acres (6,431 hectares) being registered in 2011. In spring 2014, growers’ permits were given for 25,557 acres (10,343 hectares) in the province. Alberta’s share of total Canadian hemp production area ranged from approximately 2 per cent in 1998 to 32 per cent in 2011.

Figure 2. Hemp-licenced area (hectares) in Alberta and Canada (1998 – 2014). Source: Health Canada

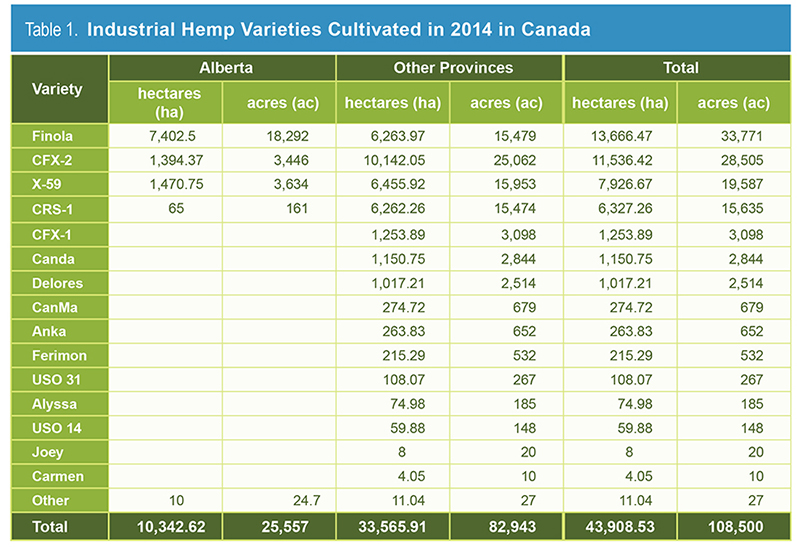

While over 20 industrial hemp varieties were grown in 2014 in Canada, 4 grain type cultivars (Finola, CFX-2, X59, and CRS 1) accounted for 90 per cent of the national acreage. In Alberta, the grain type cultivar Finola dominated hemp production, taking 72 per cent of the provincial hemp acres.

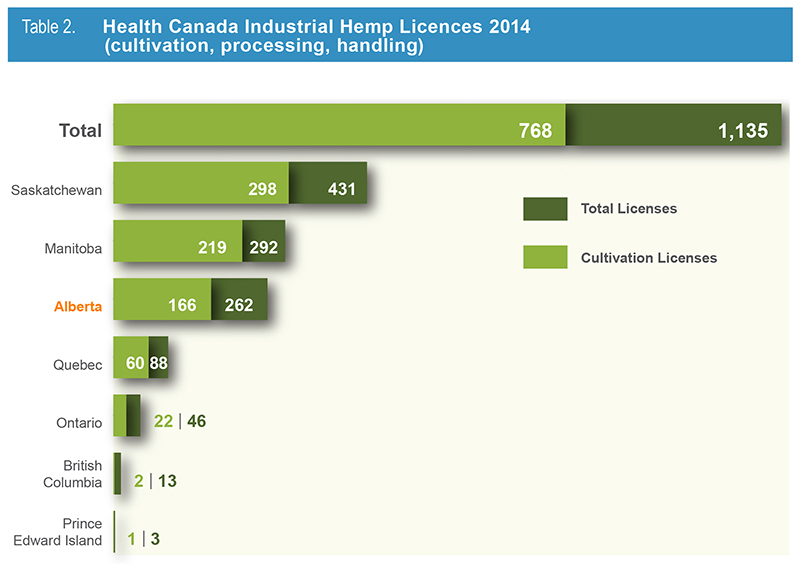

Industrial hemp cultivation is concentrated in the three prairie provinces while smaller operations are run in Quebec and Ontario (Table 2.). During the last 6 years, Alberta farmers grew 24 to 32 per cent of the Canadian hemp acreage. In 2014, Health Canada granted Alberta growers 166 cultivation licences. Additionally, almost 100 licences were obtained by hemp handlers, buyers and processors.

Markets: nutritional, industrial and other emerging uses

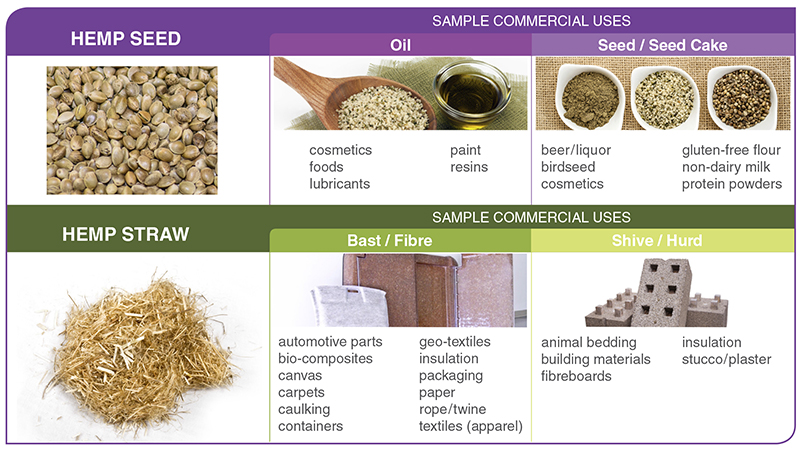

Hemp is a multi-purpose crop delivering seeds, fibres and bio-active chemicals for a number of uses and markets. Producers can maximize plant value by considering various markets for both the grain and potential new, emerging markets for the straw.

Hemp crops grown in Europe are for fibre production. The current driver for Canadian hemp production is the demand for hemp grain (seed, oil and meal) for food and the nutraceutical market. Other uses (bio-industrial, cosmetic, pet food) for the grain and hemp stalk are under development in Canada (Figure 3).

Both seeds and oil are used for human and pet food. Industrial hemp is not currently approved for use as a livestock feed; however, research is underway to evaluate seed suitability for livestock feed applications. Recent studies commissioned by the Canadian Hemp Trade Alliance have shown that hens will produce omega-3 eggs when fed with the seed or meal (see www.hemptrade.ca).

In the hemp food and natural health product markets, the nutritional value, beneficial fatty acid and protein profile have established the crop’s value in the market. Hempseeds, which are small nuts, have a high nutritional value.

Hempseed oil has an excellent, unique fatty acid profile. The oil is of high nutritional value because of its 3:1 ratio of omega-6 to omega-3 essential fatty acids. The seed contains about 35 per cent oil and 25 per cent crude protein. The oil contains about 80 per cent essential fatty acids, that is, linoleic acid, omega-6, alpha-linoleic acid, omega-3.

Omega 3 and 6 are essential polyunsaturated fats needed by the body to build healthy cells and maintain brain and nerve function, and these fats can only be sourced through food. Nutritionists advocate the consumption of foods with a 2:1 to 4:1 omega 3:6 ratio, which hemp provides.

Figure 3. List of sample industrial hemp products

Three tablespoons of hempseed contains 11 grams of protein, comprised of 67 per cent edestin, which supports a healthy immune system (and is also hypoallergenic), and 33 per cent globulin, which is easily digested by humans. Hemp is also a good source of zinc and magnesium.

The initial appeal of hemp is that it is a rapidly renewable material. Then, the benefits of growing hemp increase when considering its exceptional functional properties.

Some Canadian cultivars of hemp can produce an impressive amount of vegetative biomass, reaching up to 10 t/ha. Hemp biomass offers several components: fibre (outer core) about 25 to 30 per cent of the stalk, hurd (pithy inside part) and dust. Processing provides pure elements as well as blends of these components.

In comparison with other bast fibres (such as from flax, kenaf, jute or ramie), hemp fibre has excellent fibre length, strength, durability, absorbency, anti-mildew and anti-microbial properties.

Hemp offers super absorbency. This quality is desirable for oil and gas cleanup, livestock bedding and personal hygiene markets. Hemp’s very high tensile strength, strength-to-weight ratio, flexural strength and ability to rebound are desired benefits in bio-composites for automotive parts, aerospace and packaging. The textile, paper and building markets have interest in some specialty applications due to hemp’s durability, anti-microbial, acoustic and aesthetic properties.

There is growing demand in food markets for certified organic hemp production. Some 80 to 85 per cent of Canadian grain production is exported, mainly to the United States.

Cosmetics and personal care products are a growing area of market interest. A number of the more than 80 industrial hemp bio-active constituents are of growing interest in medical markets, in particular, cannabidiol (CBD) and turpines. However, these substances are typically harvested from plant parts that are not currently approved for commercial use.

In Alberta, the government is working with industry to advance product development and commercialization as well as facilitate supply chain development in the province. In 2009, the Government of Alberta invested in a pilot decortication facility (a system to separate bast fibres from hurd) in Vegreville. It has a 1 t/hour capability. For more information, see the website www.albertabiomaterials.ca

Marketing for producers

It is important to note that anyone considering growing industrial hemp should secure market contracts before planting the crop.

Growers should secure contracts by teaming up with companies who will buy their seeds. Many buyers also offer value-added extras including access to company agronomists. Please see the Canadian Hemp Trade Alliance website for links to Canadian buyers (www.hemptrade.ca).

The markets for hemp products are new and developing. The business potential of commercial hemp production remains uncertain while markets for hemp products evolve.

Hemp growers must be prepared to undertake market research for the following:

- identify buyers for hemp production

- understand the technical requirements for different hemp products and ensure growers have the necessary systems in place to produce for these different hemp products

- become informed about certifications, such as organic or environmental, to determine cost-benefit to their business

- ensure they have the proper data collection methods to meet buyer(s) and/or certifier(s) requirements

Generally, the demand for hemp products is expected to benefit from a growing demand for products that are environmentally and economically sustainable.

Environmental benefits

With its fast growth and significant biomass yield, second only to bamboo, hemp supports efficient land use. Once established, the hemp plant thrives well against competitors, therefore lessening the introduction of chemical inputs into the hemp industry as compared to some other commercial crops.

Hemp can be useful in carbon sequestration as it yields 4 times the biomass of an average forest in 90 days compared to 25 years in tree growth. Hemp can provide a useful break in a crop rotation.

Hemp production may generate additional environmental benefits. Research is underway in various world locations to provide documentation to support hemp claims. One claim is that hemp’s root system can break up compacted soil, providing aeration, and will also hold soil firmly, which helps control erosion.

Another claim is that hemp may contribute to pollution abatement through its ability to mitigate toxins from the ground through phytoremediation (decontaminating soil or water using plants and trees).

Licence application

Industrial hemp is a regulated crop in Canada. Growers must apply to Health Canada for a licence to grow the crop. The application is free of charge. Health Canada starts accepting licence applications in November.

Licences to grow industrial hemp for grain or fibre are issued for 1 calendar year for crops of 4 hectares(10 acres) or more and if cultivating for pedigreed seed, not less than 1 hectare (2.47 acres).

Applicants must include required information: specific acreage, cultivar, where seed is sourced from, a map showing field location, legal land description and its co-ordinates, what certified laboratories will be used for testing for cannabinoids and a consent for a criminal record check.

Growers in Alberta have to pay a fee of approximately $150 for THC analysis, which must be completed by a technically certified sampler licensing process. For more information, please see the Health Canada website and Industrial Hemp Application Licence Simplified webinar.

Varietal selection and sourcing pedigreed seed

Each hemp cultivar on the List of Approved Cultivars has been approved under the Policy for the Inclusion of Cannabis Varieties on the List of Approved Cultivars. The most common approved varieties presently being contracted and grown in Canada are Finola, CFX-2, X 59, CRS-1 and CFX-1 (see Table 1).

In recent years, several new varieties have been released that have been bred specific to the food market (shorter plants) or fibre markets (taller plants). Dual-purpose varieties are under development, including Silesia. Silesia is a new, licenced varietal of Alberta Innovates – Technology Futures and is performing well at field trials in various locations on the Canadian prairies.

Yields of hemp grain vary depending on a number of geo-climatic factors. An average Canadian yield is 850 kg/hectare (750 lbs./acre). Industrial hemp is known for its high biomass yield.

See Table 3 for a list of varieties and hempseed sources.

Table 3. Varietal Selection and Sourcing Pedigreed Seed |

| Company | Contact Person | Phone / email | Variety |

| Terramax | Dale Horn | 306-281-0977

zennova8@gmail.com | Hempnut (X59) |

| Hemp Genetics International | Kevin Friesen | 604-607-4953

hempgenetics@gmail.com | CFX 1, CFX 2, Crag, USO 14, USO 31 |

| Parkland Industrial Hemp Growers | Canda Chafe | 204-629-4367

pihg@mts.net | Alyssa, Delores, Canda, Joey, Debbie, Petera |

| ArtCan | Gabriel Gauthier | 450-830-2842 | Ferimon |

| Hemp Oil Canada | Darrell McElroy | 1-800-289-4367

Darrell@hempoilcan.com | Finola |

Silesia nursery hemp crop

Growing hemp

Plant biology: flowering

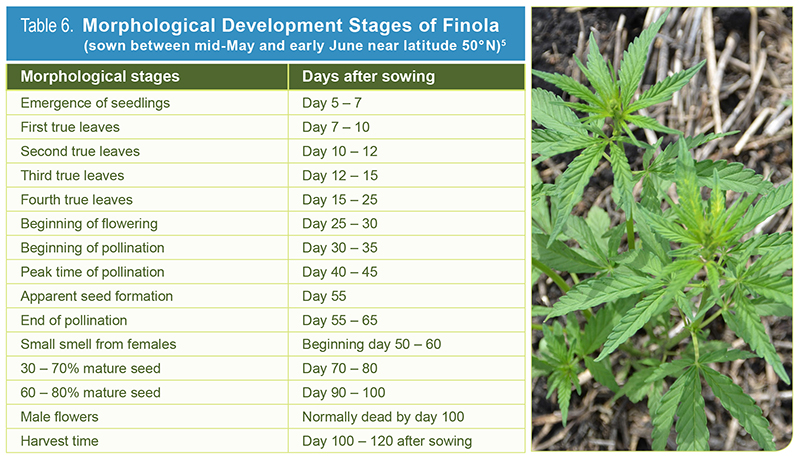

Hemp is a short-day plant. Its flowering is delayed by long days and hastened by short days. The hemp stem grows until the end of June or beginning of July. Shorter days then typically trigger flower development.

Hemp is primarily dioecious, that is, the pollen-bearing parts are found in one plant and the seed-bearing flowers on another. Cannabis has a diploid genome (2n = 20). The male and female plants are not distinguishable before flowering. The male inflorescence can be identified by the development of round, pointed flower buds with five radial segments, while the female inflorescence can be identified by the presence of calyx. Male plants die shortly after flowering. The female plants live 3 to 5 weeks until seed is fully ripe.

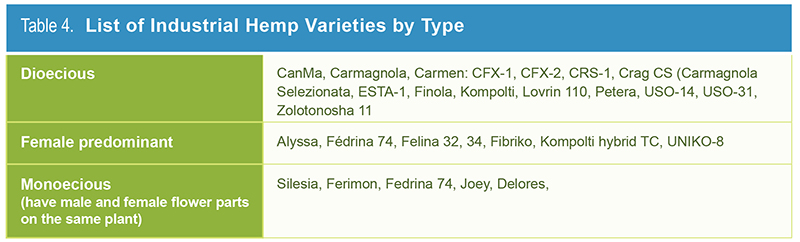

In a dioecious crop, the number of female plants is 10 per cent to 50 per cent higher than the number of male plants. There are a few monoecious cultivars now that have both male and female flowers on the same plant (Table 4).

There are about 40 cultivars for cultivation in Canada (check the Health Canada web document ), with 4 cultivars grown widely (see Table 1).

Stem

Plant height varies significantly among cultivars ranging from 150 cm for Finola to 246 cm for Uso 31. The hemp plant stem can range from 4 mm to 11 mm in diameter in Alberta.

Biomass properties

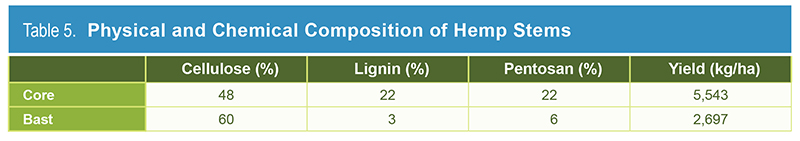

Table 5 below shows the physic-chemical properties of hemp varieties grown at two sites in Alberta. The cellulose content of the bast component of hemp varieties ranged between 57 per cent and 65 per cent. The mean cellulose content was 61 per cent. The core of the hemp stalk has 46 per cent cellulose, while the fibrous sheath (bast) has more cellulose (60 per cent).

Crop physiology

A hemp crop is high yielding, partly because it already shows full ground cover after a thermal time of about 400 to 450° Cd (Cd = thermal time units).1 Thermal time is the accumulation of temperature to which a plant has been exposed.

Hemp is a short-day plant, which affects crop production. Once the flowering starts, the efficiency with which intercepted radiation is converted to dry matter drops rapidly.2 The cultivars grown in Europe are usually of French origin and have a critical photo-period of between 14 and 15.5 hours.

Hemp has been photo-period sensitive, meaning it tends to flower at the same calendar date no matter when it is planted. New varieties are available that are not photo-period sensitive.

The differences in growth rate and development between male and female plants are large.3 The male plants tend to flower and senesce earlier. This variation may limit yields, reduce the efficiency of resource use and may result in variable quality.

Crop growth

The base temperature for leaves to appear is 1°C and for canopy establishment 2.5°C.4 From sowing to 50 per cent plant emergence, hemp requires 56°Cd (base 3°C). To reach canopy closure, hemp (at 64 plants m2) requires another 340° Cd (base 2.5°C). Hemp seedlings are frost tolerant to about -4°C. Prolonged cold at this stage is detrimental, but not fatal to the plants.

Plant density

Hemp plants are grown at a wide range of plant densities, depending on the goal of the production and the expected yield level. Plant density is significantly affected by cultivar, seeding rate and year. Seeding rate has no significant effect on plant height.

Seed sowing rates vary. In Alberta, the recommended hemp stand at harvest for hemp grain production is approximately 100 to 120 plants m2. According to data from Manitoba, thousand kernel weights of the current varieties are USO14 = 16 g, USO31 = 18 g, Alyssa = 18 g and Finola = 12 g. These figures give a seeding rate of 24 to 32 kg/ha, depending on variety.

Overall, a high plant density produces a better crop with early growth competition with weeds. Seeds should be drilled at a depth of 2.5 cm in rows spaced 15 to 50 cm apart. Planting at 20 cm row spacing using large seed openers (12.7 cm) gives 67 per cent seed utilization.

For fibre production, seed is sewn densely so that growth produces tall, slender stems with small bast cells. Dense stands (300 – 375 plants/m2) are preferred when growing hemp as a fibre crop. The recommended seeding rate for hemp fibre production is 67 kg/ha. The higher seeding rate for fibre is due to the need for many fine stems with a higher percentage of fibre in the stems.6

Climate and soil conditions

Hemp is well adapted to growing on the Canadian prairies. It survives dry conditions better than most crops because of its extremely well developed fibrous root system, but it does not like growing in saturated soils for the same reason. For juvenile plants, frost tolerance is similar to other crops, but at the later stages in crop development, the plants can take much harder frosts without damaging seed yield or germination.

Hemp can be grown on a wide range of soil types. Hemp grows best on well drained, loamy soils with high levels of organic matter. Moist, sandy loams with near pH 6 to 7 are best. Heavy compacted clays and low wet areas are not ideal for hemp production.

Rotation

A rotation of industrial hemp following cereals is useful because volunteer cereals are controlled more easily than volunteer broadleaf crops. Organic hemp is best preceded by perennial alfalfa, green-manure fields, legumes and potatoes because hemp is a high nutrient user.

Volunteer hemp plants emerging in other crops in the rotation must be destroyed. It is not recommended to grow hemp on hemp stubble. Detailed research on the fit of hemp in Prairie crop rotations is warranted.

Hemp growing and retting hemp side by side

Time of sowing

Hemp seedlings can survive a short frost of up to -10°C7 and older hemp plants can tolerate frosts of up to -6°C with little effect on seed quality.8 Hemp should only be sown once the risk of hard frost has passed.

Because no herbicides are registered for industrial hemp, a seeding date late in May gives the opportunity for some pre-planting weed control. In Alberta, mid to late May is the optimum seeding window, but seeding up to the end of June is possible, often without severe grain yield penalty.

Seedbed preparation and planting

The seedbed should be firm and relatively fine, similar to that prepared for canola.9 Industrial hemp is normally sown using standard seeding equipment such as air drills being used for other crops. Ideal seeding depth is 1 to 2 cm, but in good moisture conditions, shallower seeding works very well.

Optimum soil temperature for fast germination is 8 to 10°C, although hempseed will germinate at 4 to 5°C. Packing is good, but do not pack too tightly as excess soil compaction will reduce emergence. Soil compaction due to heavy rainfall after planting can significantly reduce plant emergence.

Fertilizer

In research studies, hemp has shown a significant yield response to applied fertilizers when levels of plant-available nutrients in soil were low and soil moisture conditions were adequate for plant growth. On the other hand, hemp was generally not responsive to additional phosphorous (P) fertilizer on soils not deficient in available P, or to the addition of sulphur (S) fertilizer on a soil deficient in available S.10

Increasing nitrogen (N) rates significantly increased plant height, biomass and seed yield, when data were averaged across all sites (location-years), reaching maximum values at about 150 kg N ha of nitrogen, depending on soil fertility and past cropping history.

Research to date supports the application of 40 to 90 km/ha of potash for fibre hemp. Growers should base phosphorus (P205) and potash (K20) applications on a recent soil test.11

Hemp will grow taller and produce more biomass with increased fertilization. In-depth fertility studies that address the needs of different usage types of hemp on the Canadian Prairies are still required.

Increasing fertilization may also delay seed maturation.12 Organic producers are advised to precede a hemp crop with a perennial alfalfa breaking or green manure plow down.

Weed control and management

Hemp is competitive with most weeds as long as there are good growing conditions that allow a uniform stand to emerge ahead of weeds.

Pre-seed weed control is the only approved method of weed control in hemp. This control can be a herbicide burn-down or for an organic grower, a cultivation pass.

Hemp can out-compete weeds if several conditions are met: the hemp germinates before the weeds, is grown in a relatively clean field and spring growing conditions are good. Given a good start, hemp can be an effective weed suppressant. A quick, even emergence is the key to effectively competing with weeds by rapidly creating a dense leaf canopy within the first month of growth.13

Problem weeds in hemp include hemp nettle, wild buckwheat, wild oat, pigweed, lamb’s quarters and Canada thistle. Wild buckwheat seed is especially difficult to clean away from small hempseed. Note, no herbicides are registered for use on hemp in Western Canada for grain production, although pesticide trials are ongoing through the Minor Use Program.14

Disease and pest management

Industrial hemp seems to be fairly disease-free in western Canadian conditions. Under wet fall conditions, stem rot and gray mould/bud blight may be a problem. Early harvest is recommended to avoid fungal damage.

Though major pest issues have not been reported in Canadian crops, research is required to fully understand this area of crop management (Figure 4). Management practices include rotation with non-susceptible crops, disease-free seed and management of hosts such as volunteer canola.

Figure 4. Maturing industrial hemp crop with beneficial field crop insects (photo: Alberta Agriculture and Forestry)

Field sampling for THC

Field sampling and testing for tetrahydrocannabinol (THC) is a requirement for some hemp varieties. Increasingly, cultivars are being exempted on an annual basis. Please check with Health Canada when applying for a licence and see whether the grower is required to have the crop sampled and tested. Sampling and testing must be done at the early seed set stage in August.

In Alberta, the varieties CRS 1, CFX 2, USO14, USO31 and Crag are exempt from annual testing as required under paragraph 16(1) of the Industrial Hemp Regulations. In total, 11 cultivars are exempt from THC testing in all Canadian Provinces.

Harvest

Grain yield

Production is estimated using information gathered on yield and acres harvested. Industrial hemp yield (grain or fibre) varies with variety, plant population, soil conditions, timing of harvest and annual climatic conditions.

The highest seed yield recorded in Canada to date has topped 2,000 lbs. per acre (2,242 kg/ha), and average yield is between 600 to 800 lbs. per acre (673 to 897 kg/ha), but rising. An acre will also produce an average of 5,300 lbs. of straw, which can be transformed into about 1,300 lbs. (590 kg) of fibre.

In Manitoba, hemp grain yields range from 100 to 1,200 lbs. per acre (112 to 1,300 kg/ha), while yield for crops grown and managed solely as fibre crops range from 1 to 6 tons per acre (1 to 6 tonnes/ha). Typical grain yields in Saskatchewan vary from 660 to 1,070 lbs. per acre (740 to 1,200 kg/ha).

In Alberta, hemp grain yields from research plots have been found to vary from 200 to 1,600 lbs. per acre (220 to 1,800 kg/ha). The expected yield would likely average nearly 760 lbs. per acre (850 kg/ha).

Biomass yield

Hemp straw yields under dryland conditions have an average of between 2.4 to 4.8 tonnes per acre (6 to 12 tonnes/ha) for the higher yielding varieties like Carmen, Alyssa, Delores and Silesia.

The harvest timing for top quality fibre to be used for textiles is important. If harvested too early, plants may be immature, and yield will be low and fibre strength weak. If harvested too late, fibres may become too coarse to use in textile products. For most industrial applications, hemp stalk harvesting after seed harvest is permissible.

Grain harvesting

Harvest of seed is approximately 100 to 120 days after sowing, depending on variety. Hemp shatters very easily and makes excellent birdseed. Harvest should begin soon after birds are noticed in the field.

Straight combining industrial hemp seems to be the preferred harvest method, especially with taller varieties. Excess biomass material going through the combine can cause problems, so harvesting only the inflorescences is preferred.

Because seed is easily damaged, many farmers will combine in the 18 to 20 per cent moisture range and dry the seed to around 10 per cent for storage. It is important to aerate the grain immediately off the combine down to about 9 per cent moisture – this step is critical to prevent seed heating, to reduce mould growth and to preserve seed quality.

Reduce cylinder, rotor and unloading auger speeds to prevent seed damage while harvesting. Watch for fibre wrapping around shafts, particularly the drive shaft and sprockets of the feeder chain, or front beater, and front drum for the feeder chain. There are some combine modifications that may limit fibre wrapping and speed up harvesting.

Modest ground speeds and input rates, with high engine speeds, should help limit potential problems. As always, careful attention is the best way to prevent mechanical problems.

Stalk harvesting

Hemp can be cut strictly for fibre and the remaining stalk after combining can be cut with a discbine or sickle bar mower. Ideally for good decortication, this material will then be baled using either a big round or big square baler after some retting has taken place, but it can be baled immediately upon drydown.

Retting

The quality and quantity of hemp fibre yield are affected by retting, the process of partially breaking down the gummy substances, especially pectin, that bind the fibres together in bundles and to the plant core. Retting can be done chemically or biologically.

In field dew retted approaches, the stems are left spread over the surface of the field after the crop has been cut until stems start to turn black. During this time, the spread stems are normally turned a number of times to expose them evenly to light and moisture. Field retting micro-organisms attack the hemp stems and break down the cementations that bind them together.

An alternative method of stem harvest is to leave the stalk standing through the winter and roll the stems in the spring to break them off at ground level before raking and baling. This approach is called winter retting. Other forms of retting in and beyond the field include water, chemicals and enzymes.

Drying and cleaning

Ideally, drying should begin in the field. In wet conditions, combined grain can be dried in a grain dryer and aerated in grain bins, the same as with other crops. For the highest quality, SLOWLY dry hempseed down to 9 per cent moisture in a grain dryer, immediately after harvest, at LOW temperatures (20° – 25°C maximum) and HIGH volumes of air flow. Faster drying temperatures can be used for lower quality grain, like for paint or animal feed.

Moisture should be checked with a calibrated meter. Finola grain can be effectively cleaned with the following sieve sizes: 1.60 to 3.25 mm oblong and 2.50 to 5.00 mm round. A gravity table may be necessary to remove some seeds. All seed cleaning facilities handing hemp must obtain a licence from Health Canada.15

Storage

The grain should not be stored for any amount of time without sufficient drying. Mould problems can ruin a harvest within a few hours, in some cases. Be sure that the drying facility is nearby and available at harvest time, and be sure that the moisture meter is pre-calibrated for oilseed hemp.

Store dried grain in bins or tote bags, away from birds. Hempseed should keep well for 2 to 3 years if properly dried and stored.

(photo left) Combine in hemp field (photo right) Aeration bins

Decortication facility Vegreville

Economics

Below is a recent Cost of Production Study done in 2015. To access just this report, please click here.

Industrial hemp seed production costs and returns in Alberta, 2015

This report provides a summary of the 2015 cost of production study for industrial hemp seed grown in Alberta. In total, 10 growers were surveyed to collect their cost of production information. These growers had a total of 2,370 acres (19 fields) representing about 10 per cent of Alberta’s hemp seeded acreage in 2015. Out of this total, 1,340 acres (10 fields) were on irrigated land and the remaining 1,030 acres (9 fields) were on dryland. The raw data obtained were reviewed for any information gaps before entering into the computer for analysis. Preliminary results were sent to the survey participants for their review and comments. Specifically, numbers which appeared to be out of range were identified and the growers were asked to reverify.

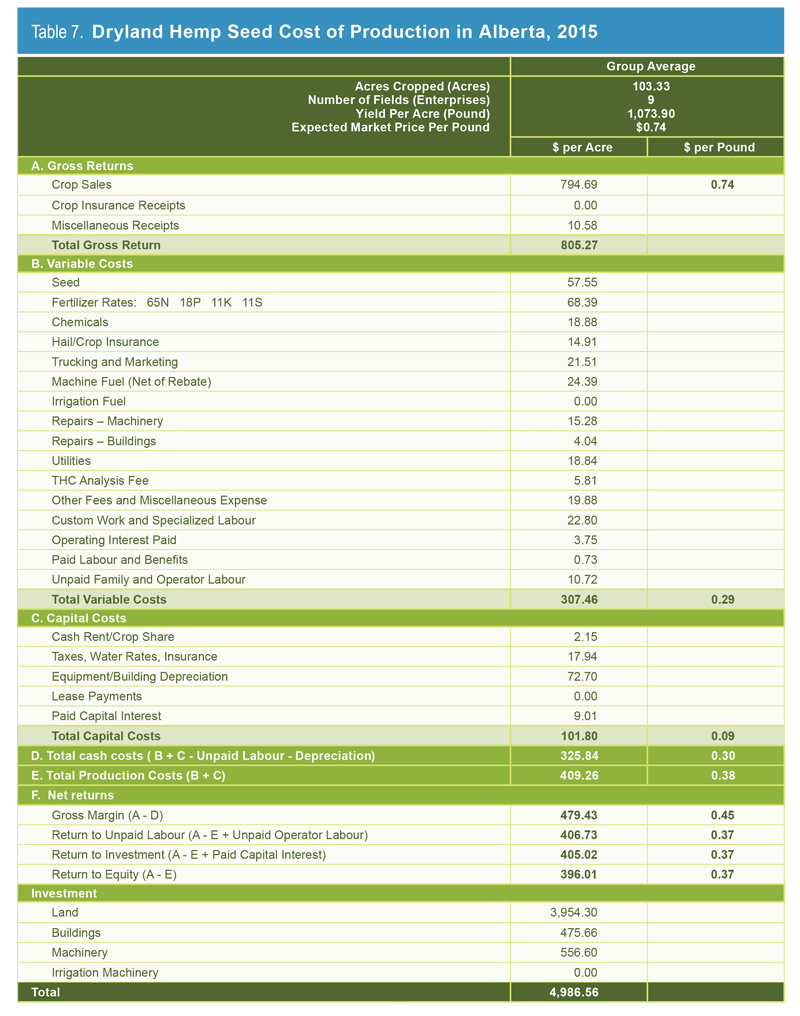

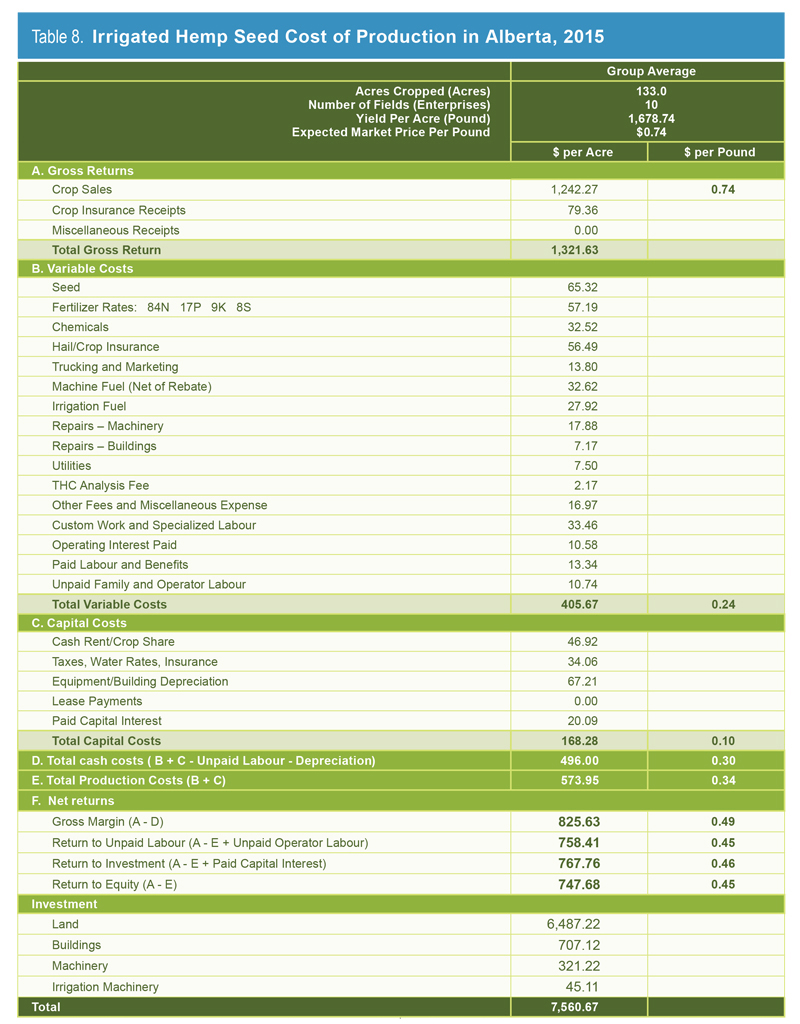

Tables 7 and 8 show the estimated cost of production benchmarks for dryland and irrigated hemp seed grown in Alberta. All of the costs are weighted averages and expressed on a per acre basis. Growers are advised to note that benchmarks do not suggest that all producers in a region have the same “average costs”, so application of these averages to individual situations requires caution. In fact, significant farm to farm variation is normal.

Gross returns

As shown in Table 7, the average area cropped by each dryland grower was approximately 103 acres. Their yield was estimated at 1,074 pounds per acre. With a price of $0.74 per pound, average gross returns including miscellaneous receipts, was estimated at approximately $805 per acre. With regards to hemp grown on irrigated land (Table 8), the average area cropped by a grower was estimated at 133 acres. Their yield was estimated at 1,679 pounds per acre, 56 per cent higher compared to dryland. With a price of $0.74 per pound, average gross returns including miscellaneous receipts, was estimated at approximately $1,322 per acre, 64 per cent higher compared to dryland. None of the growers surveyed have realized any revenue from the sale of hemp straw; however, there is potential in the future for straw revenue.

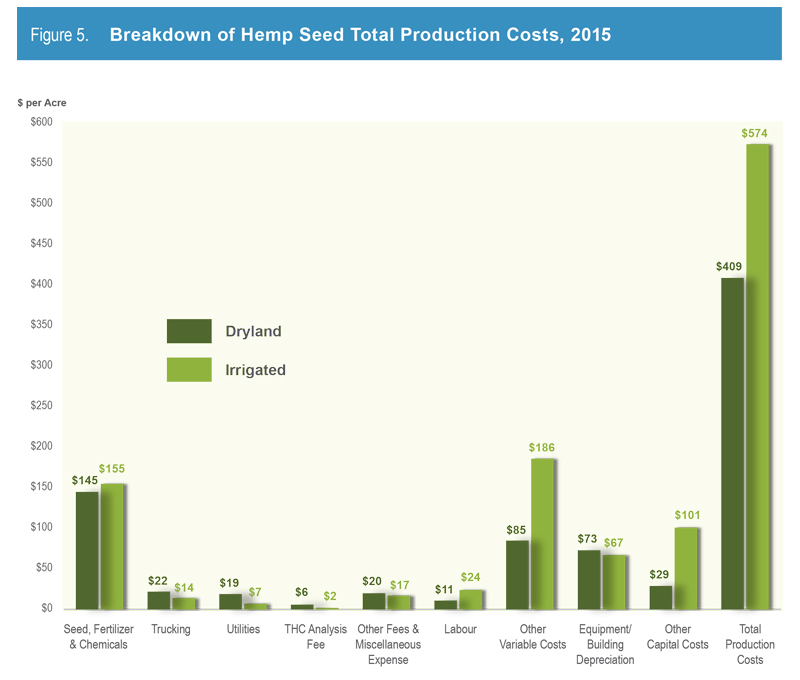

Total production costs

Total production costs for hemp seed grown on dryland was estimated at $409 per acre or $0.38 per pound of hemp seed produced (Table 7). Of this, approximately 75 per cent were variable costs and the remaining 25 per cent were capital or fixed costs. The corresponding costs for hemp seed grown on irrigated land was estimated at $574 per acre or $0.34 per pound (Table 2). Of this, approximately 71 per cent were variable costs and the remaining 29 per cent were capital or fixed costs.

Expenses associated with seed, fertilizer and chemicals accounted for a significant portion of the operating expenses of growers. For example, it was approximately $145 per acre for dryland farmers and $155 per acre for growers on irrigated land. For dryland, this translates to about 35 per cent of total production costs or 44 per cent of total cash costs. Similarly, under irrigation this translates to about 27 per cent of total production costs or 31 per cent of total cash costs. Total cash costs represent all out-of-pocket expenses incurred during the production period. It does not include costs associated with operator and family labour and depreciation for buildings and equipment.

Figure 5 shows a graphical presentation of the total production costs per acre for hemp seed grown on both dryland and irrigated land.

As shown in Figure 5, expenses associated with testing for tetrahydrocannabinol (THC) was higher for dryland compared to irrigated land. This is due to the different mix of hemp varieties cultivated by the growers. Field sampling and testing for THC is a requirement for some hemp varieties. In Alberta, the varieties CRS-1, CFX-2, USO 14, USO 31 and Crag are exempt from annual testing as required under paragraph 16(1) of the Industrial Hemp Regulations. In total, 11 cultivars are exempt from THC testing in all Canadian Provinces. Increasingly, cultivars are being exempted on an annual basis.

Net returns (gross margin, returns to unpaid labour, investment and equity)

Section (F) of Tables 7 and 8 presents gross margin, returns to unpaid labour, investment, and equity for both dryland and irrigated hemp seed respectively. The following procedures were used to calculate net returns:

Gross margin

Gross margin is the difference between gross returns and total cash costs. Average gross margin for irrigated land was estimated at $826 per acre (Table 8). This was approximately 72 per cent higher compared to the $479 per acre obtained under dryland conditions (Table 7).

Return to unpaid labour

Return to unpaid labour is gross returns less total production costs other than costs imputed for unpaid family and operator labour. As shown on Table 7, return to unpaid labour for dryland was positive at $407 per acre or $0.37 per pound of seed produced. Return to unpaid labour for hemp seed grown on irrigated land was also positive at $758 per acre or $0.45 per pound (Table 8).

Return to investment

Return to investment is gross return less total production costs with the exception of interest payments on capital spending. This reflects the dollar or per cent return to the total value of assets. As shown on Table 7, return to investment for dryland was positive at $405 per acre or $0.37 per pound. Return to investment for hemp seed grown on irrigated land was also positive at $768 per acre or $0.46 per pound (Table 8).

Return to equity

Return to equity is gross returns less total production costs (including all capital costs). Return to equity for dryland and irrigated were also positive at $396 per acre or $0.37 per pound and $748 per acre or 0.45 per pound respectively (Table 8).

Source: Industrial Hemp Seed Production Costs and Returns in Alberta, 2015. Economics Section, Alberta Agriculture and Forestry, Edmonton, Alberta.

Source: Industrial Hemp Seed Production Costs and Returns in Alberta, 2015. Economics Section, Alberta Agriculture and Forestry, Edmonton, Alberta.

Many other factors are involved in the cost of production. The cost of seed varies according to varietal. Please see the Canadian Seed Growers Association website.

New Crop Insurance Initiative (NCII) is a program that provides protection to new and non-traditional crops and does not require pre-harvest or post-harvest inspections. Dryland hemp seed as well as dryland and irrigated hemp fibre are covered under “New Crop Insurance Initiative (NCII)” in eligible coverage areas. To be eligible, producers need an active annual crop production insurance contract with insured acres in the current year and also may be eligible for hail endorsement. Please contact AFSC for details.

Some pesticides currently have minor use status and others are in review. For additional information, refer to the following Agriculture and Agri-food Canada sites: http://www.agr.gc.ca/eng/?id=1286197216280 and http://www.agr.gc.ca/eng/?id=1298926421274

Many farmers are using their current machinery as is or with slight modifications to harvest equipment, at minor costs. There is opportunity, if the industry moves toward dual-purpose crops, to consider speciality hemp harvesting equipment. This equipment has been developed and used in Europe and is not yet found in North America.

For safety concerns, some farmers have on-field water pumping equipment available during harvest.

Hemp producers should carefully evaluate the economics of production and develop strategies for achieving low cost production. Individual producers need to understand these factors for their enterprise to be profitable.

Many new entrants grow limited acres (under 300 acres/ 121 ha) of hemp in the first year or two to establish an understanding of the crop before investing in growing a larger number of acres.

Hemp fibre

Additional web resources

Growing Hemp in the Prairies Webinar, February 2014 (www2.gotomeeting.com/register/409671562)

Industrial Hemp Application Simplified Webinar, December 2013

Further information, contact

Alberta Ag-Info Centre

Call toll free: 310-3276 or 310-FARM

Website: agriculture.alberta.ca

For further information on the hemp industry, please visit the Canadian Hemp Trade Alliance website. This alliance is the national industry association for industrial hemp in Canada. Their annual conference and trade show rotates to the various member provinces every year and is usually held in November. This event is an excellent source of information and contacts.

Also, please consult the website (www.albertabiomaterials.ca) for upcoming crop walks and industry events.

Technical advisors to this publication:

Agronomy

Dr. Jan Slaski, Alberta Innovates – Technology Futures

jan.slaski@albertainnovates.ca

Dr. Kwesi Ampong-Nyarko – formerly Alberta Agriculture and Rural Development

Byron James, Alberta Innovates – Technology Futures

byron.james@albertainnovates.ca

Dr. Manjula Bandara, Alberta Agriculture and Forestry

manjula.bandara@gov.ab.ca

Harry Brook, Alberta Agriculture and Forestry

harry.brook@gov.ab.ca

Economics

Emmanuel Laate, Alberta Agriculture and Forestry

emmanuel.laate@gov.ab.ca

Ken Handford, Agriculture Financial Services Corporation

ken.handford@afsc.ca

Esther Bemile, Agriculture Financial Services Corporation

esther.bemile@afsc.ca

Marketing/Business

Food:

Kellie Jackson, Alberta Agriculture and Forestry

kellie.jackson@gov.ab.ca

Fibre:

Lori-Jo Graham, Alberta Agriculture and Forestry

lori-jo.graham@gov.ab.ca

Footnote references

- Van der Werf H M G. 1994. Crop physiology of fibre hemp (Cannabis sativa 15.). Ph.D. Thesis, Wageningen Agricultural University. 153 pp.

- Van der Werf H M G. 1994. Crop physiology of fibre hemp (Cannabis sativa 15.). Ph.D. Thesis, Wageningen Agricultural University. 153 pp.

- Van der Werf H M G. 1994. Crop physiology of fibre hemp (Cannabis sativa 15.). Ph.D. Thesis, Wageningen Agricultural University. 153 pp.

- Van der Werf H M G, Brouwer K, Wijlhuizen M, Withagen J C M. 199%. The effect of temperature on leaf appearance and canopy establishment in fibre hemp (Cannabis sativa L.). Annals of Applied Biology 1265.51-561.

- http://www.finola.fi/Finola_Development_2013.pdf

- http://www.gov.mb.ca/agriculture/crops/production/hemp-production.html

- Grenikov A S, Tollochko T. 1953. Cultivation of hemp [in Russian]. Moscow, USSR: State Editors of Agricultural Literature. 447 pp

- Senchenko G I, Timonin M A. 1978. Hemp [in Russian]. Moscow: Kolos. 285 pp.

- http://www.omafra.gov.on.ca/english/crops/facts/00-067.htm#varieties

- Vera, C. L., Malhi, S. S., Raney, J. P. and Wang, Z. H. 2004. The effect of N and P fertilization on growth, seed yield and quality of industrial hemp in the Parkland region of Saskatchewan. Can. J. Plant Sci. 84: 9 39 947.

- Dr. Jace Callaway, CEO POB 236, FI-70101 Kuopio, Finland Basic information on FINOLA Agronomy for 2013. February 2013 http://www.finola.fi/Finola_basic_farming_info_05042013.pdf Industrial Hemp: A first generation biorefinery

- http://www.omafra.gov.on.ca/english/crops/facts/00-067.htm#fertility

- Dr. Jace Callaway, CEO POB 236, FI-70101 Kuopio, Finland Basic information on FINOLA Agronomy for 2013. February 2013 http://www.finola.fi/Finola_basic_farming_info_05042013.pdf. Industrial Hemp: A first generation biorefinery

- http://www.hempgenetics.com/html/grow/grow.html

- Dr. Jace Callaway, CEO POB 236, FI-70101 Kuopio, Finland Basic information on FINOLA Agronomy for 2013. February 2013 http://www.finola.fi/Finola_basic_farming_info_05042013.pdf. Industrial Hemp: A first generation biorefinery

Source: Agdex 153/830-1. Revised March 2017. |

|